Agency Accounting: In-Depth Guide for Agencies

Effective agency accounting safeguards your operations and promotes future business growth.

However, there are many things to consider when making this process a success. In this article, we’ll discuss:

- Why accounting is so important for agencies

- Using cloud-based agency billing and invoicing software

- What are the main challenges and strategies to address them

- Tips for driving your agency’s profitability

Key Takeaways

- Agency accounting is an essential process for informed decision-making, improved client relationships, effective cash flow management, and compliance with regulations.

- Invest in modern accounting systems to automate workflows and get reliable data. Some popular analytics and reporting solutions include Productive, Xero, and QuickBooks.

- To maintain financial health, address cash flow bottlenecks, inconsistent invoicing, long payment terms, and unorganized record keeping.

- Best practices include: financial reporting, effective revenue recognition methods, overhead management, efficient invoicing, and maintaining cash reserves.

What Is Agency Accounting?

Agency accounting deals with the financial management and reporting of funds in a professional services business. There are some notable differences in accounting between a production-based company (such as retail, for example) and an agency like a creative or marketing agency.

The biggest is that agencies deal with intangible rather than tangible goods. Agencies focus on project accounting, including billable hours, client billing, and revenue recognition, rather than inventory or goods sold.

Some of the main processes of agency accounting include:

- Maintaining records of projects

- Tracking individual expenses and revenue

- Professional services billing

- Financial reporting, analysis, and reconciliation

The Importance of Accurate Accounting

- Strategic decision-making: Accurate accounting provides agency professionals with a clear picture of business financial health, including profitability and actual costs. This allows for informed decision-making on everything from whether to take on new projects to hiring additional staff.

- Improved client relationships: Clients will expect that agencies can manage their funds responsibly and provide transparent financial records of how they were used — for ex., by building timesheets with a list of finalized tasks or providing comprehensive project progress reports.

- Cash flow management: Managing revenue intake is essential for your agency’s sustainable functioning. Without timely payments, a business will be unable to cover overhead or invest in its growth (by hiring skilled staff or investing in new technology).

- Ensuring compliance: The biggest compliance risks that agencies face include data protection and privacy regulations, such as GDPR or CCPA. Accounting also covers issues of tax compliance and licensing.

Why You Should Use Cloud-Based Accounting Software

According to a survey by BlackLine, nearly 70% of business leaders and finance professionals report that their organization has made significant business decisions based on inaccurate financial data. Over 55% are not confident that they can identify financial errors before reporting results, and almost 22% say it can take up to 10 days to make adjustments to errors.

This is just one of the reasons why streamlining your accounting process with a software solution can be such a game-changer for your business.

They can provide benefits such as:

- More reliable data management

- Improved transparency between agencies and clients

- More efficient workflows due to automation

- Timely and informed decision-making with real-time metrics

An Overview of Cloud Accounting Software

However, there are many potential options to choose from. Two main categories include:

1. PSA software with financial management for agency professionals and project managers

2. Specialized tools with bookkeeping services for accountants and accounting departments

The first will provide you with basic accounting with the benefit of reducing your tech stack and overhead. A popular example is Productive, which can be integrated with Xero and QuickBooks for more robust cash management.

The second will provide more advanced financial management features but will need to be integrated with other software solutions. The most popular accounting software for advertising agencies and other businesses include Xero and QuickBooks.

1. Productive

Productive is designed as an end-to-end management software for professional services businesses. This means that it supports daily and strategic business workflows, from sales, project management, to budgeting and client invoicing.

It was unexpected that we managed to find a tool that allowed us to not only manage projects and tasks better but also allocate our resources and get an overview of our profitability. Productive allowed us to bring it all under one umbrella, which means we got a better picture of our business as a whole.

Productive’s key features for financial management include:

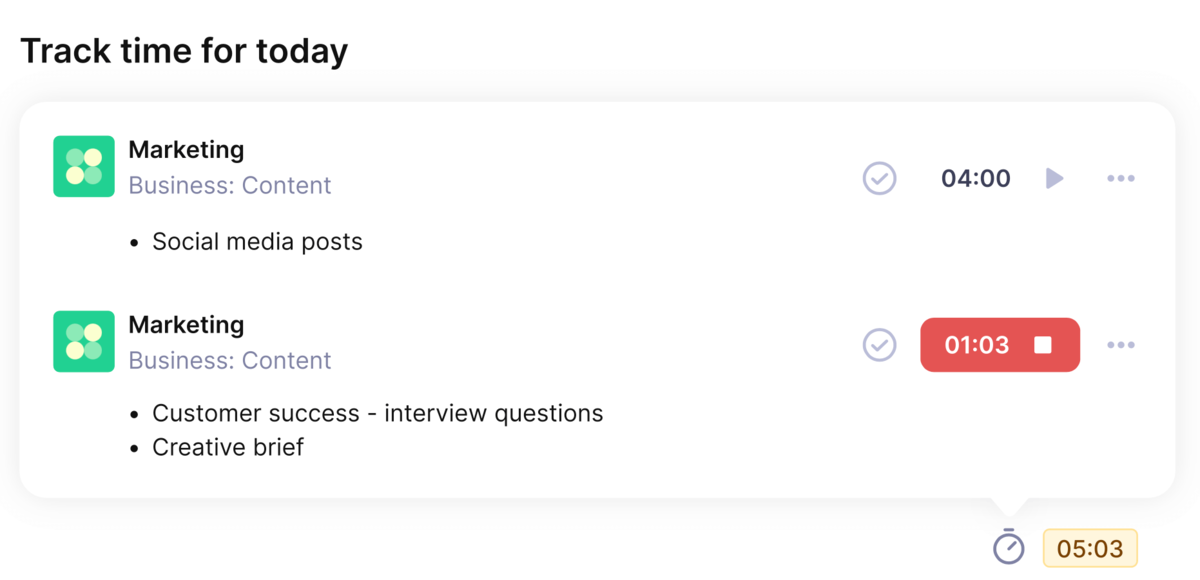

- Integrated billable hours management: Use a built-in timer or create entries manually. You can also sync Google Calendar events with Productive or run the timer with a desktop widget.

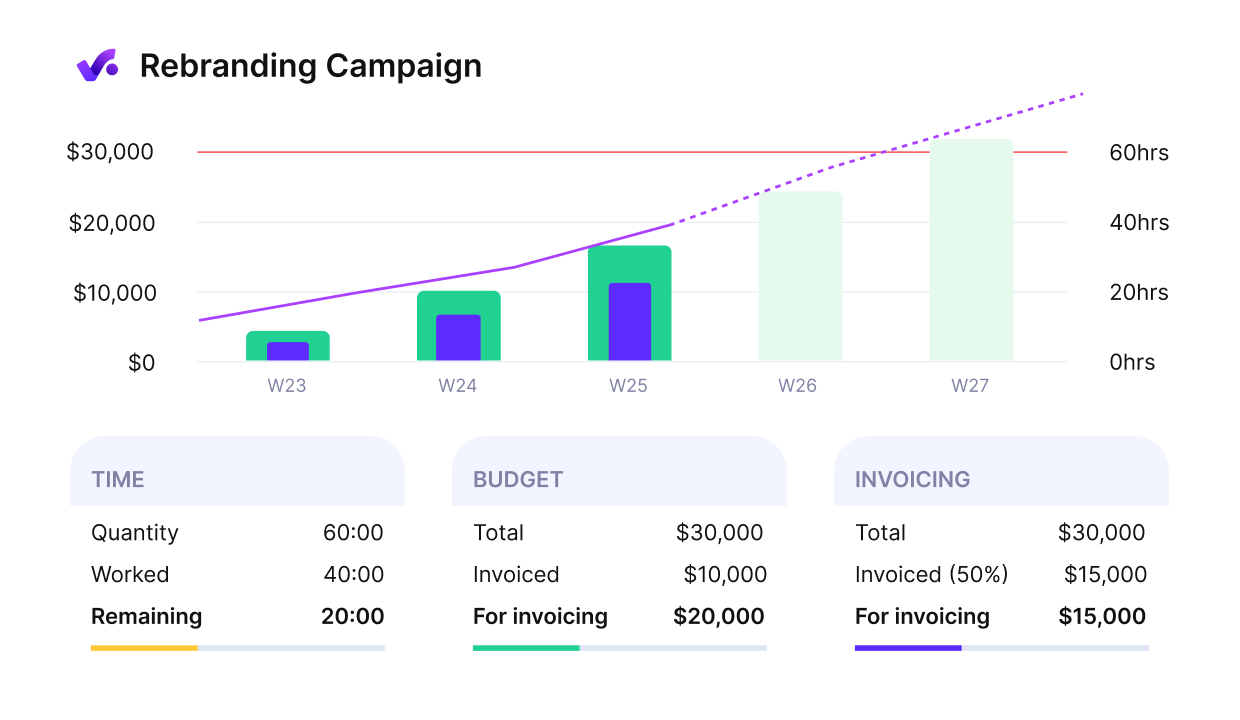

- Budgeting and invoicing: Set up your employee cost rates and agency pricing cards, and then build your project budgets (fixed, hourly, retainer). Pull financial data to create and send invoices from the platform or copy them into Xero and QuickBooks.

- Revenue recognition and profitability: Productive supports accrual and cash-based revenue recognition. By scheduling your resources, you can also forecast revenue and profit margins for future periods.

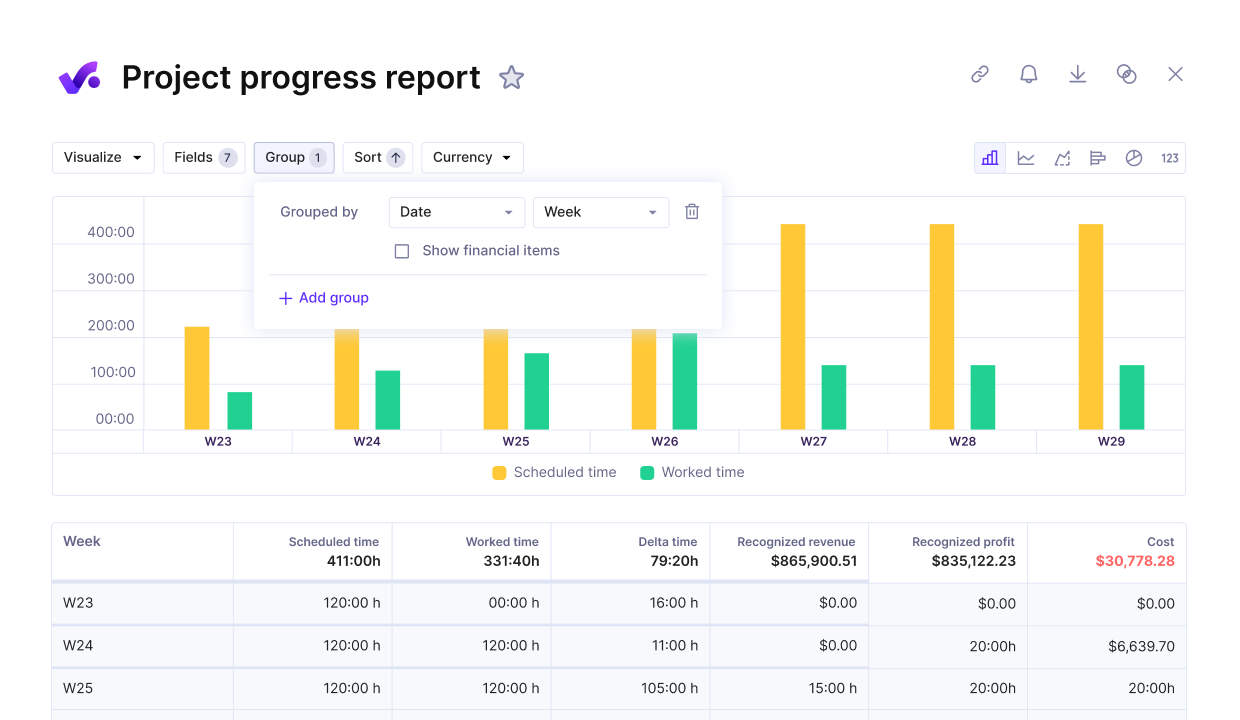

- Financial reporting: You can use Productive’s library of templates (ex., project progress report, outstanding invoices, forecasted budgets) or create a report from scratch. Use custom fields to add agency-specific parameters, create customizable dashboards, and schedule automatic report sending to Slack or email.

CUSTOMIZE YOUR REPORTING WITH PRODUCTIVE

Additional features include: project and task management, various ways to visualize project progress (including Gantt, Kanban, and Workload views), resource scheduling and time off management, sales CRM, workflow automations, client portal, and more.

Try out Productive with a 14-day free trial.

Manage Your Agency Accounting With Productive

Switch from multiple tools and spreadsheets to an all-in-one software solution for accounting and comprehensive agency management.

2. QuickBooks

QuickBooks Online is a well-known cloud accounting software for small businesses and accountants. Its key features include invoicing, real-time payment tracking, bank feeds and expenses management, tax tracking and reconciliation, and financial reporting.

QuickBooks is a popular accounting option for businesses, so consider this when you’re working on client projects:

QBO has 90% of the market share in the US. Many clients come to us with a set of books on QBO to begin with. I’m not switching them over in that case.

Source: Reddit

However, if your accounting methods are not limited by external factors, keep in mind that some users have issues with QuickBooks’ customer support, while others state that it can be expensive for what it’s offering.

Productive has a native integration with QuickBooks if you want to expand to agency management.

You can also head over to our article to compare Netsuite to Quickbooks.

3. Xero

Xero can be a great alternative to QuickBooks. Its key features include much the same capabilities, including accounts payable and cash flow management, expense management, bank feeds and reconciliation, financial statements, sales tax, and more.

While users online usually recommend Xero over QuickBooks for various factors, including user interface, usability, and customer support, QuickBooks is usually a more popular option in the US. This can be handy when working with clients or finding skilled accountants.

In short, both options are great for automating your manual accounting. Productive has a native integration with Xero if you want to expand to agency management.

Check out more options in our guide to the best project accounting software.

Common Accounting Mistakes

Here’s an overview of some common accounting mistakes or issues that can cause significant roadblocks:

- Cashflow bottlenecks: Cashflow bottlenecks often occur due to late client payments or unexpected expenses; according to QuickBooks, 52% of SMBs state that 10-39% of invoices currently with customers/suppliers are overdue.

- Inconsistent invoicing: According to Gartner, as many as 18% of accountants make financial mistakes daily. This issue can stem from a lack of standardized invoicing processes, poor oversight, or overwhelming workloads.

- Long payment terms: Extending payment terms to 90, 120, or even, in some cases, 180 days can attract clients. However, it’s incredibly risky for your agency, as it increases reliance on external support such as loans.

- Unorganized record keeping: Poorly managed financial records make it difficult to track transactions, expenses, and income accurately. This can include a lack of information or too many unnecessary details.

Next, we’ll discuss the best practices for avoiding these mistakes.

Best Accounting Practices for Agencies

Here’s our list of the most important factors for successful accounting:

Let’s cover them in more detail:

1. Regular Financial Reports and Monitoring

Regular financial management reporting and monitoring support financial health, transparency, and strategic decision-making. It ensures that project managers can identify trends, good and bad, spot and prevent potential issues, and make decisions based on accurate data.

Key financial indicators to track include:

- Revenue – allows agencies to gauge their income streams and measure growth

- Profit margins – show the true profitability of services and projects

- Cash flow – ensures that the agency can meet its obligations and invest in new opportunities

- Accounts receivable and payable – helps maintain healthy cash flow and avoid cash crunches

- Overhead costs – ensures that expenses are controlled and allocated efficiently

Consistent financial monitoring allows agencies to generate critical reports, including income statements, balance sheets, and cash flow statements. These reports provide essential insights into operational efficiency and financial stability.

It’s recommended to review accounting information on a quarterly basis at the least, though monthly is better.

2. Revenue Recognition Methods: Cash vs. Accrual Accounting

There are two main revenue recognition methods:

- Cash-based: Recognizes revenue only when cash is received.

- Accrual-based: Recognizes revenue when it’s earned, regardless of when payment is received.

The cash-based method of revenue recognition is simpler, since it can be tracked with invoicing, but it doesn’t usually reflect the true period in which work was completed. Accrual-based can be more difficult to track, but it provides a more accurate financial picture of a business.

Smaller businesses will monitor revenue on a cash basis. It’s recommended to switch your project accounting to accrual-based recognition once a certain revenue threshold is crossed:

Accrual-based accounting is more time-intensive. It does require more expertise and so to do it is more expensive. But there is a line where the business is big enough. Generally, it’s recommended moving to accrual accounting as you cross over the $1M in revenue mark.

Source: Agency Accounting 101 with Chris Hervochon

With Productive, you can monitor both types of revenue. For fixed-price project, accrual-based recognition can also be customized as being recognized at a single point or over time. You can also get revenue forecasting depending on your resource scheduling.

FORECAST KEY AGENCY METRICS WITH PRODUCTIVE

In the end, your accounting will also depend on your country’s legislation and recognized standards, such as GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards).

Learn more about the best RevOps tools and their features.

3. Overhead Management

Managing overhead is crucial for understanding your real agency profit. The best cloud accounting software can help you streamline this process.

For example, Productive uses a proprietary system to calculate your agency overhead. It takes into account your:

- Facility cost or variable costs (office, supplies, utilities)

- Time spent on internal or non-billable work

The unique thing about Productive is that it calculates your overhead per hour, which is then added on top of standard employee cost rates. This means that overhead is spread out across all projects, so you can get insights into your true profit for improved customer profitability analysis (taking into account differences in salaries and billing rates).

I generated all the financial reports for our agency, and no other software out there was able to calculate the overheads and spread them across all our clients. If I wanted an accurate report on overhead spread across clients, I would’ve spent hours working on it, but with Productive, we can generate that report automatically.

4. Efficient Invoicing Practices

As we already mentioned, a steady cash flow is essential to your agency’s sustainable functioning and growth.

According to research by Endava, the main challenges associated with the accounts payable process include manual data entry (71%), lost or missing invoices (42%), paper format invoices (37%), and a high number of discrepancies (29%).

How can you address these issues? Consider these three main factors:

- Team collaboration. Ensure that your teams understand that cash flow is a priority. This is especially important for large accounting departments, where the workload and number of employees may cause miscommunication.

- Client relationships. Consider improving your client relationships by establishing transparent communication from the outset of the project. By sending frequent project progress reports, you can also remind clients of the work you’re currently doing and that you have successfully finalized.

- Billing practices. What are your project billing methods? Do you have trouble consolidating your data from multiple sources? If yes, consider switching to a more unified software solution as soon as possible.

Between the recurring templates that I use and standard line item options, doing the invoicing for 30-40 clients each month in Productive takes me a couple of hours tops. It’s just so easy, especially with the QuickBooks integration.

5. The Profit First Method

The profit-first method provides a different perspective on your agency’s finances and profit. Pioneered by Mike Michalowicz, this method takes the usual formula for profit:

Sales – Expenses = Profit

And flips it upside down:

Sales – Profit = Expenses

It’s not a radically new way of calculating your key agency metrics. Instead, it’s a way to reframe them. By considering your expenses through the lens of your profit, the idea is to reduce your spending according to the volume of sales.

This principle doesn’t try to change your habits (that is nearly impossible to do), Profit First works with your existing habits. By first allocating money to different accounts, and then removing the temptation to “borrow” from yourself, your business will become fiscally strong and you will benefit from regular profit distributions.

Source: The Profit First Formula Explained

6. Managing Your Chart of Accounts (COA)

A chart of accounts (COA) is a systematic way of organizing and monitoring your company’s financial accounts. It usually includes four types of accounts:

- Revenue Accounts: Track the income generated from your agency’s services.

- Expense Accounts: Expense accounts capture the costs associated with running your agency, including salaries, software subscriptions, and office rent.

- Asset and Liability Accounts: Record the resources owned by your agency, while liability accounts track its financial obligations.

- Equity Accounts: Represent the ownership interests in your agency, including initial investments and retained earnings.

There are differences between a COA for a production company vs a professional services business. An agency will need to consider some specific metrics, such as profitability across clients, projects, or services.

All this is to say that your agency’s COA should not necessarily be structured the same as another company’s. The most important thing is not to get bogged down in the details. This can make your chart difficult to parse, which impacts the amount of insights you can get out of it.

According to Chris Hervochon of A Better Way CPA:

The biggest mistake is a sprawling chart of accounts where you’ve got one account for every little transaction. So if you have accounts that you know, on a very regular basis have one transaction per month or one transaction per year, you’ve got way too many accounts.

Source: Agency Accounting 101 with Chris Hervochon

Consider the most important accounts for your service business and focus on them.

7. Maintaining Cash Reserves

Cash reserves provide a financial cushion to cover unexpected expenses, manage cash flow fluctuations, and ensure stability during economic downturns.

According to Peter Kang of Barrel Holdings, agencies usually aim to cover 3 months of expenses with their cash reserves. However, he points out that sitting on a lot of cash can be to your detriment, as it encourages a passive outlook:

A large cash balance can lull an agency owner into making less disciplined choices, like tolerating decreasing margins or even negative cash flow months when business slows down.

Source: How Much Cash Reserves Makes Sense for An Agency Business?

However, this doesn’t mean that you should leave your cash reserves empty. According to JPMorgan, the median small business holds only 27 cash buffer days in reserve, meaning many “may not have enough cash to continue operations in the face of a month-long loss of cash inflows due to an economic downturn or other negative shock”.

Harvard Business Services suggests that startups set aside five to ten percent of revenue in a reserve account and then reassess this amount as the company grows.

Learn more: We also have an article on the xRechnung standard in Germany, which is a crucial part of managing and processing invoices.

Accountant vs. Bookkeeper Role

An agency accountant and a bookkeeper are both financial roles, but there are some differences.

- A bookkeeper handles the day-to-day tasks of recording financial transactions, including purchases, receipts, sales, and payments, providing a direct and consistent record of all financial activities.

- An accountant analyzes data provided by bookkeepers to offer insights and advice, prepare financial reports, perform audits, and assist with tax preparation and strategic financial planning.

Hiring for both roles is usually preferable as they go hand-in-hand. However, in a pinch, hiring an accountant first and supporting their activities with bookkeeping software can work until your business needs become more complicated.

Find out more about the key agency roles: roles of managers and the project analyst roles.

5 Tips for Increasing Revenue and Agency Profit

Finally, now that we’ve discussed some methods and techniques for streamlining your accounting, what about increasing revenue and profit?

Here are some things to consider:

1. Diversifying and Expanding Revenue Streams

According to the Agency Valuations Report, 31% of agencies generate more than 20% of their revenue from their top client. Obviously, this can be a risky strategy. How can you diversify and expand your revenue streams?

Here are some options:

- Introduce new services that complement your existing offerings

- Expanding your target market to tap into new customer segments

- Creating strategic partnerships to reach new clients

- Invest in marketing campaigns and sales strategies to generate more leads

ON DEMAND WEBINAR

Elevating Lead Generation Strategies by Leveraging Partnerships

Get a sneak peek into Productive’s Bold Community to learn all about the importance of leveraging partnerships with Nick Dan-Bergman from LaneTerralever.

2. Updating Rate Cards

To stay competitive, you’ll need to revisit your agency rate cards and retainers at least on an annual basis to match the increase in the cost of wages, operational expenses, and inflation.

You can also consider implementing a completely new pricing model, such as productized services or value-based pricing.

Value-based pricing has been especially popular. It involves pricing your services according to perceived value rather than the amount of time billed. In theory, this can significantly increase your revenue, but you’ll need to convince clients that you can truly bring this value.

This is why this strategy is best considered once your agency is well-established in your industry or you have in-demand, niche skills to offer.

3. Reliable Time Tracking

Agency financial management starts with time tracking. Consider using a professional services timekeeping tool to make this process as painless as possible for both employees and their managers. A single report, such as estimated vs. time worked, can tell you a lot — but only if the data is reliable.

For example, with Productive, time can be tracked with the built-in timer that can be started from tasks for easier management, or it can be inputted manually at the end of the day.

USE PRODUCTIVE’S TIME TRACKING TO MANAGE BILLABLE TIME

Productive also offers a desktop app for Mac OS and Windows so that you can access this timer outside of the browser, which can save a lot of time. There’s also a mobile app for teams on the go, as well as a one-way Google Calendar integration, which converts calendar entries into time entries.

These are just some examples of how you can get consistent time tracking for your service business.

4. Accurate Project Estimates

According to PMI, 37% of strategic initiatives fail because they lack clearly defined or achievable milestones and objectives.

Accurate project estimation is how you can prevent your scope from expanding to where your projects are suddenly unprofitable. This ties into your time tracking because you’ll need to have historical records of how much time it took to complete similar projects in the past.

Most of all, it requires honesty and transparency. It can be tempting to offer clients quick and breezy project delivery. But if you must do so, try to get something out of it.

Consider charging rush fees or scaling back your service offerings accordingly. You can also consider requesting services from the client, such as marketing opportunities (referrals or success stories), for expedited or cheaper delivery.

5. Implement Revenue Operations (RevOps)

Revenue operations (RevOps) can significantly enhance revenue and profitability in an agency by fostering alignment among key business functions—sales, marketing, and customer service. By integrating these departments, RevOps creates a unified strategy that drives sustainable growth.

RevOps examines metrics such as:

- Customer Acquisition Cost (CAC)

- Annual Recurring Revenue (ARR)

- Customer Lifetime Value (CLV)

It’s a holistic approach that aims to align investments across all departments, help you keep better track of your revenue cycle, and reduce silos for better team communication.

Learn more in our comprehensive guide to the revenue operations framework.

Final Thoughts: Managing Your Project Accounting

To conclude, agency accounting is a complex process, but it doesn’t have to be difficult. The main things to consider include:

- Choosing the right method of revenue recognition

- Managing overhead across all projects

- Streamlining your invoicing practices with automation

- Maintaining reliable records and charts of accounts

- Implementing a software solution to support all of the above

If you’re looking for an effective platform for managing your agency financials and other key operations, consider Productive. It’s designed to be the all-in-one solution to support agency workflows.

Book a demo today to learn more.

Manage Your Agency Accounting With Productive

Switch from multiple tools and spreadsheets to an all-in-one software solution for accounting and comprehensive agency management.