Top 10 Financial Modeling Software (2026) + Choosing Advice

Financial modeling software gives finance teams the tools to connect income statements, balance sheets, and cash flow statements, creating clear forecasts.

In this guide, we share the best financial modeling software, along with pros, cons, and real-world use cases based on user reviews.

We’ll also cover popular Excel workarounds and offer practical advice for choosing the right tool for financial planning and forecasting.

What Are the Best Financial Modeling Tools Options Right Now?

Here are the top financial modeling tools and what they’re best for.

1. Productive – Best for All-in-One Project Management for Financial Modeling

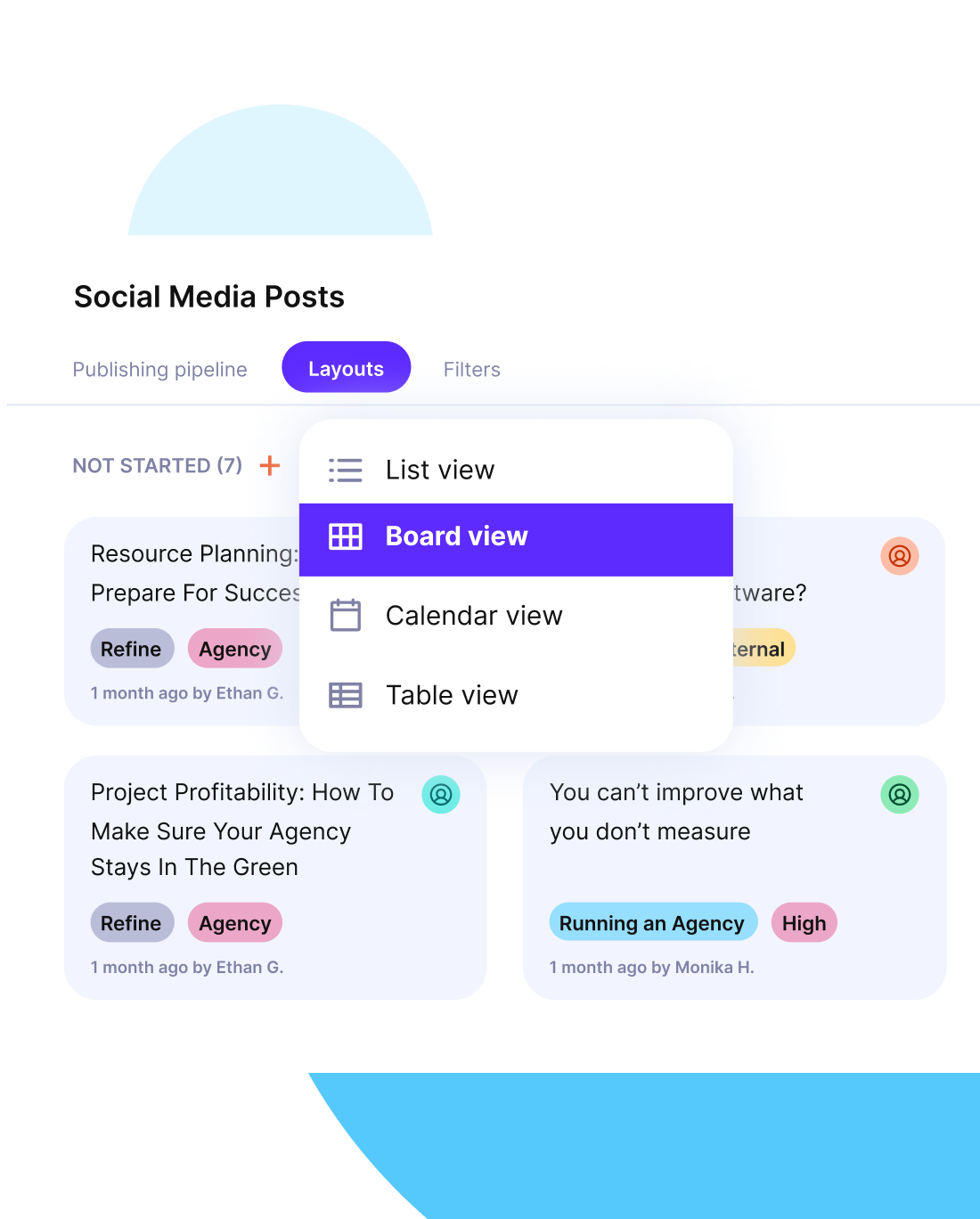

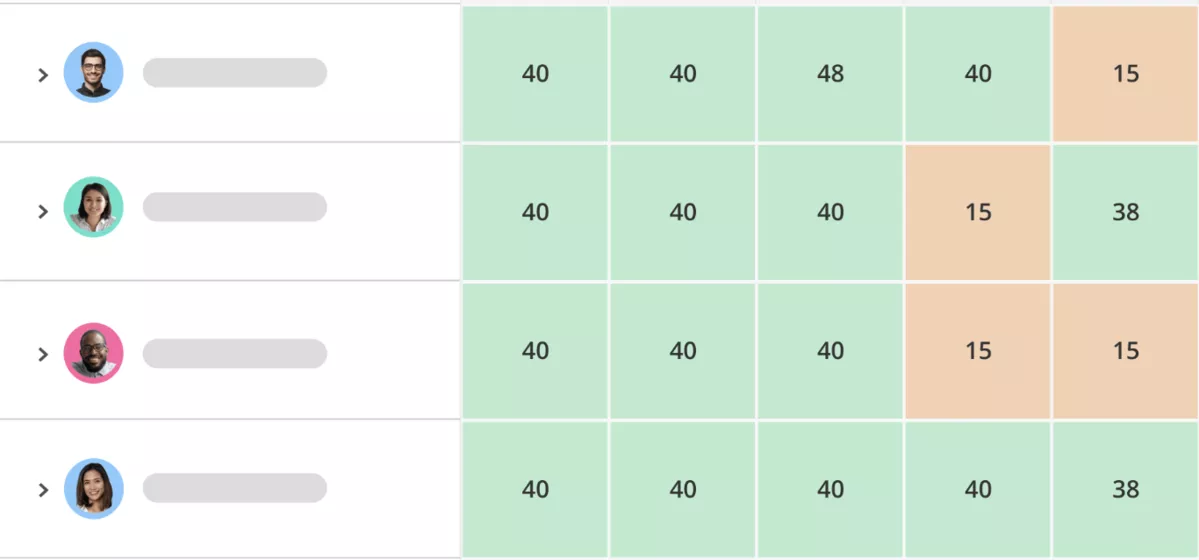

Productive is the strongest all-in-one option if you want your financial model to match day-to-day work. It replaces scattered spreadsheets and disconnected tools with one place to plan budgets, approve time and expenses, and see profitability in real time.

You can track the full cost picture, not just labor, including subcontractors, materials, and purchase orders, plus allocate overhead so margins are true.

Rolling revenue forecasts pull from scheduled work and the pipeline, while budget burn and variance alerts help you make adjustments before profit takes a hit.

With QuickBooks or Xero sync, your financial modeling software stays clean, and reporting across projects, clients, and services is consistent and review-ready.

Core Financial Features

- Budgets tied to projects and services, with live budget vs actuals

- Time tracking that rolls into financial data like costs, margins, and reports

- Expense approval and purchase tracking aligned to budgets

- Time approval before hours hit client reports or invoices

- Resource planning that reflects availability and planned work

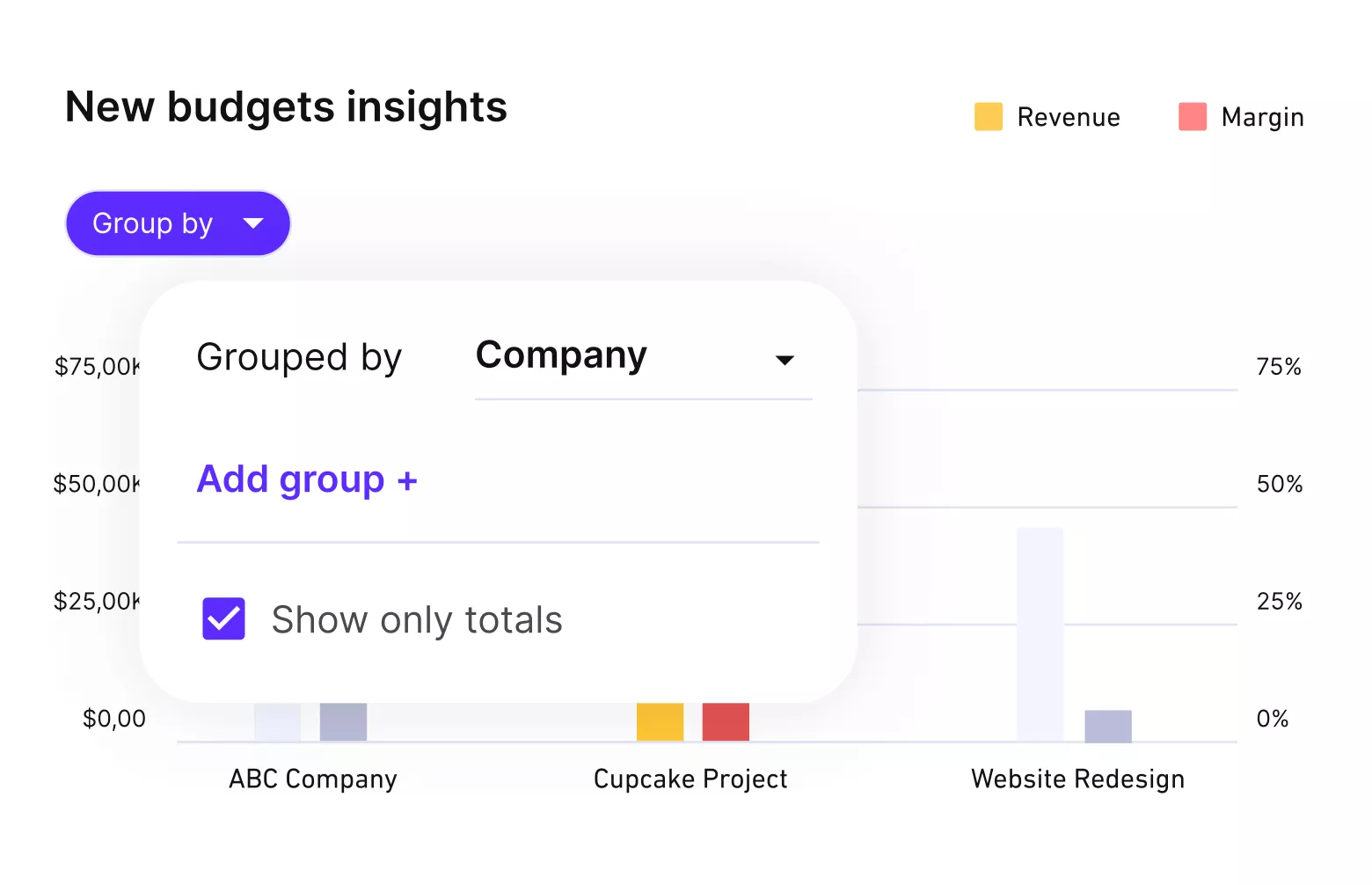

- Financial reporting on profitability by project, client, and service

- Financial forecasts from budget burns and profit to utilization rates and revenue

- Scenario builder for different financial models and scenario analyses

Manage Finances and Forecast Profitability with Productive

Fix Real-Time Profitability Blind Spots

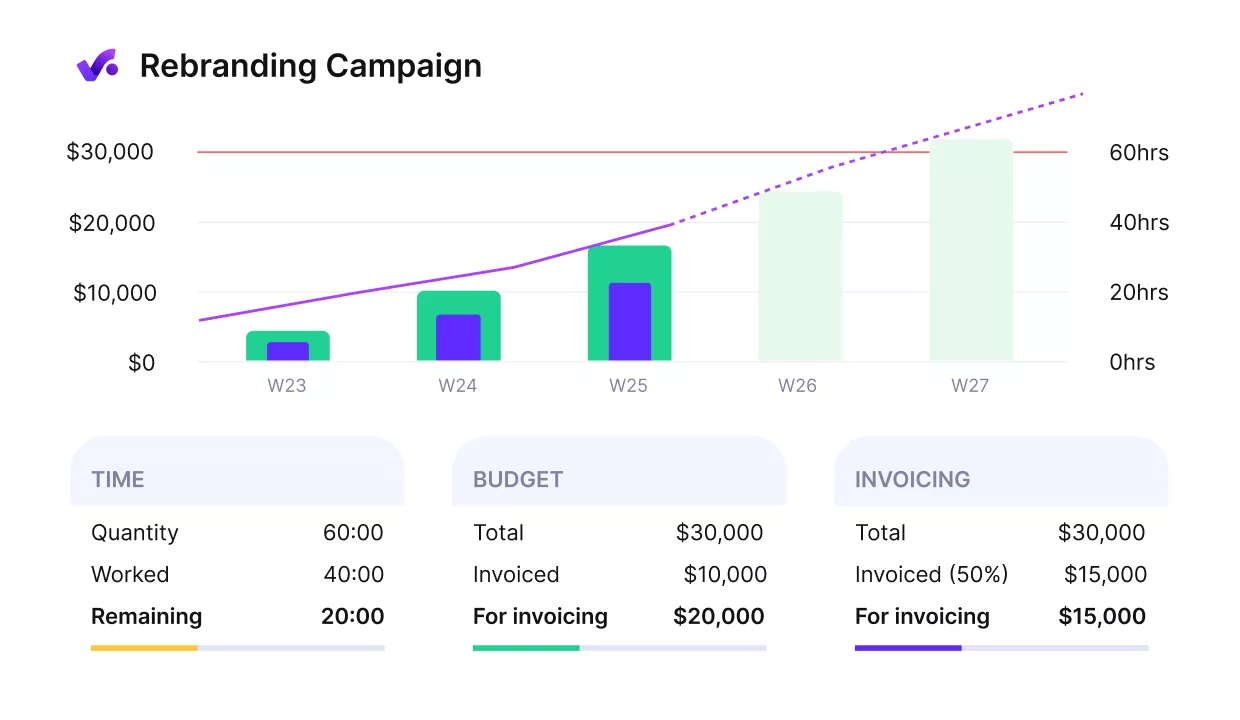

You get a clear line of sight into project health while work is happening, not after the month-end. Budget burn, margin, and variance are visible by project, client, and service, so leaders can spot over-servicing early and adjust scope or staffing before profit erodes.

Get an early alert of budget overruns.

Replace Manual Spreadsheet Dependency

Instead of stitching together 16-tab spreadsheets, budgets, time, expenses, and approvals live in one place. Automated budget vs actuals and standardized reports cut copy-paste work and reduce errors that creep in when models are maintained by hand.

Head over to Budgeting to find out more.

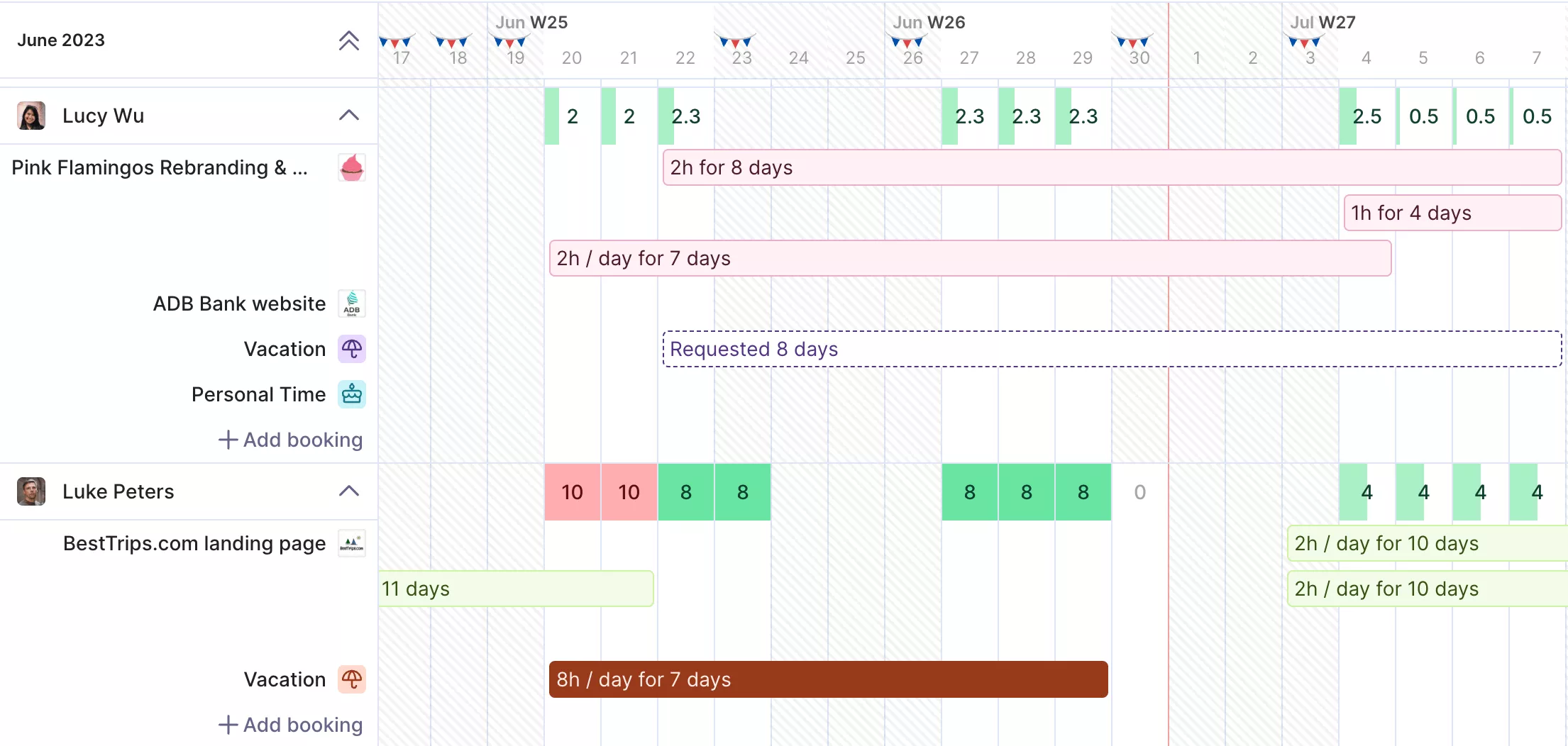

Get real-time overviews of your available resources and budgets.

Connect Time, Expenses, and Accounting Data

Productive centralizes financial inputs, then syncs with QuickBooks or Xero so finance does not reconcile the same numbers twice.

Time Approval and Expense Approval add control before data reaches reports or billing, which improves the reliability of your model and keeps stakeholders aligned.

And yes, Productive also has super-powered business intelligence called Polaris.

Get real-time budget updates on your projects.

Plan Scenarios With Different What-If Analysis

Use project budgets and the Resource Planner to explore scenarios by adjusting scope, timelines, roles, and cost rates.

You can compare versions side by side to see how changes affect margin and budget burn, then standardize the chosen plan with Time Approval and Expense Approval for control.

In case you’d like to hear more about scenario planning, watch the video below, or check out the Scenario Builder.

Forecast Revenue With Full Capacity Visibility

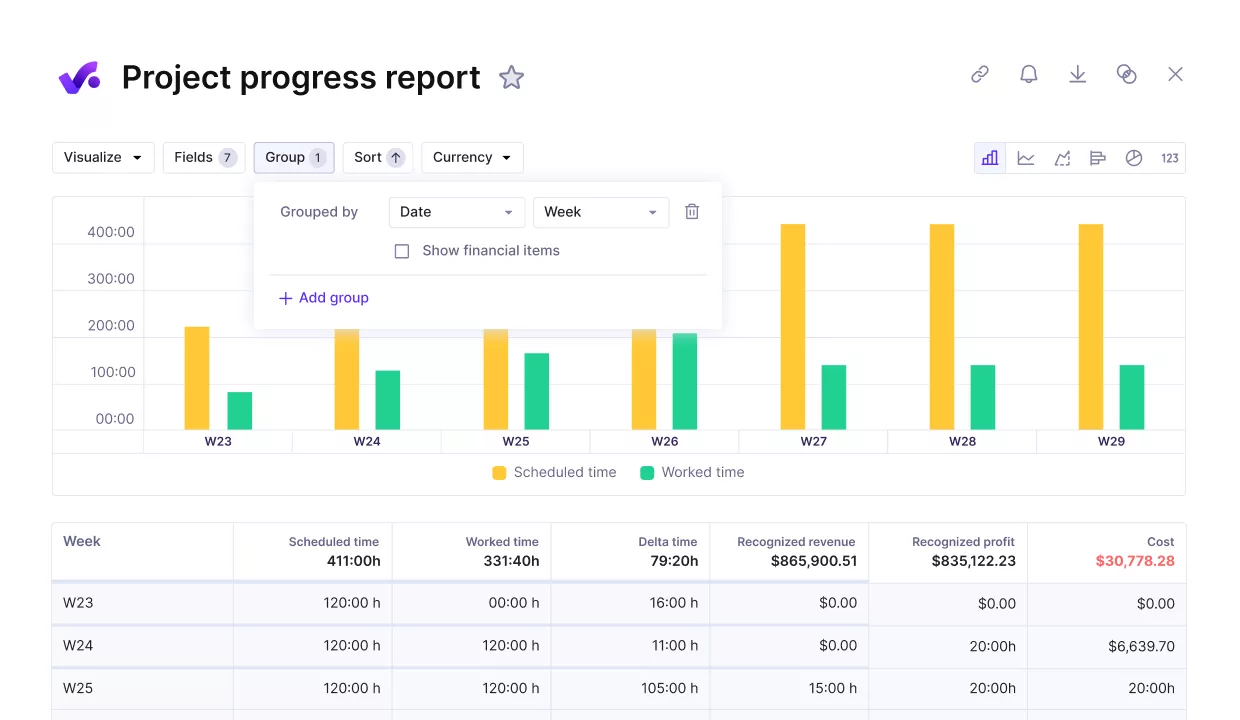

Use Productive’s Forecasting to build forward‑looking views from scheduled work and planned budgets so financial projections reflect the likely revenue and workload before the month end.

Pair utilization signals with budget vs actuals to spot bottlenecks early and keep the model realistic during reviews.

Compare your project’s progress against key financial metrics.

Pricing

- Plans start with the Essential plan at $10 per user per month, which includes essential features such as budgeting, project & task management, docs, time tracking, expense management, reporting, and time off management.

- The Professional plan includes custom fields, recurring budgets, advanced reports, billable time approvals, and much more for $25 per user per month.

- The Ultimate plan has everything that the Essential plan and Professional plan offer, along with the HubSpot integration, advanced forecasting, advanced custom fields, overhead calculations, and more. Book a demo or reach out to our team for the monthly price per user.

Productive offers a 14-day free trial, so you can see what it can do for your project’s financial health.

Forecast and Plan Revenue with Productive

Build reliable forecasts, track budget vs actuals, and see margins in real-time in the same place where work happens.

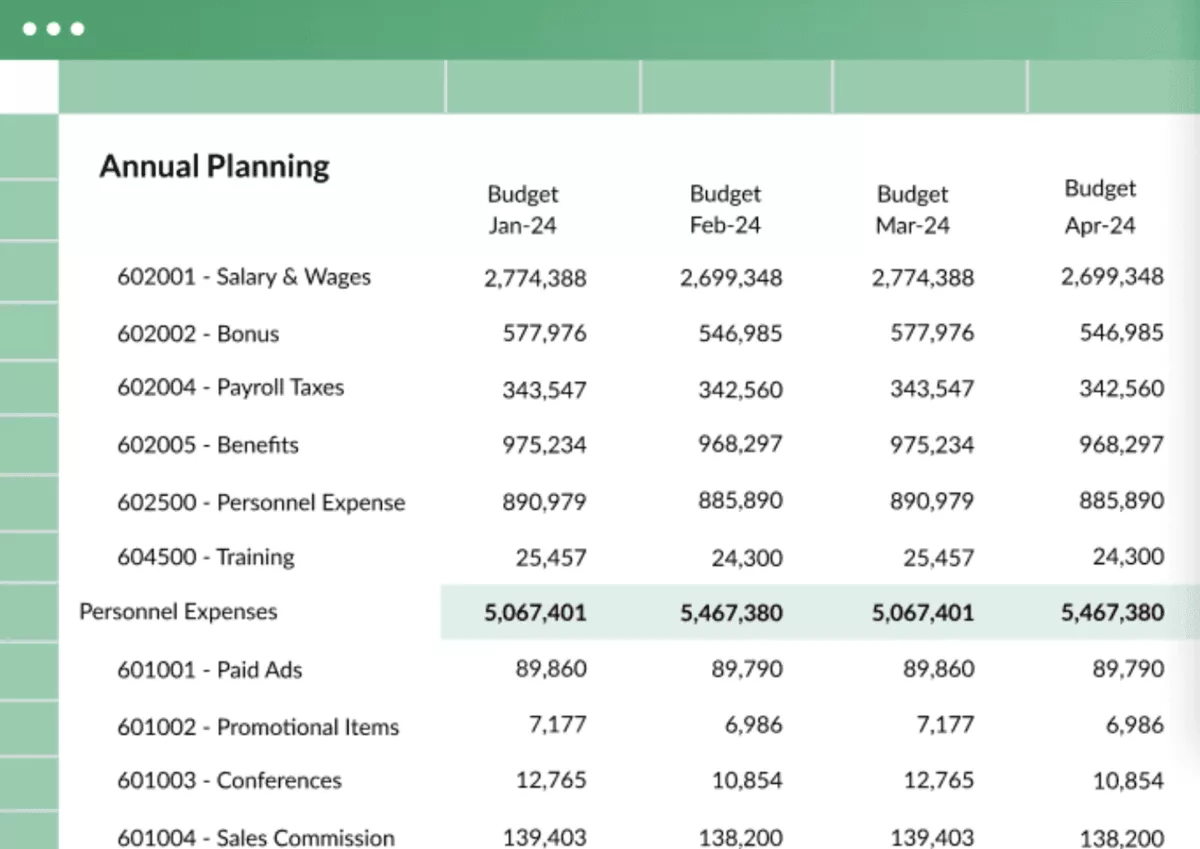

2. Planful – Best for FP&A Suites and Rolling Forecasts

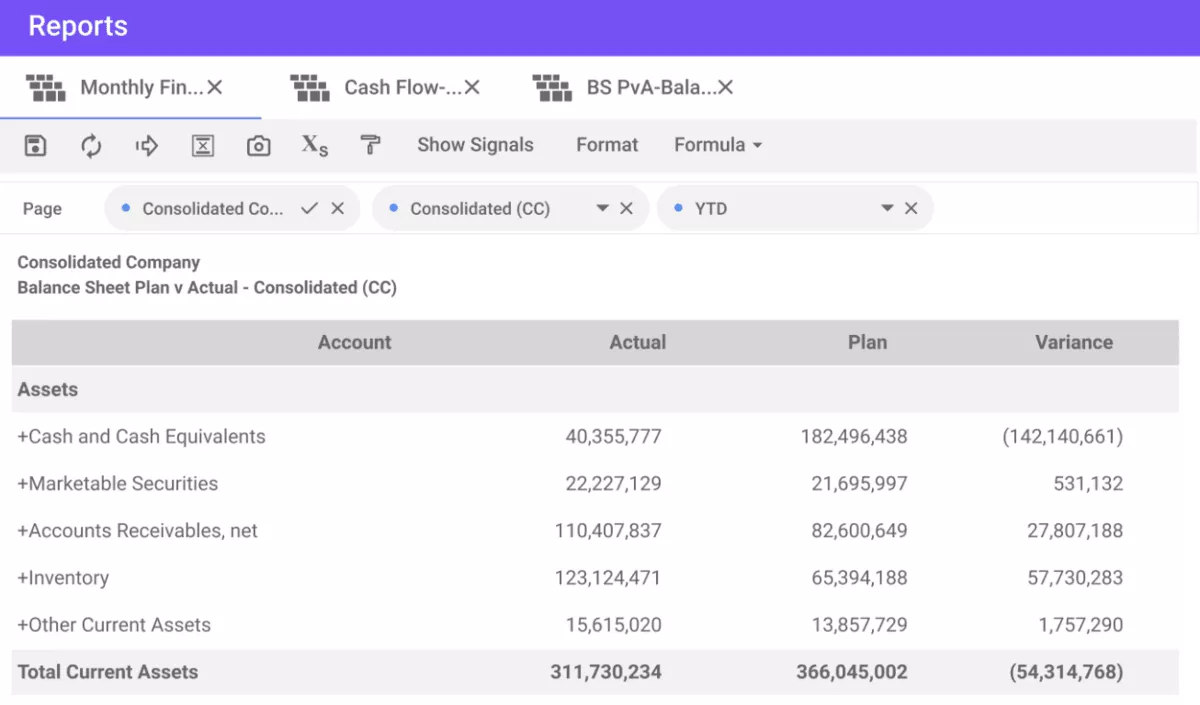

Planful is financial modeling software that extends financial modeling into planning and rolling forecasts. It helps finance build a model that scales across teams without leaving spreadsheet skills behind.

Core Features (modeling‑relevant):

- Rolling forecast setup

- Workflow approvals

- Excel interoperability

Scenario models for financial planning

SOurce: planful

Planful Final Verdict:

Planful suits teams that want a full FP&A suite for rolling forecasts, consolidation, and robust reporting. Expect real setup and training, but once live, drill-through and integrations help budget owners self-serve without bouncing back to spreadsheets.

If your planning is highly granular or very Excel-native, consider Dynamic Planning and change-management time.

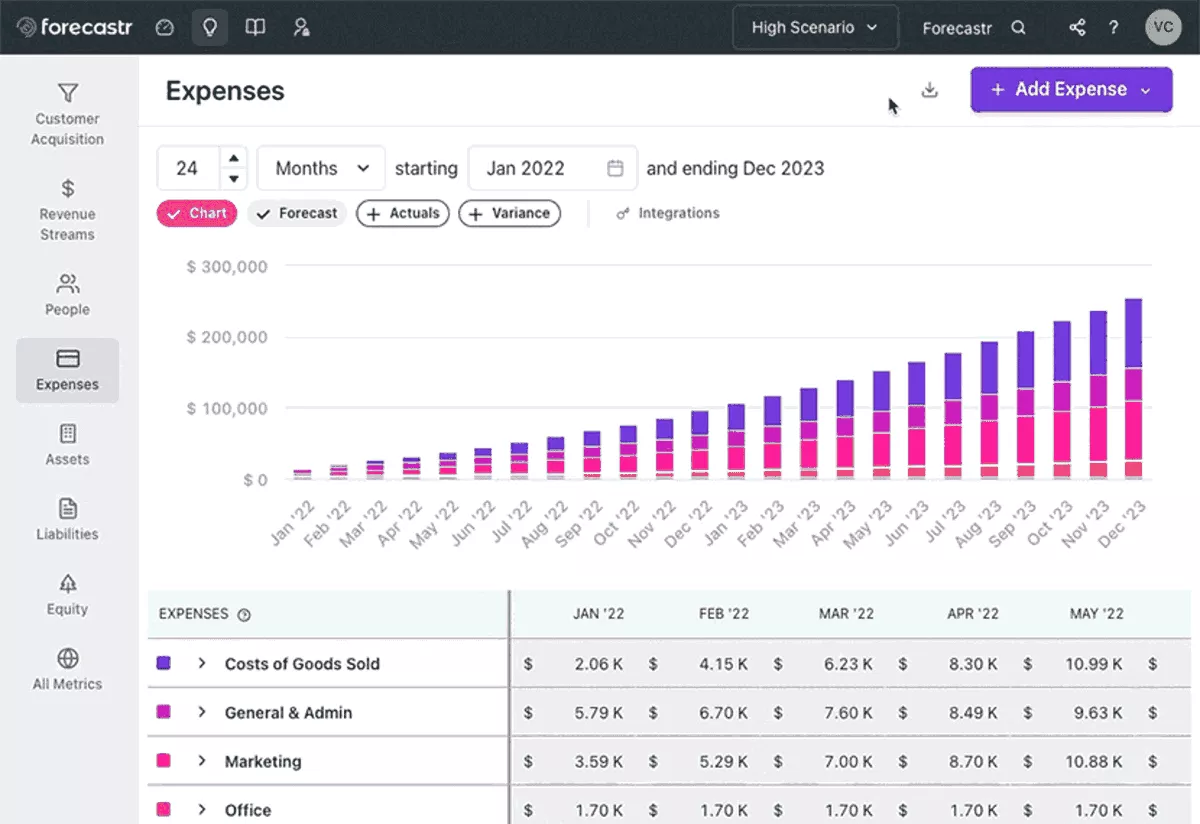

3. Forecastr – Best for SMB Forecasting

Forecastr focuses on cash flow forecasts and keeps financial modeling straightforward for small teams. It helps finance build a model for weekly liquidity, headcount planning, and basic scenarios without heavy implementation.

The interface is simple, so finance and non-finance stakeholders can follow the plan and stay aligned. If you’re here mostly for the forecasting part, you might want to check out our list of the best forecasting software.

Core Features (modeling‑relevant):

- Cash flow analysis and forecasting

- Headcount and expense planning

- Scenario and sensitivity basics

SOurce: forecastr

Forecastr Final Verdict:

Forecastr suits early-stage teams that want a clear, investor-ready model without living in spreadsheets. If you later need granular, analyst-grade modeling or stricter permissions, you’ll likely shift that work to Excel or a fuller FP&A platform.

4. Mosaic – Best for SaaS Metrics and Board Reporting

eMosaic connects financial modeling to the SaaS metrics your board expects. It turns ARR and MRR into driver-based forecasts, ties pipeline to revenue streams, and produces board reporting without extra spreadsheet work.

The platform fits next to your model to track variance and runway so finance can focus on decisions.

Core Features (modeling‑relevant):

- SaaS metric templates

- Variance analysis and reporting

- Integrations to accounting systems

SOurce: Mosaic

Mosaic Final Verdict:

Mosaic fits teams that want clearer resource visibility and an interface people actually use. Expect an easier daily workflow once data is in, but plan for slower initial syncs and occasional load delays.

If you need deep customization or org-wide visibility beyond assigned projects, validate those needs in a trial and keep an eye on total cost at scale.

5. Cube – Best for Excel-Native FP&A

Cube is financial modeling software that lets teams keep Microsoft Excel as the working interface while the platform handles control.

It connects your modeling software to a governed data layer so finance can build a model fast, collaborate without copy‑paste, and audit changes when month-end pressure hits.

Core Features (modeling‑relevant):

- Excel and Sheets connectivity

- Version control and audit trail

- Templates and driver libraries

SOurce: cube

Cube Final Verdict :

Cube is a strong fit for small to medium-sized teams that want to keep modeling in Excel while adding control, audit trail, and faster reporting.

Reviewers on G2 mention big wins on recurring reports and budget cycles, with some trade-offs on very granular analysis and external BI connectivity. If your workflows demand many dimensions or sub-ledger-level drill, validate those use cases in a trial.

6. Oracle Hyperion Planning – Best for Enterprise Governance

Hyperion brings financial models under tight control for enterprises that need auditability at scale. It centralizes the model, enforces permissions, and handles consolidation so finance can trust numbers across subsidiaries and regions.

If your financial team manages complex ownership structures or statutory requirements, Hyperion’s governance model reduces manual reconciliations and closes risk gaps.

Core Features (modeling‑relevant):

- Multi‑entity consolidation of financial statements

- Multi‑currency support

- Role‑based permissions

SOurce: Oracle Hyperion Planning

Oracle Hyperion Planning Final Verdict:

Hyperion is a solid enterprise planning choice when you need strong governance, cross-BU modeling, and Excel-friendly input via Smart View.

You should consider investing in training to keep performance acceptable and rules maintainable, and plan to pair it with an external BI tool if you want richer dashboards.

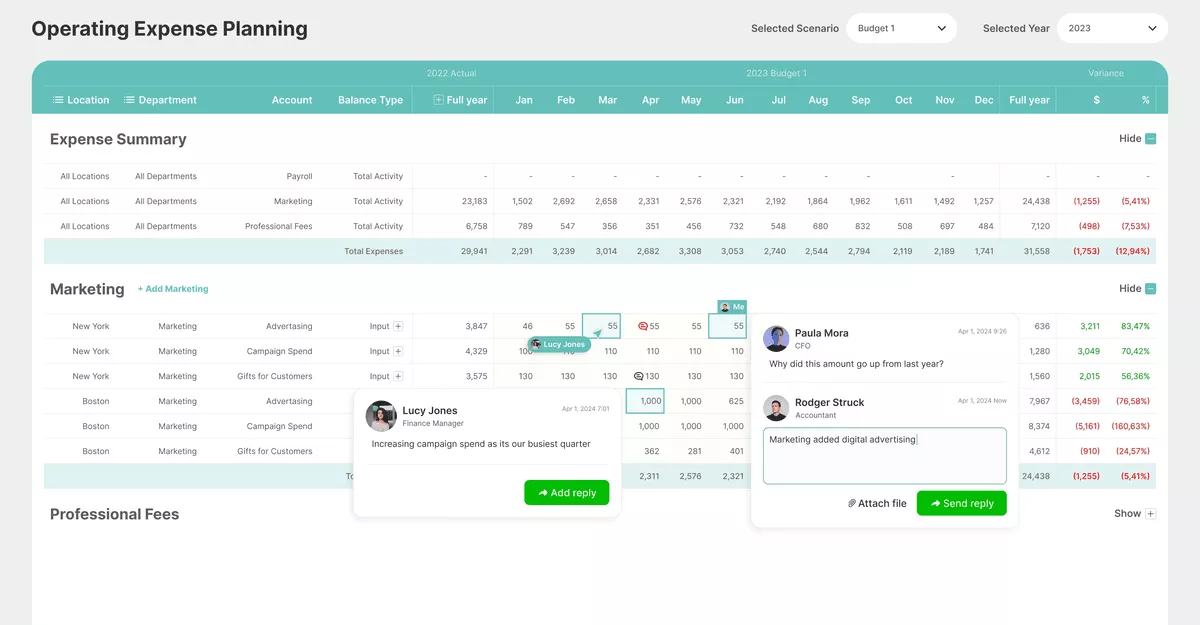

7. Limelight – Best for Finance Teams Moving From Spreadsheets

Limelight is a financial modeling tool that eases the move from spreadsheets without a steep learning curve. It guides the model into reusable templates and streamlines budget versus actuals, so financial reviews move faster.

The result is a cleaner modeling workflow that lowers errors while keeping familiar shortcuts.

Core Features (modeling‑relevant):

- Budget vs actuals reporting

- Template library

- Collaboration and comments

SOurce: Limelight

Limelight Final Verdict:

Limelight is a practical step up from spreadsheets for finance teams that want cleaner budgeting and month-end reporting.

Some users on Capterra and G2 mention how the tool helped them centralize data and producing statements. However, others aren’t happy with trade-offs in advanced Excel-style features and potential add-on costs for heavy customization.

If complex, highly customized reporting is a must, validate those needs during a trial and factor in support time.

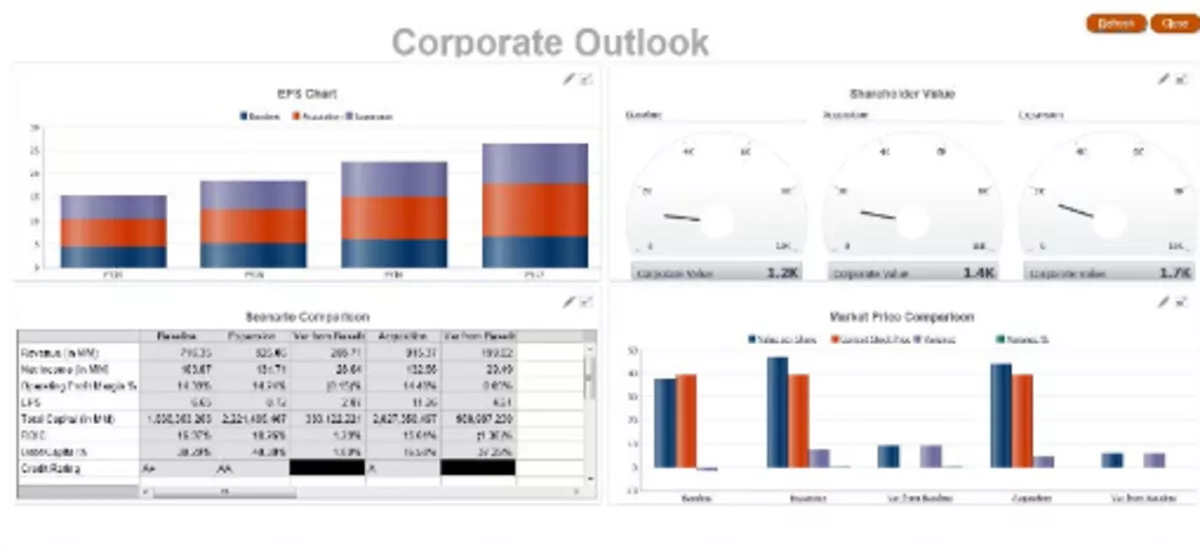

8. Anaplan – Best for Complex Driver-Based Modeling

Anaplan scales driver-based financial models across teams with robust scenario capabilities. It lets finance model granular drivers, connect assumptions across functions, and run scenario analysis without breaking the model.

If you need cross-functional alignment and repeatable versions for planning cycles, Anaplan keeps the structure consistent while the team iterates on inputs.

Core Features (modeling‑relevant):

- Driver‑based financial planning

- Scenario analysis and what‑ifs

- Large‑scale model governance

SOurce: anaplan

Anaplan Final Verdict:

According to users on G2, Anaplan suits organizations that need collaborative planning across many functions with clear dashboards and scalable model structures.

If your roadmap depends on real-time data feeds or very large, sparse models, validate connector options, performance, and total cost during a proof of concept.

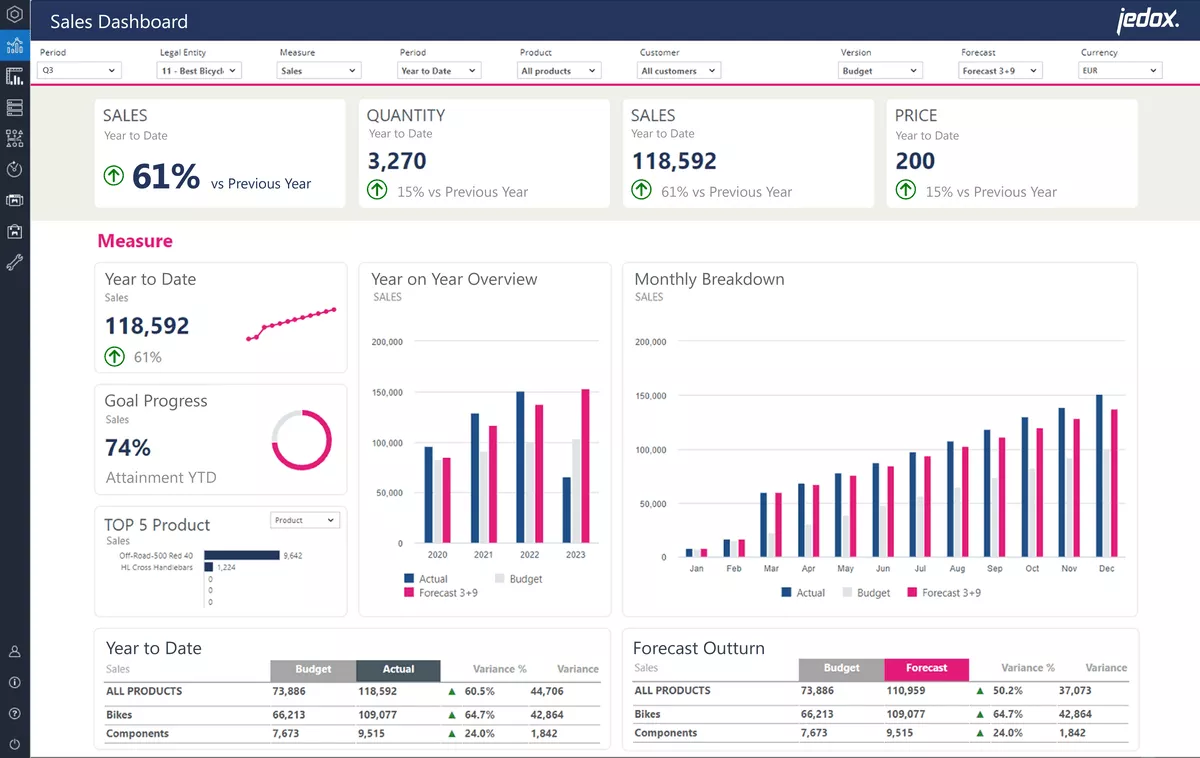

9. Jedox – Best for OLAP-Style Modeling

Jedox uses OLAP (Online Analytical Processing) cubes for financial models with fast aggregation and dimensional analysis. It helps finance teams iterate on a model quickly across entities, products, and regions.

The cube structure speeds rollups, keeps calculations consistent, and reduces manual restructuring when plans change. If you need multi-dimensional analysis without rebuilding spreadsheets, Jedox keeps performance high and workflows predictable.

Core Features (modeling‑relevant):

- Cube modeling and hierarchies

- Excel integration

- Workflow and permissions

SOurce: jedox

Jedox Final Verdict:

Based on G2 reviews, Jedox is a good choice if you want multi-dimensional, cube-based models that pivot by time, product, or region and roll up fast.

The Excel-like front end helps spreadsheet users adapt, but test performance on your largest datasets and confirm the report looks and feels how stakeholder expect it to be.

10. Vena – Best for Excel Interface With Platform Control

Vena is a financial Excel-like tool, but with extra structure and finance management features. You get templates that standardize inputs, workflows that guide approvals, and a central database that keeps versions aligned.

It suits teams that want spreadsheet speed with platform guardrails for collaboration and auditability.

Core Features (modeling‑relevant):

- Excel interface with a central database

- Workflow and approvals

- Templates library

SOurce: vena

Vena Final Verdict:

According to G2 reviews, Vena suits teams that want an Excel-first experience with platform control, workflows, and centralized data. It speeds up budgeting and reporting once templates and processes are in place.

If you need sandboxed development, advanced scripting, or proof of fit in a specific ERP and industry, validate those needs in a pilot since there is no free trial.

How To Choose the Right Financial Modeling Software?

Choose by modeling style first. Pick financial modeling software that matches how you build models and run financial reviews. From there, decide whether you will stay in spreadsheets, use an Excel add-in, adopt an Excel native platform, or move to an FP&A suite.

Next, write down the integrations you need by system and object, then run a one-week pilot to confirm data sync and driver setup.

Finally, agree on the model outputs you must ship in week one, who signs off, and the checks you will use to validate results against the general ledger.

Step 1: Choose Your Modeling Style

Decide if you stay in spreadsheets, use an add-in, or adopt a platform. If your work is fast and ad hoc, stay with a spreadsheet first. If you need repeatability and shared logic, choose modeling software that adds structure without slowing the team.

Step 2: Confirm Your Integration Scope

Next, confirm which systems connect natively. Prioritize the accounting system your data lives in, then CRM and data warehouse. Write down objects and sync methods before you shortlist tools, so testing is focused.

Step 3: Check Scenario Modeling and Sensitivity Depth

As you compare options, check how the tool builds scenarios, drivers, and sensitivity analysis. You should create cases in minutes, not hours. Look for quick inputs and clear outputs that finance can explain. Deep models need reusable drivers and clean assumptions.

Step 4: Map Consolidation Needs

If consolidation is part of your month, map entities, currencies, and ownership rules. Verify intercompany eliminations and translation settings in a quick pilot. Your model should handle structure changes without rebuilds.

Step 5: Set Permissions and Access

Map roles by task: who inputs, who reviews, who approves. Enable audit trails and set least privilege permissions that non-finance users can follow.

Step 6: Keep Collaboration in One Place

Run reviews inside the tool with comments, assignments, and change tracking so conversations stay tied to numbers. Publish one source of truth and block email attachments to prevent version sprawl.

Step 7: Plan the Learning Curve

Set a time to productivity target for finance and stakeholders. Train on model logic and review steps, and choose an interface that teams already know if timelines are tight.

Step 8: Commit to Time to First Forecast

Commit to a baseline and a rolling forecast in week one. Define the day one outputs and owners, and track time to value over features you will not use.

Can You Do Financial Modeling With Microsoft Excel?

Yes, you can do financial modeling with Microsoft Excel; however, you should match the tool to your control needs. Excel models are fast, flexible, and familiar for finance. They shine when you need quick changes, custom logic, and full keyboard speed.

The limits show up with collaboration, version control, and audit requirements. That is where modeling software or a platform adds structure so your model scales beyond one analyst.

| Excel pros | Excel cons | Useful add-ins | Best use fit | Hybrid workflow? |

|---|---|---|---|---|

| Fast for ad hoc analysis | Can get messy as models grow | Macabacus for productivity and auditing | Quick one offs and short cycles | Yes. Keep core calculations in Excel and publish outputs from a platform. |

| Easy formulas and full keyboard speed | Fragile links break across tabs and files | Modano for template driven modeling | Custom logic built by an analyst | Yes. Use Excel for logic and a platform for sharing and approvals. |

| Vast template ecosystem | Inconsistent template quality | Modano for reusable structures | Faster starts with standard layouts | Yes. Store assumptions and inputs in the platform. |

| Familiar to finance and non finance | Conflicting file versions in email threads | Macabacus for workbook hygiene | Teams that already live in spreadsheets | Yes. Centralize versions in the platform. |

| Low switching cost | Limited permissions and approvals | Macabacus for error checks | Small to mid sized teams | Yes. Keep Excel as the front end and the platform as the system of record. |

| Transparent cell level logic | Weak audit trails and change history | Macabacus for trace precedents | Internal models where creators are known | Yes. Use the platform for audit trail and publishing. |

| Possible to do consolidation with effort | Manual consolidation and intercompany eliminations | Quantrix when you outgrow flat spreadsheets | Single entity or simple structures | Yes. Hand off consolidation to the platform. |

Final Thoughts

Choosing financial modeling tools comes down to how you build models and where your financial data lives.

If you want one place to connect budgets, time, expenses, and reporting to the work itself, consider an all-in-one platform like Productive. It keeps planning, approvals, and tracking in one flow so finance and delivery stay in sync.

If that sounds right for your team, book a short demo of Productive to see how it supports financial modeling, approvals, and reporting handoff to accounting.

Connect With Agency Peers

Access agency-related Slack channels, exchange business insights, and join in on members-only live sessions.