Agency CFO Key Roles and Responsibilities In Productive

Agencies are meant to deliver some form of creative work. That’s a no-brainer.

So they’re hired by brands, individuals, companies or institutions for what they do best—but can they do what they’re meant to without being profitable? Not for long.

To deliver successful projects and keep clients happy, financial health is a must. To get that, you need consolidated financial data so that you can optimize investments and continue to grow. That’s where the Agency CFO usually comes in. (I say usually because the size of your agency will likely indicate whether or not you decide to hire one.)

Still, even if you’re an aspiring agency looking to expand, it’s beneficial to get an idea of what the Agency CFO (or Agency Finance Director) does.

Read on the discover the key roles and responsibilities of an Agency CFO. Plus, learn about the main areas used by this particular persona for agency finance management in Productive.

What Does an Agency CFO or Agency Finance Director Do?

We’ve talked about what agency operations managers, agency project managers and agency traffic managers do. So where does an Agency CFO come into the picture?

An Agency CFO’s main job is to manage a business’ financial activities and team, plus offer strategic business consulting for the CEO and peers.

An Agency Finance Director will forecast business growth, know how the agency can take on potential market opportunities and avoid risks. CFOs usually have an educational background and professional experience in the fields of finance, business management, or accounting.

Keep Your Agency Running Smoothly

Simplify your daily workflows with a full suite of management features, from time tracking to reports.

The Difference Between an Agency CFO, Agency Finance Director or a Head of Finance

Now you may be asking yourself: what’s the difference between an Agency CFO, Agency Head of Finance and Agency Financial Director?

Well, it depends.

Just as each agency is different, titles will vary for similar job descriptions. Likewise, job descriptions for agency finance management positions will be different for each agency’s specific needs.

Agency CFO – Key Roles and Responsibilities

The size and organizational structure of an agency will dictate the exact roles and responsibilities of an Agency CFO.

Generally, there are five key areas that an Agency CFO’s roles and responsibilities will fall into:

- Managing cash flow

- Reporting

- Managing ROI

- Business Forecasting

- Strategic consulting

To get more granular, the roles and responsibilities of an Agency CFO will comprise of all, most or part of the following:

- Managing the agency’s financial planning and activities and determining financial KPIs

- In charge of overseeing financial forecasting, budgeting, investments

- Preparing financial reporting

- Leading the Finance and Accounting team

- Performing risk assessment, overseeing investments and liabilities

- Providing industry knowledge to benchmark the agency against peers

- Offering strategic advice and long-term financial planning to the CEO

- Collaborating with members of management and stakeholders

- Ensuring legal compliance, establishing formal finance-related procedures

How an Agency CFO Can Get the Most Out of Productive

An Agency CFO’s main focus will be making data-driven decisions based on financial reports.

Whether it be forecasting revenue, assessing potential investments, contributing to hiring decisions, or day-to-day cash flow management, all of these answers can be found in Productive.

There are three main areas of Productive that you’ll enjoy using as an Agency CFO:

- Going over items, tasks, project phases and due dates

- Reviewing timelines and schedule changes with account or project managers

- Reviewing budget spending with account managers to get client approval

- Planning and forecasting upcoming projects

How Agency Traffic Managers Can Get the Most Out of Productive

As an agency traffic manager, these are the features you’ll mostly use in Productive:

- Reporting

- Pulses

- Dashboards

Learn more about each below.

I can safely say that finance and administration is one of the areas that has experimented the biggest change since the implementation of Productive.

The improvement in the efficiency of the processes and the even greater knowledge of our business is clear if you also take into account that you can treat each client, even each project from a client, as an independent unit of profitability.

Without a doubt, in the billing area there has been considerable change. I can say that the hours we dedicate have been reduced in a 15-20%.

Read the full story on how BICG got a 360-degree view of their business with Productive.

1. Set Up Agency Reporting In Productive

Reporting will be the main are an Agency CFO spends time in Productive because reports comprise consolidated business data from different sources (e.g., service rates, employee salaries, tracked time, overhead expenses, budgets, etc.).

To get accurate (real-time) data on everything from budget spending to profit earning, each teammate (including billable and non-billable roles) must track time on the services they provide and projects their work is attributed to.

Speaking of reporting, one of the most popular reports that you’ll be looking at in Productive as an Agency CFO are revenue forecasting reports. Forecasting reports can be linked with budget usage, revenue, utilization, profitability—any data you’re particularly interested in can be customized as a report.

To learn all about it, check out our webinar on forecasting:

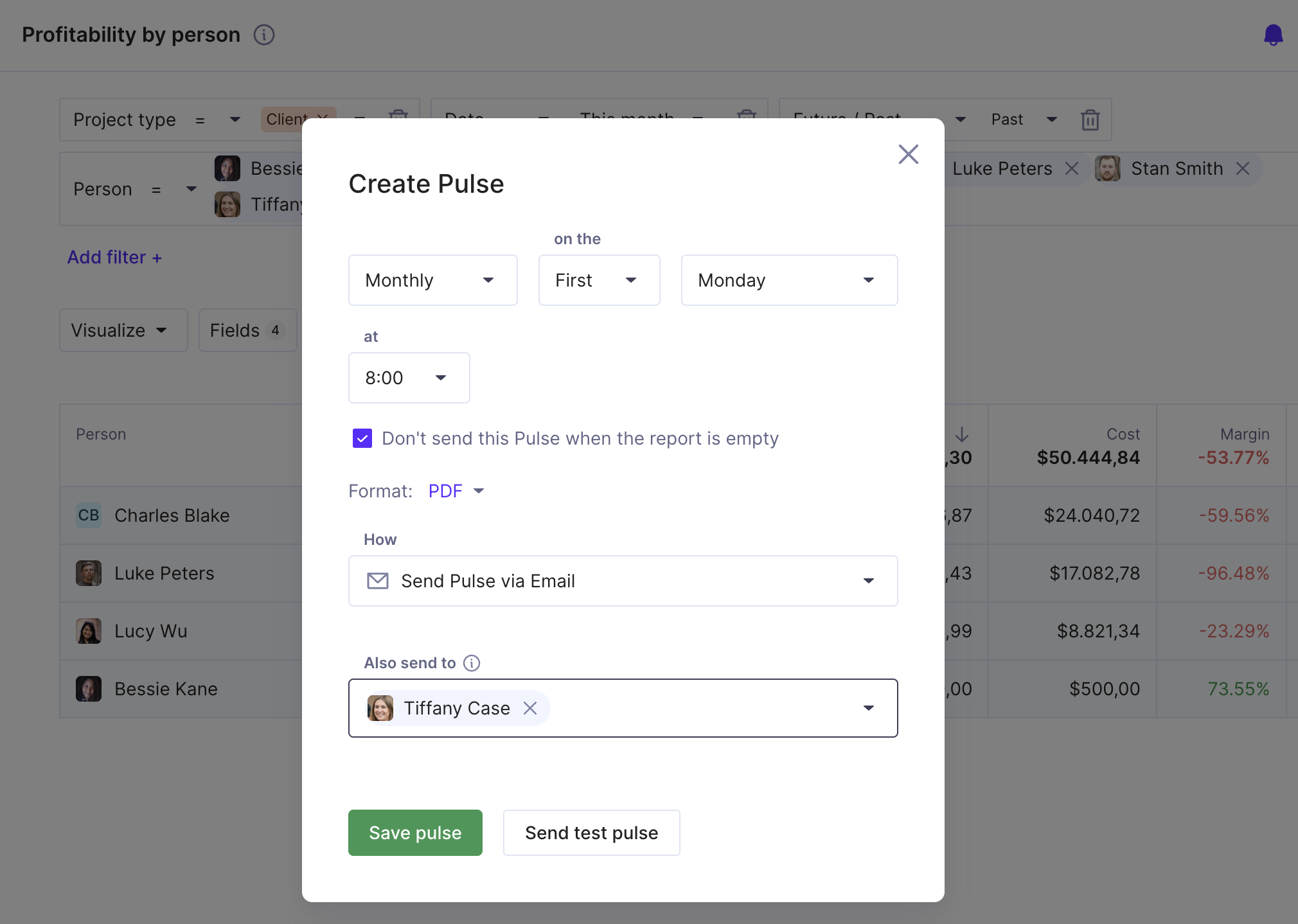

2. Create a Pulse, an Automatic Agency Report

A Pulse is an automatic update you can set up and subscribe to in Productive. It’s formed around an insight (report) or view from Productive and sent out to email subscribers daily, weekly or monthly. If you’d like to send Insights to your Slack channels via Pulse, here’s a quick guide on how to set everything up.

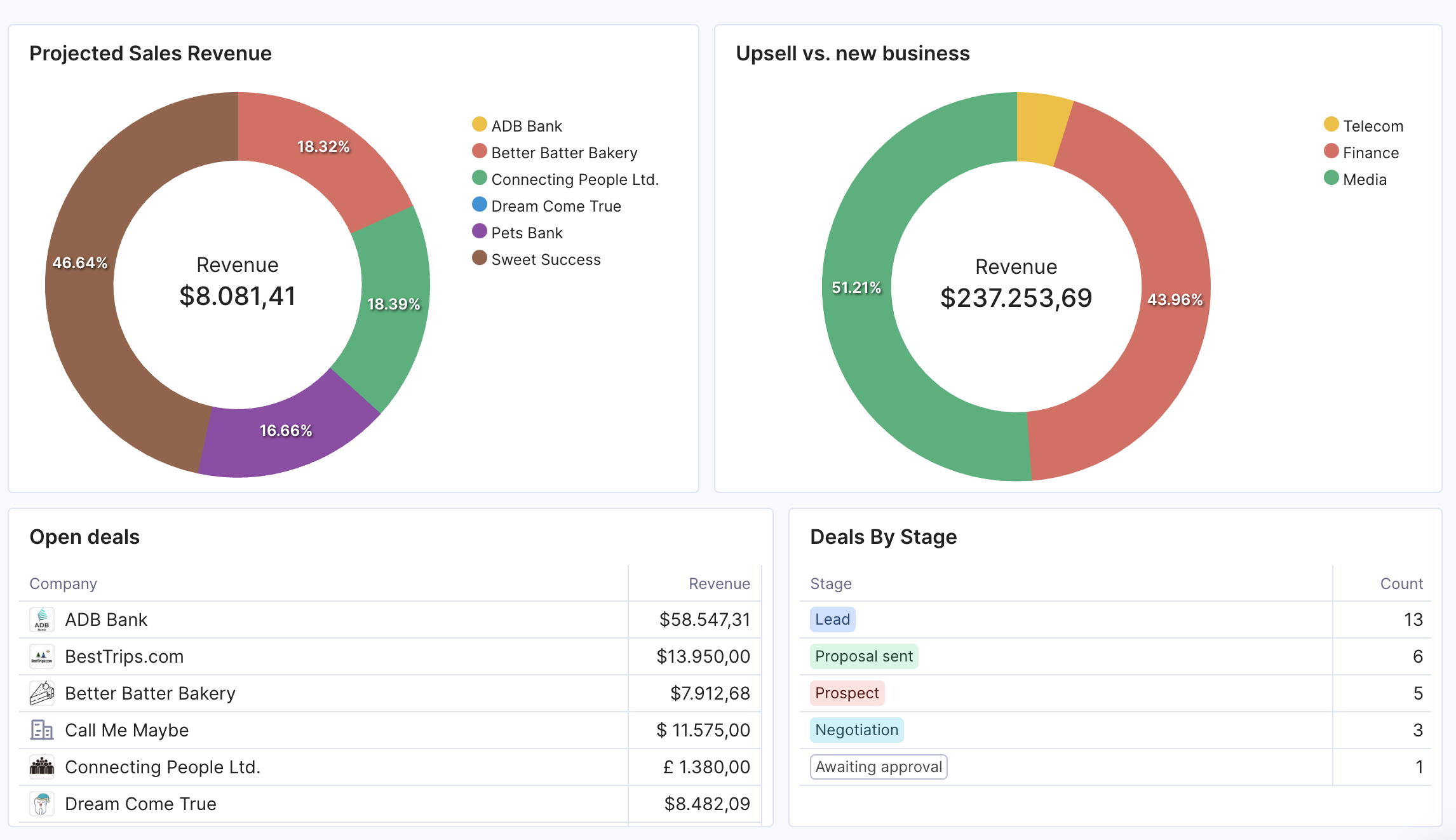

3. Get Visual With Dashboards

Besides ready-made agency-specific reports, as an Agency CFO you’ll be keen on creating your own, customized Dashboards that will let you see what matters most to your business. You can think of Productive’s Dashboards as the control panel of your agency. Simply combine the data you’re interested in and cast an eye at your Dashboard—which is updated in real time.

Productive helps me stay on top of internal and external budgets, manage invoices and payments, and store information for each project. Not to mention the reports, which provide me with crucial data right away.

If You’re an Agency CFO, Try Productive

Not all agencies (think they) can afford a CFO. However, as the digital agency landscape is getting more and more competitive, it’s becoming commonplace for service business of all shapes and sizes to consider hiring such a role. Why?

Simple: to make the most out of their business without letting anything related to finance fall through the cracks.

To get a better idea of how Productive help your agency thrive, book a demo with our team.

Keep Your Agency Running Smoothly

Simplify your daily workflows with a full suite of management features, from time tracking to reports.