What Is Value Based Pricing & How To Apply It (2026 Guide)

Many companies underprice their work by focusing only on costs, rather than what customers are willing to pay.

Value-based pricing flips this approach by setting prices based on the value customers perceive.

In this guide, you’ll learn how value-based pricing works, why it’s effective, how to solve common challenges, and how to implement the right pricing strategy step by step.

Key Takeaways

- In value-driven pricing, you set your price based on the specific outcomes and benefits the customer expects (like boosting revenue by a defined percentage, or cutting operational project management costs), rather than focusing on the production costs.

- Your value-based pricing model will be successful if you have a clear value proposition, consistently deliver the promised results, and earn trust over time.

- Always back your value-based approach with actual numbers. If you claim to reduce downtime by 50%, you need data and testimonials to back it up.

- When buyers clearly associate your brand with delivering measurable, premium results (like faster project delivery or superior customer service), they are more likely to choose you again and pay for the added perceived value.

What Is Value Based Pricing?

Value-based pricing is a pricing strategy where you set your price according to the benefits and outcomes customers believe they’ll receive, rather than your internal costs.

Setting a value-based price means identifying the exact factors (like cost savings, revenue potential, convenience) that influence their willingness to pay, and then structuring your offer to match those specific priorities.

If a monthly subscription to your project management tool saves a client 20 hours a month there’s a measurable impact.

If you can show that time is worth $500 (20 hours × your clients hourly fee of $25 per hour), you can set a price that reflects that value, not just your cost to build and maintain the software (cost-plus pricing).

To get a better understanding of your company’s finances and delivered work, read our guide on Earned Value management.

What Is the Difference Between Value-Based Pricing and other Pricing Strategies?

The main difference between value-based pricing and other pricing strategies is how the price is determined: whether it is based on internal costs, competitor rates, market demand, or perceived customer value.

Each strategy has its logic, advantages, and trade‑offs.

Below, we’ll expand on the differences between value-based pricing and other strategies with clear examples, so you can understand exactly when each strategic pricing method works best.

Differences Between Cost-Based Pricing

Cost-based pricing focuses on covering your expenses and adding a set margin, which ensures you stay profitable, but often limits your earning potential.

Value-based pricing aims to capture more of the actual worth you deliver, which is especially effective if your products or services stand out in, and produce measurable results.

Imagine you build a software feature that cuts a client’s annual costs by $20,000 on basic admin work. In a cost-based pricing model, you’d charge enough to cover development plus a standard markup, let’s say $4,000.

In a value-based model, you could charge $8,000, because the client still saves $12,000 of admin work, while you significantly increase your profit. Between the two, value pricing often beats cost-based pricing.

Differences Between Competitor-Based Pricing

Competitor-based pricing means you set your price based on what similar products or services in your market are charging.

This method is simple and keeps you within a familiar range for buyers, but it often pushes companies to be more competitive by lowering their prices.

If your offering delivers more value (like better customer support, faster results, or higher quality), but you match the price of a lower-quality competitor, you are likely undercharging and losing potential profit.

If you have a strong value proposition and clear differentiators, relying only on competitor rates can leave significant revenue on the table. Keep in mind that it’s better to show buyers why your added value justifies a higher price.

Differences Between Demand-Based Pricing

Demand-based pricing means adjusting prices according to market conditions, charging more when demand is high and lowering prices when demand drops.

A common example is airline tickets that become more expensive during holidays and cheaper in the off-season.

While this can be effective for short-term revenue boosts, it does not usually create lasting pricing power because it relies on temporary conditions rather than long-term value.

With value-based pricing, your price stays linked to the tangible outcomes and benefits you deliver, such as increased revenue or cost savings, rather than reacting to short-term swings.

What Are the Best Practices Value Pricing?

The best practices for value-based pricing include clearly quantifying the measurable benefits you deliver (value proposition analysis), backing your price with proof (proving your unique value), and positioning yourself to solve high-priority problems better than anyone else (building competitive differentiation).

In the following sections, we’ll break down these best practices into actionable steps to show exactly how to put them into play.

Perform a Value Proposition Analysis

Clearly define, in measurable terms, why a customer should choose you over any other option. This works because when prospects see tangible results, they are more likely to accept a premium price.

Use this perceived value approach whenever you sell a product or service where benefits can be quantified.

For example, instead of saying you “improve efficiency,” demonstrate that you reduced downtime by $50,000 annually for a client, increased campaign leads by 30%, or halved project delivery times.

The more concrete and relevant these outcomes are, the easier it is to defend your price.

There’s a detailed revenue operations guide where we talk more about increasing revenue for agencies and professional service providers.

Identify and Prove Your Unique Value

This best practice works because it shifts the conversation from “What does it cost?” to “What is it worth to me?”. You should use it when you need to establish why your solution can’t be replaced with cheaper, patched-up alternatives.

Start by asking:

- What problems do we solve better than your competitors?

- Which results get customers most excited in reviews or feedback?

- How do our outcomes compare to industry averages or competitors?

Collect proof through surveys, interviews, and historical performance data. For example, if clients save 15% annually on operating costs using your service, calculate that in economic value (dollars saved) and present it as part of your pricing rationale.

Build Competitive Differentiation With Evidence

Competitive differentiation means showing, in clear and measurable terms, why your price is justified by the specific value you deliver.

You do this by presenting concrete evidence such as product performance data, independent benchmark comparisons, or real client results that demonstrate your advantage over other options.

This approach works best in markets with aggressive competitive prices, where you need to shift the conversation from cost to economic value.

For example, rather than saying “better quality,” prove that your product lasts twice as long as the industry average or share a verified case study showing a client achieved a 200% ROI within the first year.

The idea is to link proven benefits directly to your service or product prices, helping customers focus on return and results rather than just seeking the lowest cost option.

How to Implement Value-Based Pricing (Step-by-Step Process)?

To implement value-based pricing, you should: research what your customers value, create detailed buyer personas, design a pricing model based on measurable benefits, test and validate your price, and refine it based on feedback.

Stick with this process to base your pricing on hard data and real customer feedback.

Now let’s walk through each step in detail so you can see how to put your value-added pricing into practice.

Step 1: Conduct Comprehensive Market Research

Start by gathering hard evidence (detailed market research) about what your customers value most and what they are truly willing to pay.

Your goal is to quantify customer value in dollars, hours saved, or other measurable metrics you can use later to justify pricing. Use a mix of qualitative and quantitative methods so your insights are reliable:

- Surveys and interviews: Ask specific questions about buying priorities, challenges, and what a solution is worth to them.

- Focus groups: Compare perceptions of your product with alternatives, probing for which benefits matter most.

- Segmentation analysis: Group customers by shared traits to find segments that have a higher willingness to pay.

- Competitor research: Identify exactly where your offer delivers more measurable value.

- A/B testing: Test different price points in controlled settings and track the impact on conversions and retention.

Use Productive’s docs to share, edit and collaborate on documentation and research.

Step 2: Create Buyer Personas

Translate your research into detailed buyer personas that represent real customer segments.

Apply the insights (assumptions) form that customer segmentation to guide your pricing decisions and messaging, so each segment sees how your price reflects their priorities.

Include their:

- Budget range and how sensitive they are to price changes

- Decision-making factors such as ROI expectations, speed, convenience, or brand prestige

- Key pain points your product solves for them

- Preferred communication style for discussing value

Step 3: Develop a Pricing Model

List the benefits each segment values most and connect them directly to what you offer.

Quantify those benefits in monetary terms to make a pricing based on value. If $10,000 in annual savings from reduced downtime, you can attach a price that reflects the real impact.

Use these numbers to design tiered packages or bundles, making sure each higher tier adds meaningful benefits that justify the increase. Set an anchor price that makes the top tiers feel proportionate to their value.

Review competitor pricing only to ensure credibility, not as a target to copy, unless it aligns with the value you have proven you deliver.

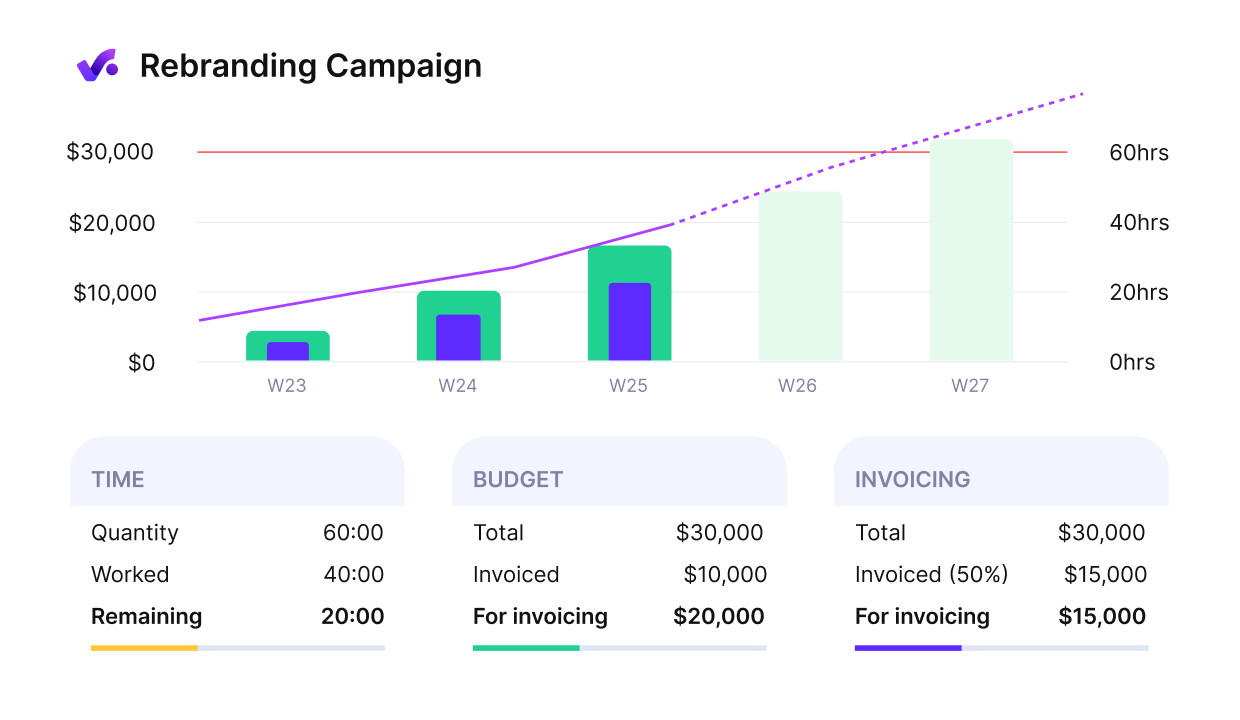

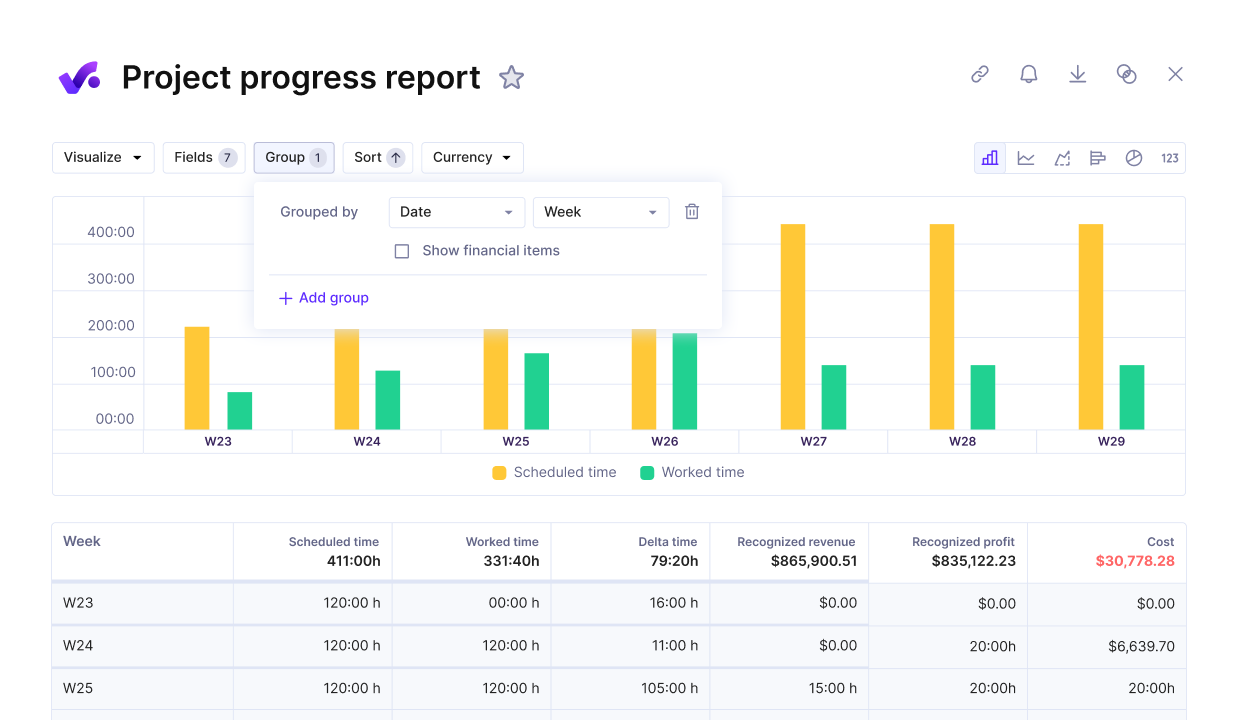

Use Productive to estimate project costs and update project budgets in real-time.

Step 4: Test and Validate Your Prices

Pilot your pricing model with small, targeted groups before rolling it out to everyone. The goal is to analyze the numbers and the feedback to pinpoint the price points that bring in the most revenue (without lowering perceived value).

Then use this insight to decide which pricing approach to roll out broadly. Start by clearly defining your test groups so that they represent your main customer segments.

Then:

- Start A/B testing: Offer different prices to matched groups and track performance over a set period, making sure all other variables like marketing messages and product features remain consistent.

- Keep an eye on key metrics: Monitor conversion rates, acquisition costs, retention, and revenue per customer to understand both short- and long-term effects.

- Implement customer feedback loops: Follow up with customers using surveys, short interviews, or post-purchase questionnaires to learn whether the price felt fair for the value they received and why.

Manage finances and profit forecasts with Productive

Budgets play a huge part in pricing. In case you need a detailed recap, head over to our budget management guide.

Step 5: Adjust Based on Feedback

Refine your pricing using what you learn from both performance data and direct customer input. Look for patterns in which features drive the most satisfaction or the highest willingness to pay, then adjust accordingly.

To make good value-pricing even better, you should:

- Add or enhance tangible benefits that directly address high-priority customer needs, such as faster turnaround or dedicated support.

- Revise marketing content to highlight specific ROI figures and real customer outcomes, making the value clear and measurable.

- Repackage or tier your offers so there are clear upgrade paths for those willing to pay more for added value.

What Are the Benefits of Value-Based Pricing?

The main benefit of value-based pricing is that it allows you to capture more of the real value you deliver. You also increase customer loyalty, and stand out more in the market.

When you set prices based on proven results rather than costs alone, you create a direct link between what customers pay and the tangible outcomes they receive.

To add more context, here’s how these benefits translate to your finances:

- Higher profit margins: By pricing according to the measurable value you create instead of adding a standard markup, you can retain a larger share of the financial benefit your solution generates.

- Stronger customer satisfaction and loyalty: When buyers see they are paying for clear, meaningful results, they are more likely to continue working with you.

- Encourages innovation: The more you improve your offering and deliver bigger results, the more your pricing can reflect that increased value, giving you a reason to keep innovating.

- Service or product differentiation in the market: Positioning your price around unique, proven outcomes helps move the conversation away from low-price competition and toward the results only you can provide.

What Are the Challenges of Value-Based Pricing and How To Solve Them?

The main challenges of value-based pricing include accurately measuring perceived value, dealing with differences in what customers value, adapting to shifts, and ensuring your value is communicated clearly.

These obstacles can limit the effectiveness of your pricing if they are not addressed directly.

Below, we’ll walk through strategies to overcome each of these challenges so you can apply value-based pricing more confidently and consistently.

Challenge 1: Measuring Perceived Worth

This challenge appears because benefits like time savings, improved efficiency, or reduced risk are not always easy to express in exact monetary terms.

Without a clear value figure, it becomes difficult to justify your pricing to customers.

How to solve it: Work with customers to estimate the financial impact of your solution using case studies, before-and-after performance metrics, or ROI calculators. Use specific, verifiable numbers wherever possible. You can make this process easier with business budgeting software.

Get the actual numbers behind your work in Productive’s detailed reports.

Challenge 2: Varying Customer Perceptions

Different customer segments may prioritize different outcomes. One may value cost savings above all else, while another cares more about quality or speed. This variation can make a single pricing approach less effective.

How to solve it: Segment your customers based on their primary value drivers and tailor your offers and messaging accordingly. Create multiple packages or tiers so each segment can choose based on what they value most.

Challenge 3: Continuous Market Changes

Economic trends, competitor actions, or new technologies can quickly shift what customers are willing to pay.

How to solve it: Regularly review new market data, track competitor pricing changes, and run customer surveys to monitor shifts in priorities. Adjust your value messaging and pricing models promptly in response to these signals.

Challenge 4: Communication Gaps

If you cannot clearly explain your value and back it with evidence, customers may not understand why your price is justified.

How to solve it: Train sales and marketing teams to use clear, evidence-based messaging. Use customer testimonials, quantified results, and case studies to show the connection between your price (perceived value) and the outcomes you deliver.

What Are Real-World Examples of Value Based Pricing?

One of the best real-world examples of value based pricing is HubSpot, the marketing automation and CRM platform.

Context:

In the early 2010s, HubSpot was competing in a crowded SaaS landscape where many tools were priced per seat or based on feature access. Rather than following industry pricing norms, HubSpot conducted research into how customers actually measured value.

In this case, the number of marketing contacts managed and the revenue generated from them.

How Hubspot implemented value-based pricing:

HubSpot shifted its pricing model to scale with the size of a customer’s marketing database and the level of features required to convert those contacts into customers.

The more contacts and advanced tools a client used, the higher the subscription cost. This directly tied pricing to a metric that correlated with business outcomes.

Results:

HubSpot reported sustained revenue growth, surpassing $1 billion in annual revenue by 2021.

In Sequoia Capital’s Crucible Moments podcast, Brian Halligan, HubSpot’s co-founder, explained that the company’s model was built to “offer value before capturing value,” ensuring that customers saw clear benefits before paying more.

This approach strengthened retention rates because clients could directly connect what they paid to the measurable results they achieved.

Final Takeaway

Implementing value-based approaches requires a deep understanding of your customers, their pain points, and the markets you’re operating on.

In case you need accurate data on your profit margins or any other financial aspect of your projects, Productive can help.

It gives you the visibility to see exactly where your value is being delivered and the profitability insights. With real-time reporting, budgeting, and forecasting in one place, you can justify your pricing strategy with hard data and strengthen client relationships.

Book a 30-minute demo to see how Productive can help you capture the actual value you create.

Track the Real Value of Your Work with Productive

Show clients the exact time saved, costs reduced, and revenue gained. Turn those results into higher, fairer, and more profitable prices.