What Is Planned vs. Actual Analysis and How To Perform One?

Projects don’t always go as planned. Planned vs. actual analysis helps you systematically evaluate your business’s performance against predetermined financial goals.

The goal of this analysis is to get precise numbers that tell you if your project is on track.

Stick with this short 2025 guide to learn how to understand these performance metrics, implement analysis techniques and keep project management on track.

Key Takeaways

- The analysis compares expected performance against real results to identify variances and improve decision-making.

- Positive variances happen when results exceed planned targets, while negative variances indicate performance falling below expectations.

- Regular monitoring of planned versus real metrics helps team leaders track progress, identify issues, and make data-driven adjustments.

- Automated tools and PM software make the comparison process more straightforward, reduce manual effort, and provide real-time insights for better financial control.

What is Planned vs. Actual Analysis?

Planned vs. Actual Analysis (also known as variance analysis) is a measurement technique that compares forecasted targets with real-world results. Its goal is to identify and analyze variances in their financial performance.

When businesses work on achieving their financial objectives, they’ll use a systematic way to evaluate their performance against predetermined goals.

You can learn a lot from this financial measurement comparison. It will help you track progress toward your business goals while highlighting areas that need special attention.

During the analysis you’ll typically examine key metrics such as sales figures, revenue streams, and operational expenses. Whether you’re using spreadsheets or specialized software, this comparison is your compass for making informed strategic adjustments and improving future projections.

What Are the Benefits of a Projected vs. Actual Analysis?

Conducting a projected vs. real analysis will help you make better-informed decisions and maintain better financial control through systematic tracking of performance metrics.

You’ll notice significant improvements in your projections as you learn from past variances and adapt future predictions based on what you’ve learned (e.g., estimated planned time vs. the real time your project teams spent).

Frequent monitoring of positive and negative variances helps businesses understand their realistic performance relative to goals and make strategic adjustments in time.

Below, we’ll zoom in on the benefits of these frequent reports.

Improve Forecasting Accuracy

When you systematically analyze planned versus real outcomes, you’ll enhance the accuracy of your projections and decision-making capabilities. Just like with other forecasting approaches, combining quantitative and qualitative techniques will deliver more reliable predictions over time.

Maintaining high-quality data integrity while conducting regular difference analyses creates a foundation for precise predictions. Advanced analytics tools and comprehensive data management systems help identify trends and patterns that might otherwise go unnoticed.

Here are a few bonus tips:

- Establish automated data validation protocols to guarantee consistency and accuracy in your inputs.

- Conduct monthly variance analyses to understand the gaps between projected and real-life results.

- Implement continuous feedback loops to refine forecast models based on historical performance data.

- Use Productive’s forecasts to get accurate project data, from budget burns and profit to workforce utilization rates, and revenue.

Visualize planned vs. worked time and costs across weekly intervals—track time and profit in one view.

Better Decision-Making

The analysis gives you essential insights into performance gaps, making it easier to identify and make the strategic adjustments needed for success. When managers have the numbers behind the differences between planned and real outcomes, they can pinpoint areas that require immediate attention and develop more effective management approaches.

This analysis empowers you to make data-driven decisions based on real performance metrics rather than assumptions. You’ll be able to refine your project execution approach, address underperformance, and replicate successful approaches across your organization.

The analysis is an invaluable tool that drives continuous improvement and helps you align operations with your business goals.

Financial Control and Accountability

Rigorous financial oversight is only possible when you compare planned versus actual costs in detail.

You’ll need to focus on the significant variances between projected and real performance, and investigate these gaps in time. The regular reviews help you refine future projections and enhance financial management practices.

Here’s what you should do:

- Compare real sales, expenses, and cash flow with realistic projections to spot trends and opportunities.

- Use specialized software (or at least spreadsheets) to streamline analysis and reduce errors.

- Implement monthly reviews to maintain proactive control and make timely data-driven decisions.

This systematic approach guarantees you’re tracking performance effectively while maintaining a strong grip on financial accountability across all departments.

Adjusting Business Strategies

When businesses conduct this analysis method, they gain key insights that drive strategic adjustments and operational improvements.

This analysis comes in particularly valuable for identifying performance variances and understanding their root causes. You need to keep a close eye on these discrepancies, so that you can make informed decisions about resource allocation and market positioning.

The process enables you to adapt swiftly to changing market conditions while maintaining your competitive edge.

You’ll also be better equipped to refine your forecast models using historical data, which leads to more accurate predictions. This continuous cycle of evaluation and adjustment guarantees you’re always aligned with your strategic objectives and prepared for market shifts.

What Are the Key Financial Components To Review?

When you’re evaluating your company’s financial performance, you’ll need to review sales, expenses, cash flow, and profit & loss.

Your review should start with sales and expense comparisons, which reveal revenue patterns and cost management effectiveness, before moving on to cash flow analysis, which shows your business’s liquidity position.

The final piece of the analysis puzzle includes going over your profit and loss statements, which provide an extensive view of how well your planned financial targets align with real results.

Let’s break down each component.

Sales

Monitoring the relationship between planned and real sales is where effective financial management and strategic decision-making really begin. Here, you need to analyze the projected vs real sales and review regular performance metrics (how many units were expected to be sold vs. how many units actually got sold).

In return, you’ll get valuable insights into your business’s operational effectiveness and market position. When you’re examining sales data, focus on both quantitative metrics and qualitative factors that influence your results.

- Compare real revenue against sales projections using segmented data by product lines and customer segments.

- Track seasonal variations and market trends to adjust your predictions more accurately.

- Analyze customer retention rates and average order values to identify growth opportunities.

Use Productive to Quickly compare forecasted deal values with current sales pipeline.

Expenses

If you want to be effective at expense management you should keep an eye on projected costs, real expenses, and their resulting cost variance analysis. When you’re doing cost assessments, focus on key categories like operational costs, personnel, and materials.

Market fluctuations and external factors can greatly impact your real spending, so you’ll want to implement special cost-control measures.

In Productive you can compare scheduled time, budget, and invoicing status.

Cash Flow

When comparing planned and actual cash flow, you’ll need to examine operational activities, investing initiatives, and financing decisions to identify discrepancies. Understanding these variances helps you make informed adjustments to your financial strategy.

Here you should:

- Monitor your operating cash flow margin to assess how efficiently you’re converting sales into available cash.

- Compare planned versus real free cash flow to evaluate your company’s actual financial flexibility.

- Track your cash conversion cycle to identify potential timing issues between projected and real cash movements.

Profit & Loss

Since effective financial management depends on accurate performance assessment, comparing planned versus actual profit and loss statements is a critical component of business analysis.

You’ll need to carefully examine revenue variances, COGS (Cost of Goods Sold) fluctuations, and operating expense deviations to gain meaningful insights into your business’s financial health.

Focus on analyzing gross profit margins and sales projections while monitoring key financial ratios.

IN PRODUCTIVE YOU CAN Evaluate monthly revenue and cost trends side-by-side.

How To Perform a Plan vs. Actual Analysis?

To conduct an accurate plan vs. actual analysis, you should start creating a thorough plan that outlines your expected financial metrics and goals in detail. You’ll then keep track of your real results as they happen.

On this step don’t forget to ensure accuracy in data collection from your accounting systems and financial reports. Finally, you’ll systematically compare your planned figures against the actual outcomes to identify variances, which will help you understand where your business is meeting, exceeding, or falling short of its targets.

To make it easier for our readers, we’ve broken down this process in the sections bellow. Let’s start with step one.

STEP 1: Create a Detailed Plan of Financial Objectives

In the first step, you’ll need to establish clear financial objectives, develop thorough forecasts, and identify relevant KPIs that align with your business goals. Structure your plan around strategic initiatives while maintaining realistic timelines for implementation.

- Define specific, measurable financial targets, including revenue projections, profit margins, and growth rates.

- Create detailed sales and expense forecasts using historical data and market analysis.

- Establish KPIs that effectively track progress, such as customer acquisition costs, conversion rates, and operational efficiency metrics.

STEP 2: Record Real Results

You’ll need to utilize data collection tools (or at least spreadsheet workarounds) to systematically record financial metrics, behaviors, and outcomes. Maintain consistency in your documentation by following good documentation practices and organizing data into categories that mirror your plan’s structure.

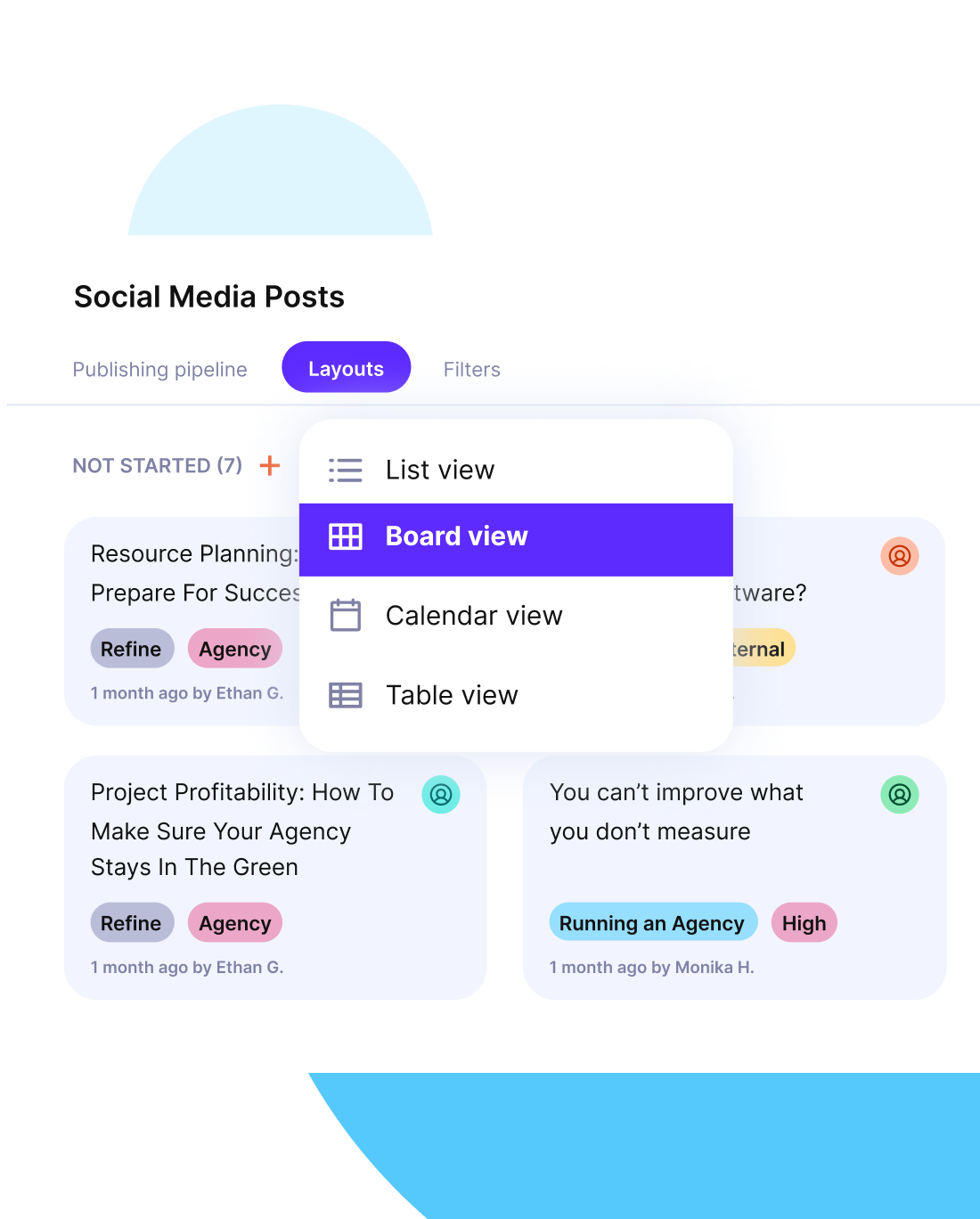

Track planned documentation vs. what’s actually delivered in real time.

Implement reliable recording methods while ensuring data accuracy and legibility.

You’ll want to capture information over the same time frame as your plan, making it easier to conduct meaningful comparisons later. Also, you might want to consider using visualization tools to make your data more accessible and comprehensible.

STEP 3: Compare Planned and Real Data

To get a good basis for future comparing, you’ll need to integrate your project data into a unified table or visualization platform, enabling direct comparisons between projected and real resulting figures. Tools like Productive have a specialized Scenario Planner feature (and a bunch of other finance mush-have tools) make this process easy and accurate.

- Create scenario columns to clearly distinguish between planned and real values.

- Analyze variances at multiple levels of granularity to identify specific areas needing attention

- Document insights and patterns to refine future forecasting models

When comparing data, focus on sales, revenues, and expenses to identify meaningful trends and discrepancies that warrant strategic adjustments.

STEP 4: Analyze Variances

When analyzing plan vs. actual data, you’ll encounter positive variances, which signal that real results have exceeded your planned targets, indicating favorable performance. In contrast, negative variances occur when actual results fall short of planned objectives, suggesting underperformance that requires investigation and corrective measures.

You’ll need to calculate these variances using the formula (Actual – Planned) and express them as percentages to gain meaningful insights into your business’s performance relative to expectations.

Positive Variance

Positive variances mean that real results surpass initial expectations. These favorable positive risks can occur in both sales performance and cost management, providing valuable insights for strategic decision-making.

They can manifest as:

- Higher sales volumes or revenue than forecasted indicate market opportunities.

- Lower operational expenses demonstrate effective cost-control measures.

- Improved efficiency metrics suggest successful process optimization strategies.

Negative Variance

Negative variances are super common in business. When they happen companies need to identify and address performance shortfalls effectively ASAP.

When analyzing these variances, you’ll notice how negative results in sales happen when real figures fall below planned targets, while in expenses, they indicate overspending beyond budgeted amounts.

To manage and mitigate these variances, you should track performance metrics regularly and implement appropriate strategic responses.

What Are the Best Practices for Performing the Planned vs. Real Analysis?

The best practice for performing the planned vs. real analysis is to use project management software with strong financial features like automated data processing and comparison.

Additionally, you should integrate these solutions with your existing accounting tools to create a smooth flow of financial information and enable real-time tracking and instant variance detection.

If you can, choose a tool that has visualization dashboards to transform complex financial data into clear, actionable insights. Automated comparison functions will help you spot trends and anomalies that might otherwise go unnoticed in traditional spreadsheet analysis.

Using Business Planning Software

Business planning software has revolutionized the way companies conduct planned vs. actual analysis. This type of PM software has advanced features that make data comparison and decision-making processes way more precise.

Real-time data visualization capabilities and customizable models enable precise tracking of variances between projected and real performance metrics.

- Predictive forecasts help you anticipate future trends and adjust strategies accordingly.

- Scenario planning tools allow you to explore multiple business outcomes before making critical decisions.

- Collaborative platforms facilitate team input and enhance the accuracy of planning processes.

Integration with Accounting Tools

Integration with accounting tools has provide your planned versus actual analysis the most accurate financial data. These integrated systems enable real-time data processing, reducing errors while providing extensive reporting capabilities across all accounting functions.

You should integrate your PM software with bookkeeping software to get a detailed analysis of costs (including actual time, e.g., hours per project).

Visualization Dashboards

Visualization dashboards help transform complex project data into actionable insights. Color-coded elements and real-time updates make variance identification immediate and intuitive.

Their biggest benefit is that anyone with some project context can understand them. Their customizable interfaces will help you drill down into specific metrics while maintaining a clear overview of performance trends.

- Interactive filtering options let you segment data by time periods, departments, or project phases.

- Color-coded indicators highlight significant deviations between planned and real values.

- Dynamic trend analysis features track historical patterns and forecast future outcomes.

Automated Comparisons

Automated comparison adds unprecedented efficiency and accuracy to the evaluation process. The algorithmic comparisons and automated data mining capabilities greatly reduce manual effort while maintaining precision.

These systems also eliminate human errors and integrate machine learning to enhance comparison accuracy over time while continuously monitoring data streams for real-time insights.

When you implement automated comparison tools, you’ll benefit from automated data visualization. These neat features generate clear, actionable reports.

This technology enables you to scale your analysis efforts efficiently, handle larger datasets, and make data-driven decisions faster.

Planned vs. Real Analysis Example

Whether you’re tracking sales goals, controlling expenses, or comparing high-level financial metrics, the process is always the same: define your plan, collect real results (e.g., actual sales), analyze the variance (compare the real results with financial statements), and use those findings to adjust future decisions.

Below, we’ll cover the key components of your actual comparisons.

Sales Forecast vs. Real Sales Performance

When developing a practical sales plan, businesses must integrate multiple components to create a thorough strategy that drives revenue growth.

Let’s say your team has a sales plan that estimates $100,000 in monthly revenue based on pipeline activity and historical conversion rates. At the end of the month, you generated only $85,000. That’s a $15,000 shortfall or a 15% negative variance.

Instead of stopping at “we missed the target,” go deeper:

- Segment the results by product, region, or rep: Did one sales channel underperform?

- Compare deal velocity and win rate: Were there delays in closing, or a drop in conversion?

- Investigate qualitative factors: Was there a change in pricing, competitive activity, or lead quality?

Forecast profitability and sales with Productive

Planned vs. Real Expense Tracking

In another example, let’s say you’ve budgeted $12,000 this quarter for marketing, broken down across ads, software, freelancers, and events. At the end of Q1, you spent $13,800 — $1,800 over budget.

Here’s how to structure the analysis:

1. Break expenses into granular categories (e.g., Meta ads, Canva subscription, email tools)

2. Compare planned and actual spending per category

3. Use variance percentages to highlight where overruns occurred (e.g., ad spend was 30% higher)

From there, identify whether the overspend was a one-off, justified by results (e.g., higher ROI), or a signal that your original budget was unrealistic.

Comprehensive Financial Comparison

A full planned vs. actual financial comparison often happens at the end of a reporting period. This is where you zoom out from individual line items and assess overall performance across revenue, gross margin, and net profit.

Let’s use an example:

- You forecasted $250,000 in Q2 revenue, with $160,000 in costs and a target profit margin of 36%.

- You ended up earning $240,000 in revenue but only spent $145,000 — resulting in a better-than-expected profit margin.

Even though revenue underperformed slightly, profitability exceeded expectations, which might indicate tighter cost control, a change in sales mix, or efficiency improvements.

For a detailed analysis, you should:

- Compare budgeted vs. actual numbers for revenue, COGS, and OPEX.

- Calculate variance in both absolute terms and percentages.

- Interpret what those variances mean for future planning – do you need to raise targets? Adjust pricing? Shift resources?

What Tools To Use for Projected vs. Actual Analysis?

The best tools for Planned vs. Actual analysis are spreadsheet software, specialized project planning software, and accounting tools.

- Microsoft Excel or Google Sheets is a free but very basic tracking and visualization solution.

- Specialized business planning platforms like Productive let you monitor progress in real-time and generate detailed variance reports.

- Accounting integration tools help you automatically pull actual cost data and compare it against planned budgets.

We’ve made a detailed list of the top scenario-planning software solutions (along with other useful articles) that you might want to check out.

Spreadsheet Software

Options like Microsoft Excel and Google Sheets have solid features that are fairly cheap, with Excel available for a modest monthly fee and Google Sheets completely free.

The upsides of these tools are:

- Real-time collaboration that enables your team to work simultaneously on analyses.

- Built-in visualization tools that help you create basic charts and graphs.

- Integration with accounting software for importing real results.

Business Planning Platforms for Specialized Projects

While spreadsheet software provides the essentials, specialized business planning platforms offer a complete toolbox designed specifically for plan vs. actual analysis.

These platforms have AI-powered features, collaborative tools, and customizable templates that enhance your planning process. Their financial projections will help you project future performance while tracking real results in real-time.

With platforms like Productive, you can leverage automated financial calculations and capacity planning features to create sophisticated analyses.

Accounting Integration Tools

Accounting tools use APIs and cloud-based solutions to synchronize data across multiple platforms, from CRM systems to inventory management software, enabling real-time financial insights and automated workflows.

- Integration with popular e-commerce platforms like Shopify streamlines your online sales accounting

- Cloud-based solutions such as QuickBooks and Xero have API connections with huge amounts of other tools

- Real-time synchronization reduces manual data entry and minimizes errors

These integrations transform your financial management by creating a unified ecosystem where data flows automatically between systems, improving accuracy and efficiency while reducing operational costs.

Final Takeaway

This financial comparison analysis is your essential tool and best friend for maintaining financial control and strategic alignment in your business operations.

Only when you regularly compare projected figures against real-world results, you’ll be able to identify variances, adjust strategies, and make the best decisions.

The only way to compare sales, expenses or operations with concrete realistic data is to use modern analytics tools and established methods.

Though we’ve talked a lot about financial solutions and spreadsheets, choosing a PM software is the best decision you can make to make your analyses realistic, accurate, and actionable.

Book a short demo and get started today.

Manage Project Forecasts, Finances and Execution with Productive

Analyze gaps between your planned outcomes and what really happened. Switch from multiple tools and spreadsheets to an all-in-one solution for complete project management.