What Is Customer Retention Rate and How To Calculate Yours?

Customer retention rate measures the percentage of customers who continue doing business with you. It’s one of the most important project management metrics that directly impact a business’s profitability and growth.

Stick with this guide to know everything you need to about this metric – how to calculate it, learn from it and improve the numbers of happy customers that you can always count on.

Key Takeaways

- The formula for calculating the customer retention rate is ((End Period Customers – New Customers)/Start Period Customers) × 100.

- Retaining existing clients can cost up to 700% less than acquiring new ones, making retention a key profitability component.

- Industry benchmarks vary significantly, with media and professional services at 84%, while SaaS companies experience higher churn rates.

- Key metrics for tracking client retention rate are churn rate, repeated purchase rate, customer lifetime worth, and net promoter score.

What Is Customer Retention Rate?

Customer retention rate (CRR) is a success metric that measures the percent of users that continue to buy your product or service over a period of time. In other words, it tells you how good your business is at retaining its customers.

Success doesn’t just come from about your ability to attract new users but also from keeping the old ones coming back.

This financial metric reflects your company’s financial health and effectiveness in maintaining long-term relationships with your customer base. The calculation process starts with the first interaction with the new user and requires careful tracking throughout their journey.

Tracking the rates of returning customers is particularly important because keeping existing clients costs considerably less than acquiring new ones. According to a detailed study by Bain & Company:

Increasing customer retention rates by 5% increases profits by 25% to 95%.

Another cool article about the topic in the Harvard Business Review mentions that acquiring a new user is anywhere from five to 25 times more expensive than retaining an existing one.

If you think more about it, retained customers contribute to recurring revenue, provide valuable market insights, and often become brand advocates who generate organic growth through referrals. Never forget that a friend’s recommendation trumps all other marketing channels.

How To Calculate the Rate of Retained Customers?

To calculate your customer retention rate, you’ll need to apply a simple retention rate formula: RR = ((E – N)/S) × 100.

This calculation gives the percent of original customers you’ve kept during a time period, or in other words – how good your company is at holding its clients.

- E represents your end-period customers

- N represents new customers acquired

- S represents start-period customers

You can collect these numbers by tracking your user base over your chosen time period, whether that’s monthly, quarterly, or annually. Higher rates typically indicate stronger user satisfaction and loyalty levels.

SaaS and subscription-based companies need to pay special attention to this metric because they rely on recurring monthly revenue.

Step-by-step Calculation Method

To begin, identify your specific time frame and gather insights on your starting user count. Next, determine the number of new clients acquired during this period and your total user count at the end.

Then, subtract your new users from your ending count to find retained users. Finally, divide your retained users by your starting count and multiply by 100. For example, if you started with 100 users, gained 20 new ones, and ended with 95, your RR would be 75%.

You can use CRM software or Excel templates to automate and update this process.

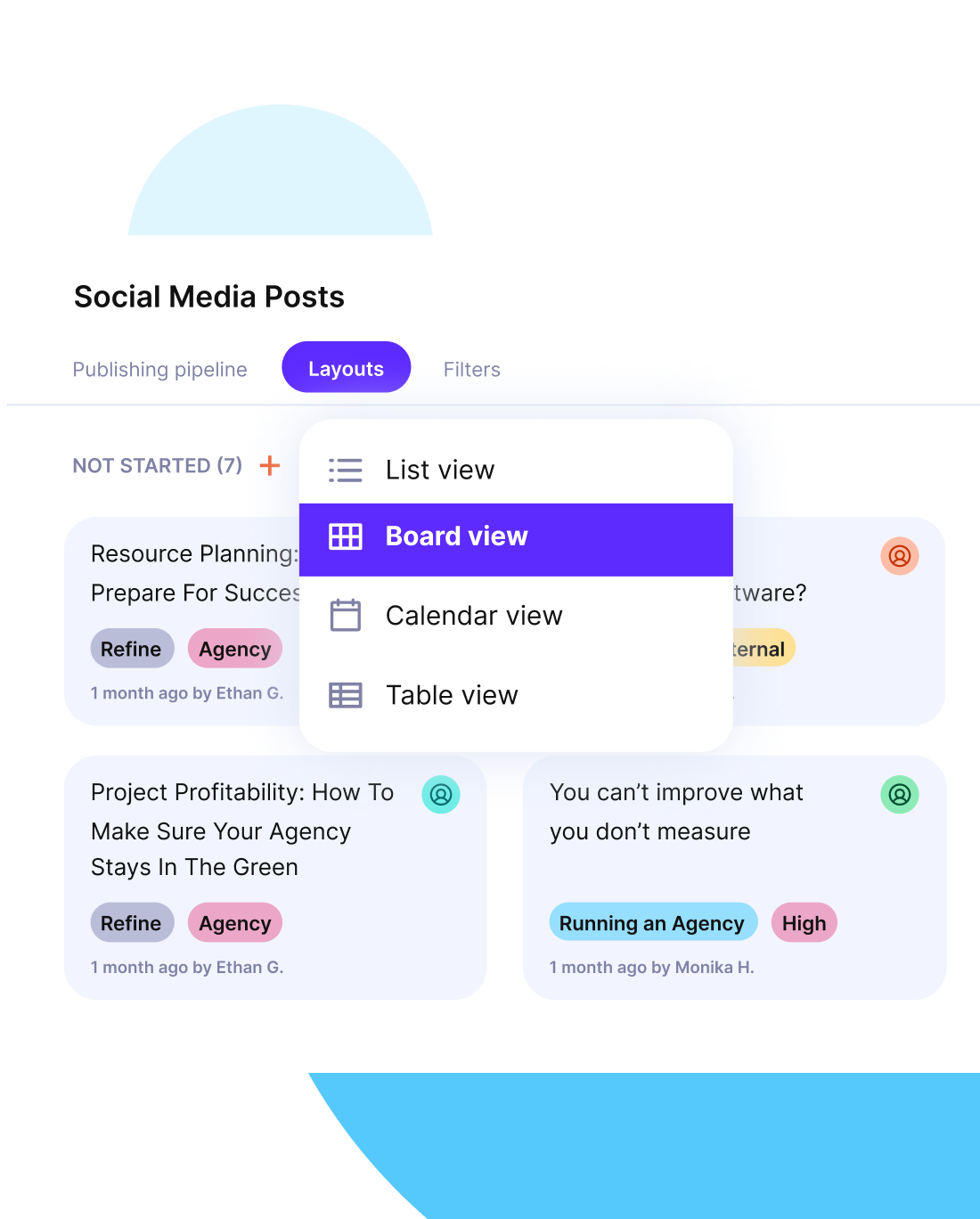

Even better yet, there’s amazing project management software with CRM features, that can calculate profitability. It’s called Productive. There’s also a detailed PM software choosing guide on our blog that you might want to check out.

Monitor revenue trends and link them to customer retention rate.

Get real-time project and profitability metrics with Productive

What Are Key Customer Retention Metrics?

The key customer retention metrics include churn rate (the percent of clients who stop using your services or buying your products), repeated purchase rate (how often users return), customer lifetime value (the total revenue generated from a service or product buyer), Net Promoter Score (buyer loyalty measurement), and user satisfaction scores (direct comments or reviews on customer experiences).

All these metrics work together to create a clear picture of your repeated purchase efforts and help identify areas where you can strengthen relationships with your users.

Below, we’ll give you more context for a better understanding of every metric.

Churn Rate

Churn rate (what percent of your customers stopped being your customers) is a fundamental indicator of buyer loss in business operations.

You can easily calculate it by dividing the number of customers lost during a specific period by your total customers at the start, then multiplying by 100.

While average first-year churn rates typically range from 3-7%, you should aim for less than 3% in the following years.

Understanding your churn rates helps you assess customer loyalty efforts and identify service issues that need addressing. You can think of it as reverse retention.

Monitoring both metrics helps you to make strategic adjustments that actually improve customer loyalty and maintain financial stability.

Repeat Purchase Rate

Loyal users repeat their purchases over time, making it pretty obvious that repeat purchase rate is a vital metric for measuring consumer behavior patterns.

You’ll calculate it by dividing repeat customers by total customers and multiplying by 100. Understanding your repeat purchase rates helps you identify areas for improvement and develop targeted client loyalty strategies.

You can bump up your repeat purchase rates with these buyer-centric approaches:

- Offer personalized product recommendations based on purchase history (like Amazon does).

- Implement a rewards program that incentivizes frequent purchases (like Starbucks does).

- Create exclusive VIP events or early access opportunities (like Twitch does).

- Develop targeted newsletter campaigns with customized offers (like Zalando does).

The industry benchmark typically ranges from 20-30%, though it varies by sector and business model. We’ll get back to real-life examples and what you can learn form them later in the article.

Customer Lifetime Value

A customer’s lifetime value (CLV) tells you how much you’ll earn from each buyer during your business relationship.

To simplify this metric, imagine you run a doughnut shop, and there’s a loyal doughnut buyer caled Pete. Pete buys 2 doughnuts every week, each costing $3. That’s $6 per week. Let’s say Pete keeps coming back for 3 years.

To calculate how much income Pete brings to your shop, you’d just have to multiply $6/week × 52 weeks × 3 years = $936. So, Pete is worth $936 to your business over his “lifetime” as a buyer of your doughnuts.

- Keep Pete happy = $936 in the bank

- Lose Pete = $936 lost (plus more ads and marketing costs to acquire someone new)

You’ll calculate CLV by multiplying average order value, purchase frequency, and customer lifespan to understand the total net profit a buyer generates throughout their relationship with your business.

CLV also helps you make strategic decisions about new user acquisition costs, customer loyalty strategies, and personalized marketing efforts.

Since it’s way cheaper to retain customers than acquire new ones, you should focus on increasing CLV through improved user engagement, tailored support, and targeted product development that meets your high-value clients’ needs.

Net Promoter Score

Net Promoter Score (NPS) is a metric for assessing buyer satisfaction and loyalty. It provides businesses with a straightforward and powerful way to understand their users’ likelihood to recommend their products or services.

To calculate NPS, you’ll survey customers using a 0-10 scale, categorizing responses into three groups:

- Detractors (0-6)

- Passives (7-8)

- Promoters (9-10)

Subtract the percentage of Detractors from Promoters, and you’ll get a score ranging from -100 to 100.

You’ll find out that:

- Detractors express frustration through negative reviews.

- Passives remain neutral in their recommendations.

- Promoters enthusiastically share positive experiences.

- Survey responses reveal actionable user insights.

Customer Satisfaction Score

The Customer Satisfaction Score (CSAT) directly measures how well your products or services meet buyer expectations.

It provides crystal clear stats through a straightforward calculation: dividing positive responses by total survey responses. You can implement CSAT surveys using various scales, from simple 1-3 ratings to more detailed 1-10 measurements.

What’s especially useful is that you can deploy these surveys at any customer journey touchpoint, helping you make data-backed decisions to boost your approaches and improve overall user experience.

Customer Effort Score

Customer Effort Score (CES) measures how easily your customers can accomplish their goals, from resolving issues to making purchases. These interactions should be as simple as possible. These easy and simple interactions play a huge role in determining long-term loyalty to your business.

When you implement CES surveys using scales of 1-5, 1-7, or 1-10, you’ll gain valuable insights into areas requiring improvement.

These insights can be something like:

- Users struggling to navigate your website’s checkout process

- Clients spending too much time on hold with customer service

- A user repeatedly attempting to reset their password

- A shopper facing multiple steps to complete a return

Keep your clients happy and make sure they know you’ve got their backs and they’ll be coming for more.

Benchmarks for Each Retention Metric

Retention Rates (RR) vary across different industries. In media and entertainment, RR are quite higher (around 84%), IT services maintain 81% RR, while banking sees 75% due to established relationships and switching barriers.

Hospitality usually has a lower RR of 55%. SaaS companies typically face a 32% or churned users, while telecommunications maintain 78% RR despite competitive pressures.

These benchmarks, along with metrics like NPS, help you dissect your success and identify areas where you can strengthen buyers’ loyalty.

Retention Rate vs. Churn Rate

Retention rate is reverse to churn rates. You can look at them as two sides of the same coin. Both are complementary success metrics, and both track user behavior. However, they approach the measurement from opposite angles: retention focuses on customers who stay, while churn counts those who leave.

These metrics are inversely related, meaning that an RR of 80% typically corresponds to a 20% churn rate.

You should understand both metrics because they provide valuable insights into user satisfaction and help identify areas where you need to strengthen relationships with your buyers.

Impact on Business Performance

When you’re really good at retaining users, you enjoy significant notice and significant cost savings since acquiring new clients usually costs five times more than keeping existing ones.

A tiny 5% increase in repeated purchases can sometimes boost your profits by 25% to 95%.

High RRs translate to stable revenue streams and increased client lifetime value. Loyal shoppers sometimes become brand advocates, spreading valuable word-of-mouth referrals.

Meanwhile, excessive churn can drain your resources through constant user acquisition efforts and lost revenue potential.

What Are the Factors Affecting Customer Retention?

The factors affecting customer retention are customer experience, product quality, support quality, and the pricing strategies you use. Customer experience and product quality are the big ones here because they directly impact satisfaction and loyalty.

Your customer support infrastructure has a leading role in maintaining strong relationships, addressing concerns promptly, and creating positive interactions that encourage long-term commitment.

Additionally, your pricing strategies must strike an ideal balance between perceived value and market competitiveness, as users will constantly evaluate the cost-benefit ratio of their relationships with your business.

Let’s zoom in on each factor before we go over the best strategies for improving the CR rates.

Customer Experience

The experience your customers have with your business (or brand) usually determines whether or not your business retains its clientele. Modern consumers increasingly prioritize their interactions with providers over traditional factors like price and product features.

Your ability to create seamless, personalized experiences across all touch points directly impacts how loyal your users are and how long they will continue to use your services.

Key elements of amazing buyer experience are:

- Proactive support systems identify and resolve issues before they escalate.

- Omnichannel consistency guarantees smooth changes between platforms.

- Personalized interactions based on users’ preferences.

- Regular feedback collection and implementation mechanisms.

Product or Service Quality

Product or service quality is a pretty obvious factor that influences if a used will make a repeated purchase. You should always prioritize features that meet your users’ needs, ensuring reliability, and maintaining ultracareful quality control processes.

Superior product quality differentiates your brand from competitors while enhancing buyer loyalty. Learn from user reviews to find out what the buyers actually need and mold your service so that it’s better aligned with those needs.

When you consistently deliver high-quality products, you’ll get improvements in user satisfaction metrics, reduced churned users, and increased customer lifetime worth.

Customer Support

Excellent customer support serves and drives long-term client relationships. Your ability to provide responsive, efficient support service directly impacts how long a client stays with you.

According to Salesforce’s “State of the Connected Customer” report:

89% of consumers are more likely to make another purchase after a positive customer service experience.

The quote highlights just how powerful excellent support can be for driving loyalty and long-term usage. While we’re talking about user support, you should consider the following improvements:

- Hire well-trained agents to swiftly resolve user inquiries.

- Implement 24/7 support channels to ensure constant accessibility.

- Personalize interactions to demonstrate genuine care.

- Consider implementing omnichannel solutions to provide seamless experiences.

Pricing Strategies

Value-based and loyalty-based pricing strategies align your offers with buyer expectations. Consider adopting tiered pricing models, which are particularly effective in B2B SaaS markets.

They work really well because they cater to different user segments.

- Your pricing decisions should reflect market conditions, competitor analysis, and user reviews while maintaining profitability.

- Incorporate dynamic pricing and targeted loyalty discounts to enhance customer lifetime profits and minimize revenue drain.

Strategies that Improve the Rate of Retained Users

The best strategies that improve the rate of retained users are setting realistic expectations, proactively engaging users, establishing clear success metrics, connecting with your users on social media and newsletter followups, implementing loyalty programs as well as collecting customer feedback, and acting on it.

The idea behind these approaches is to build lasting relationships. This requires you to demonstrate that you’re not only listening to your buyer’s input but also taking meaningful action based on their suggestions and concerns.

Below, we’ll expand on each strategy and give you more food for thought.

Set Realistic Expectations

All expectations need to be realistic and achievable. To establish achievable benchmarks, you’ll need to take a closer look at industry standards, track historical patterns, and monitor your competitors’ performance.

Understanding your market’s retention patterns helps you develop targeted strategies that align with your business objectives.

Here’s how you should approach stakeholder expectations:

- Research industry-specific RRs to assess market standards.

- Track and analyze your historical rates of retained customers.

- Monitor your competitors – their strategies and outcomes.

- Implement data-driven KPIs to measure success.

Proactively Engage Buyers

This approach requires predictive analytics and customer journey mapping to identify potential issues early. You also need to implement personalized communication across multiple channels, so that you keep your users informed and engaged throughout their experience with your brand.

Additionally, AI-powered chatbots and automated systems can be deployed to provide immediate support while maintaining a human touch through empathetic interactions.

Create extensive resource centers and loyalty programs that reward customer commitment, ensuring they feel valued and supported at every touchpoint.

We’ll talk more about personalization and loyalty reward programs in a bit.

Establish Clear Success Metrics

Just tracking repeated purchases isn’t enough. You should track how successful you product or service is with clear and measurable metrics. These will give you actionable insights into your business’s actual performance.

Track key performance indicators like customer lifetime worth, and net promoter score to get a realistic look at your loyalty efforts’ effectiveness. These metrics help you identify trends, anticipate the needs of your buyers, and make data-driven decisions.

Here’s a short list of the metrics you should keep your eye on:

- Monthly user churn rate to identify potential issues behind churned users.

- Average revenue per user to track spending patterns.

- Client satisfaction scores from post-interaction surveys.

- Response and resolution times for support requests.

Connect on Social Media

Social media platforms offer can be like a best friend that strengthens client relationships and boosts repeat-purchase rates in the digital world.

Use Instagram, TikTok, or LinkedIn (depending on your audience—e.g., founders of SaaS companies that could use your agency services). For example, on TikTok, posting at the optimal time can make all the difference in visibility and engagement. Cool and valuable content cultivates brand loyalty and sprinkles it with real-time engagement and personalized interactions across all touch points.

You can also leverage user-generated content and user spotlights to build a community around your product (or service) that feels valued and connected. Along the way, you’ll establish trust through behind-the-scenes content and transparent communication.

Gather and Act On Customer Feedback

Customer feedback tells you what you’re doing right and that you can do better. It’s in your best interest to have a reliable system of collecting and gathering user opinions and reviews.

This system will provide you the right infos on what can you do to improve your service (or product).

The most important thing here is that you act on those reports and make the improvements (e.g. if a surveyed user of your subscription told you that the response time was too long – you might improve your support’s response time or hire additional support agents).

To make reviews work, you should deploy multiple feedback channels to capture real-time client experiences, analyze sentiments systematically, and implement these data-driven improvements.

Here’s what you can do here:

- Set up automated surveys that trigger after key customer interactions.

- Create a centralized dashboard for monitoring user review trends.

- Establish cross-departmental response protocols for addressing concerns.

- Develop personalized user loyalty programs based on consumer preferences.

Personalize Customer Interactions

Mass marketing approaches were a game of numbers that worked well in the past. Today’s consumers expect personalized experiences that reflect their unique preferences, behaviors, and needs.

Customer data platforms and CRM systems give you valuable insights into your buyers’ purchasing patterns and preferences. These insights help you create tailored interactions across multiple channels.

You can start implementing personalization by segmenting your user base, sending targeted emails to different user segments, and offering dynamic product or service recommendations.

Use AI-powered tools to analyze buyer behavior and automate personalized experiences at scale. Address users by name and maintain consistent, context-aware support throughout their journey to strengthen relationships and boost customer loyalty rates.

Also explore Agentic AI, which takes personalization further by predicting customer intent using real-time and historical data and proactively adapting content, offers, and interactions across channels to drive engagement and conversions.

Implement Loyalty Programs

A well-structured loyalty program is the Holy Grail of improving returning customer rates. There’s a pretty good reason why most of the B2C brands from McDonalds to Nike have special perks for repeating customers.

The idea here is to design a dynamic rewards system that offers clear value to your consumers while integrating gamification elements (points, timers, badges, and leaderboards) to enhance engagement.

Focus on creating personalized experiences through data-driven insights and make your program accessible across all channels.

- VIP-exclusive preview events for upcoming product launches.

- Tiered membership levels with increasing benefits.

- Points multipliers during special promotional periods.

- Members-only workshops, educational sessions, and special perks.

When you combine your loyalty program with thorough user review mechanisms and continuous optimization efforts, you’ll create a retainer system that drives both repeated purchases and additional revenue growth.

Since you can learn the most from the pros, we’ll get back to the real-life examples after the next section. For now, let’s talk about the next-level stuff.

What Is Advanced Retention Analysis?

Advanced Retention Analysis is the practice of using deeper, more sophisticated methods to understand why users stay or leave—and to predict and influence their future behavior.

It goes beyond basic metrics because it incorporates profit, sales impact, and predictive modeling.

In simple terms: It helps you focus not just on how many users you’re keeping, but which ones matter most, how much they’re worth, and what you can do to retain them longer.

This advanced analysis typically includes:

- Profit-adjusted retention rate – tracks retention based on user profitability, not just volume.

- Sales-adjusted retention rate – accounts for the actual revenue tied to retained customers.

- Predictive retention modeling – uses machine learning or analytics to forecast which users are at risk of leaving and when.

- Cohort analysis & segmentation – analyzes behavior over time across different user groups.

Profit-Adjusted Retention Rate

Profit-adjusted retention rate analyzes user profitability alongside other important retention insights. To get a deeper dive into this metric you’ll need to integrate customer lifetime profits, acquisition costs, and segment-specific profitability insights.

Here is what you should implement to make tracking easier:

- Predictive analytics dashboards displaying real-time user behavior patterns.

- Multi-layered user segmentation charts highlighting profitability tiers.

- Interactive CLV calculators tracking profit trends over time.

- Dynamic heat maps showing retention rates across different user segments.

This thorough analysis enables you to focus your customer loyalty efforts on the most valuable buyer relationships while optimizing your overall business growth strategy.

Sales-Adjusted Retention Rate

The sales-adjusted retention rate evaluates a buyer’s loyalty’s financial impact on your business. When you’re tracking this metric, you’ll need to analyze revenue patterns alongside traditional retention insights.

Include factors like dollar RRs and monthly recurring revenue churn.

This strategy starts with segmenting your entire user base by revenue contribution and engagement levels. When you have clear segmented insights, you can then develop targeted initiatives like personalized loyalty programs or special offers we talked about earlier.

Using predictive modeling here helps identify high-value customers and their risk of churning.

Predictive Retention Modeling

Predictive retention modeling represents the next level of buyer continuation strategy. It leverages sophisticated machine learning algorithms and statistical analysis to forecast buyer behavior patterns.

You’ll find this advanced approach integrates seamlessly with your existing CRM systems, helping you identify at-risk users before they churn.

- Real-time analysis of customer purchase patterns and engagement metrics.

- Automated risk scoring based on historical behavior patterns.

- Personalized intervention strategies for high-risk segments.

- Integration of multiple data sources for thorough customer insights.

What Are Real-life Examples of Increasing Customer Retention Rates?

The best real-life examples of increasing customer retention rate come from Amazon Prime, Starbucks and Nike. In the sections below we’ll talk about what they did, what impact it had and what can you learn from them to increase customer loyalty.

Starbucks: Gamified App + Personalized Membership Offers

Starbucks implemented an app-based customer engagement and gamified loyalty program. Starbucks’ Rewards app encourages purchases by offering stars redeemable for drinks and food.

The app personalizes offers and allows for seamless payment and order tracking. As of 2023, Starbucks Rewards had 31.4 million members in the U.S., driving over 56% of U.S. company-operated revenue, according to their Q4 2023 earnings.

A loyalty program integrated into your mobile app can drive frequent purchases and deeper engagement, especially with personalized push notifications.

Amazon Prime: Best Example of a Paid Retention Strategy

Amazon introduced a subscription-based loyalty ecosystem called Amazon Prime. Its members get free two-day shipping, streaming access, and exclusive deals—all bundled into a $139 annual membership.

According to Consumer Intelligence Research Partners (CIRP), Prime members spend an average of $1,400 per year, compared to $600 for non-members. User loyalty rates for Prime hover around 93% after the first year.

Amazon offered a high-value subscription package to create a sense of investment and build long-term usage. It’s working like a charm.

Nike Membership: Free Digital Ecosystem for Retention

Nike built a loyalty ecosystem by launching the free Nike Membership program. Members get early product access, personalized workout content via Nike Training Club, running support via Nike Run Club, and exclusive in-app rewards—all connected across digital and retail experiences.

According to Nike’s FY22 earnings report, members now account for over 50% of total revenue in direct-to-consumer channels. The company has over 160 million active members globally, and membership significantly boosts repeat purchases and average order value.

Nike’s free, app-powered customer retention strategy creates daily brand engagement that drives new purchases —without relying on discounts.

How to Measure Retention Success?

To measure your success in retaining buyers, you’ll need to implement performance-tracking systems that monitor key metrics like customer lifetime worth and net promoter score.

Your key performance indicators should align with your business objectives while providing actionable insights into user behavior patterns and engagement levels.

Through continuous improvement strategies, you can use what you’ve learned from these metrics to identify areas for optimizing your loyalty initiatives.

Let’s start with basic performance tracking.

Performance Data Tracking

When you consistently monitor your user loyalty metrics, you’ll gain important insights into buyer behavior patterns and identify areas for improvement.

Use the [(E-N)/S] x 100 formula from before to calculate your repeated customer rates across different time periods. The best tips for this approach are:

- Track monthly buyers in a detailed spreadsheet.

- Set up automated dashboards for real-time monitoring.

- Create visual charts that show the trends of your grip on customers over time.

- Document user reviews and opinions alongside the stats.

Use Productive to align project specs with customer expectations and keep all documentation on one place.

Key Performance Indicators

Focus on your Monthly Recurring Revenue (MRR) and Net Promoter Score (NPS) to evaluate financial health and buyer satisfaction. To get deeper insights, track your Customer Lifetime Value (CLV) alongside Purchase Frequency and Average Order Value.

Don’t overlook service-based metrics like First Response Time and Resolution Time, as they directly impact buyer satisfaction and long-term loyalty.

Continuous Improvement Strategies

Continuous improvement strategies are a systematic approach to boosting your CR scores. Probably the biggest factor here is how you collect user opinions and reviews to identify areas of your service that need improvement.

Introduce personalized experiences and segment your user base strategically. Later, you should develop targeted repeated purchase initiatives that resonate with specific user groups.

To get the most out of your improvement routine, you should:

- Establish regular user surveys and communication channels.

- Monitor buyer behavior patterns through cohort analysis.

- Implement personalized communication strategies.

- Create data-driven loyalty programs based on different user segments.

Closing Thoughts

Your success in keeping your customers loyal and wanting more depends on consistently monitoring key metrics, learning from them, and adapting to changing buyers’ needs. You should regularly calculate your repeated purchase rate and analyze contributing factors.

Keeping your regular shoppers satisfied is always cheaper than acquiring new ones. If you want to improve a process (like a monthly service), you need to collect user and internal feedback.

Ideally, you should use project management software like Productive to automate routine tasks and keep track of all important project insights.

Remember that improving retention isn’t a one and done effort—it’s an ongoing process that requires continuous optimization of your customer experience and engagement strategies.

You can start gathering feedback, calculating finances and making improvements with a simple and short 30-minute demo with Productive.

Track Project and Financial Metrics with Productive

Turn complex financial data into actionable insights – from billable hours to project margins and revenue forecasts.