Top 10 Business Budgeting Software (Paid & Free) – 2026 Review

Business budgeting software helps you plan revenue and costs, track actuals, and forecast what comes next in one place.

However, choosing the right budget management tool takes a lot of time and adds a lot of pressure (and responsibility) for the decision maker.

In this guide, you’ll get an overview of the leading business budget management tools, with clear pros and cons, notes from user reviews, core features, and best-fit use cases.

What Is Business Budgeting Software?

Business budgeting software is a system that helps you plan, track, and forecast company finances in one place. These tools are here to automate the project financial management process.

They typically cover:

- Revenue and expense budgeting, with updates from actuals

- Forecasting for cash flow, profit, and scenarios

- Profitability insights by project, client, or department

- Invoicing and expense management

- Optional time tracking to connect billable hours to budgets

Most tools also include dashboards and customizable reports so finance and operations can see key metrics at a glance, like run-rate revenue, gross margin, utilization, and cash flow.

Top 10 Business Budgeting Software Solutions (Paid & Free)

1. Productive – Best Business Budgeting Software for Professional Services and Agencies

Productive is one of the best budgeting software for professional services firms. It offers a variety of features that support client project management, while delivering in-depth insights on business financial performance.

By using Productive, you’ll be able to switch from using different CRM, HRM, time trackers, billing, and task tracking tools to a centralized platform for budgeting.

In Productive, the ability to tie invoicing and detailed estimates and project deliverables: that’s kind of been the secret sauce.

Learn more about how Clear Launch got more predictability and consistency with Productive.

Some of Productive’s key features for business budgeting include:

- Financial management

- Revenue recognition

- Expense management

- Time tracking and invoicing

- Resource planning and forecasting

- Budget burn and profitability insights

Let’s explore these features in more detail:

Manage your budgets with Productive

Build accurate budgets for fixed, hourly, and retainer work

With Productive’s Budgeting feature you can easily up fixed‑fee, hourly, retainer, or mixed budgets in minutes. Either create your templates or use ours reusable templates so project setup is consistent across finance teams.

Once rates and scope are set, Productive tracks burn and margin in real time and alerts you before you overshoot (so PMs aren’t waiting on month‑end spreadsheets to spot issues).

Make informed decisions on your budgeting and maintain a healthy cash flow

Productive also includes overhead management, expenses tracking, and revenue recognition for more accurate insights into business finances.

Productive’s overhead calculator spreads overhead costs per hour, which means that you can understand your true profit margin across clients and make better financial decisions.

Expense tracking also includes Purchase Orders. Expenses can be managed through the platform, added to your budgeting, and even forecasted.

This was a major benefit we experienced after switching to Productive: using it to see profitability for specific projects and to check out our revenue.

Forecast revenue and margin from your schedule

Productive’s financial management doesn’t stop at real-time financial reports; you can also forecast your metrics to predict your future budgeting performance.

Turn your schedule into a forecast. As you assign people to projects, Productive projects revenue, costs, margin, and utilization weeks and months ahead.

Forecasts update when plans change, so you can compare projected burn to approved budgets and spot shortfalls early. If a budget is heading off course, adjust allocations or timing and see the impact before it hits your margin.

Monitor financial health during the entire project lifecycle

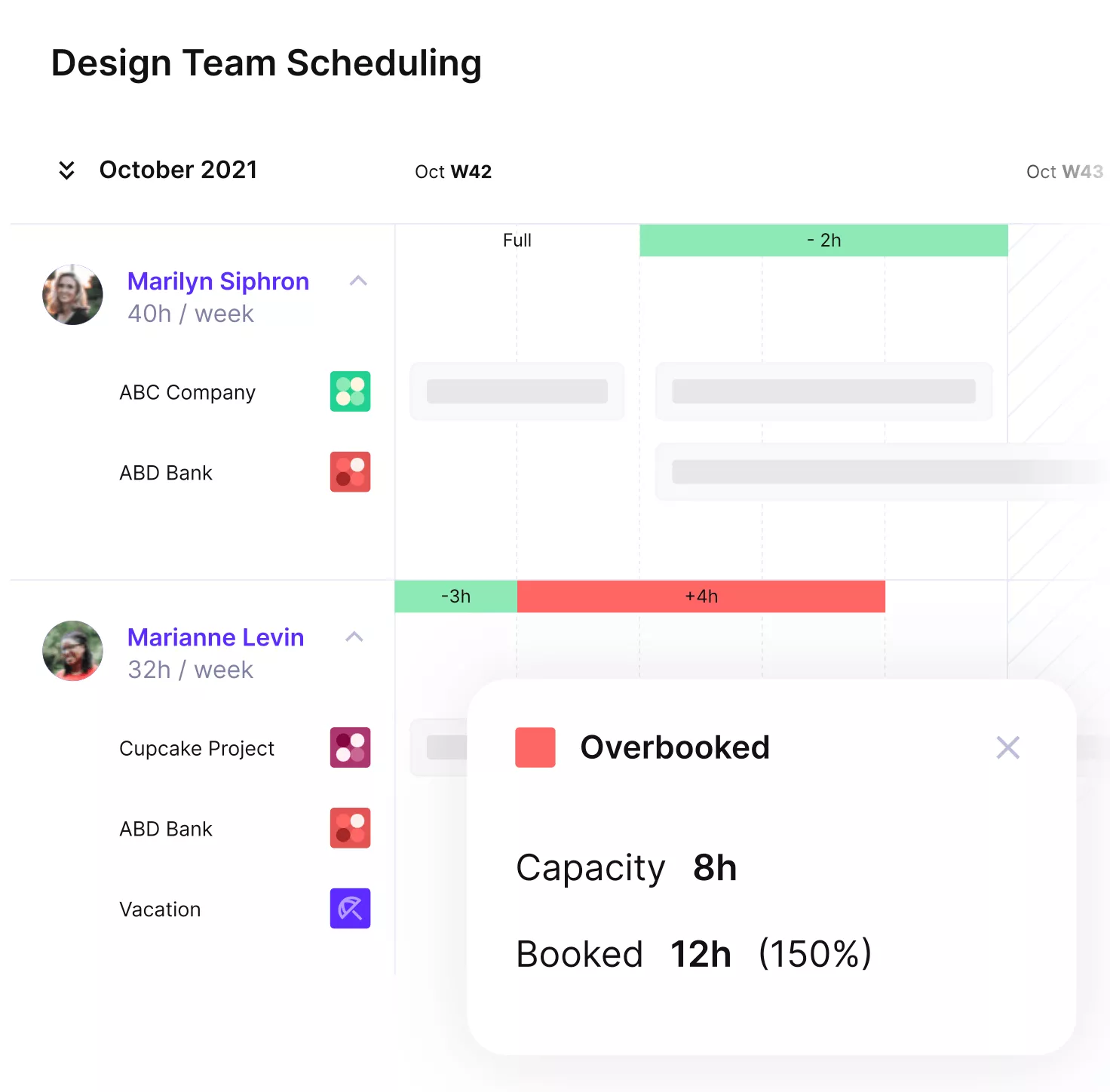

Another metric that can be forecasted is utilization, which provides useful insights into your workforce planning.

Utilization forecasting helps with workforce planning, showing where service teams are over or under capacity so you can rebalance work or plan hiring.

In the short video below, we explain how Productive helps with scenario planning and data visualization.

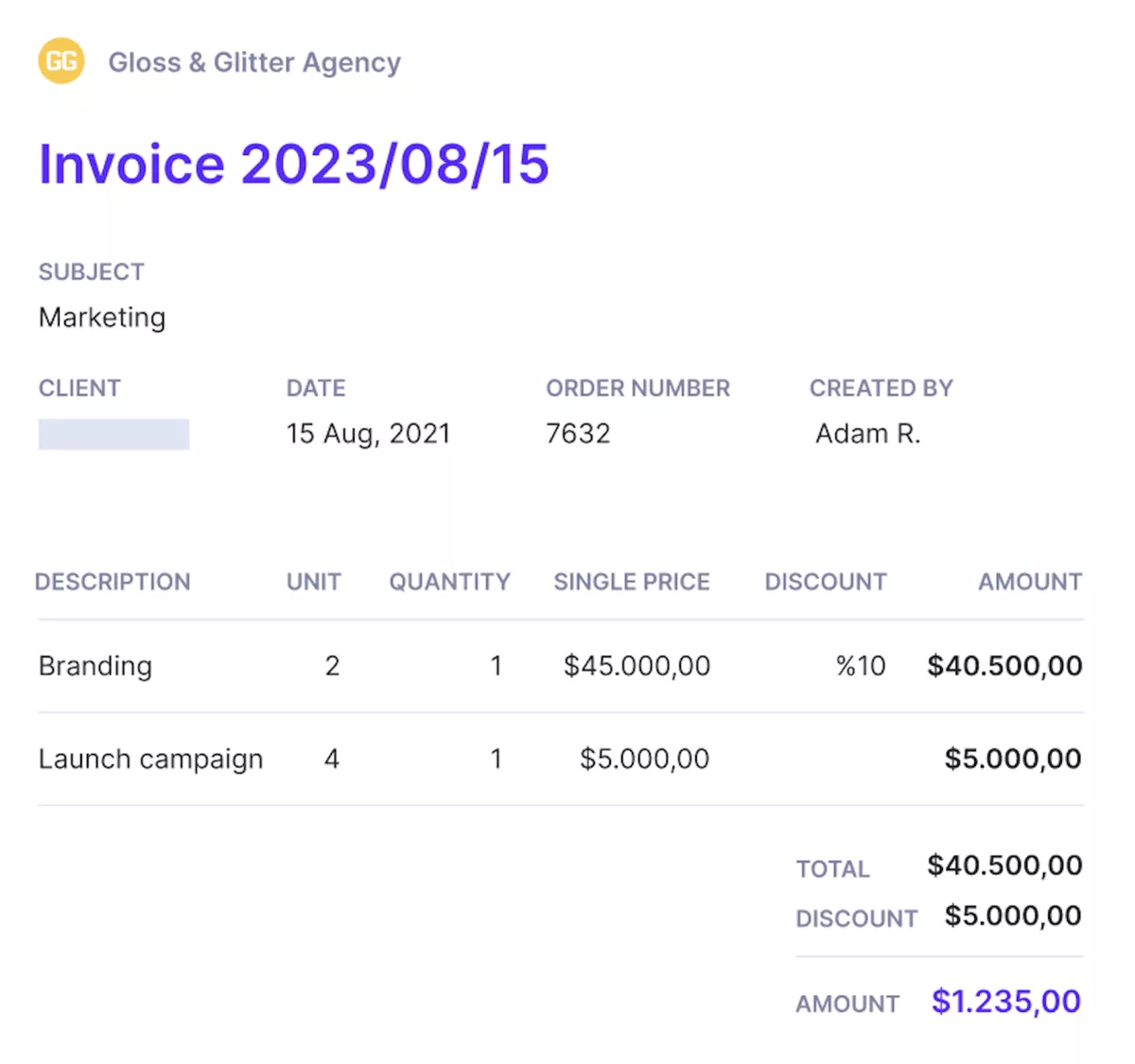

Invoice faster from budgets and time

Invoice directly from approved budgets. Pull uninvoiced time on hourly work or the remaining amount on fixed-price projects. For more context, head over to Productive’s billing.

Automations can create invoice drafts when budget conditions are met, for example when a budget is created or updated.

Productive’s AI speeds up expense entry: upload an invoice or receipt and the details are autofilled.

Generate branded invoices and send them directly from the platform.

You also get tax rate management, multi-currency invoicing, and reports for overdue, left to invoice, and already invoiced amounts.

Once you’re ready to deliver a budget, you can create an invoice by pulling information from your budget – whether uninvoiced time entries on hourly projects or the remaining amount of the budget on fixed-price projects.

Track budget burn and profitability in real time

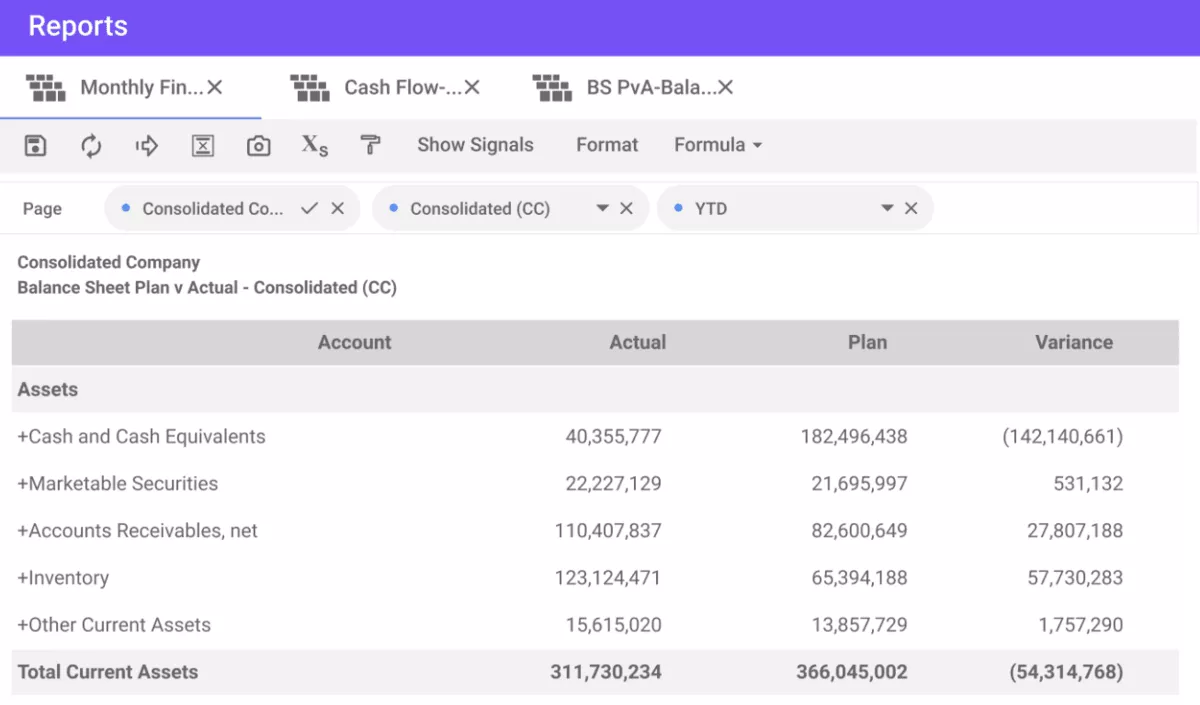

Reporting gives finance and operations a live view of budgets and performance.

Productive brings budgets, time, expenses, and billing into real-time financial reporting so you can track budget burn, profitability by client or project, invoicing amounts and status, and forecasted revenue and margin.

Ensure that your projects are aligned with financial goals

Choose from 50+ professional services templates, customize them, and add them to custom dashboards for the metrics you watch every week.

Schedule reports to send automatically to email or Slack so stakeholders stay informed without manual exports.

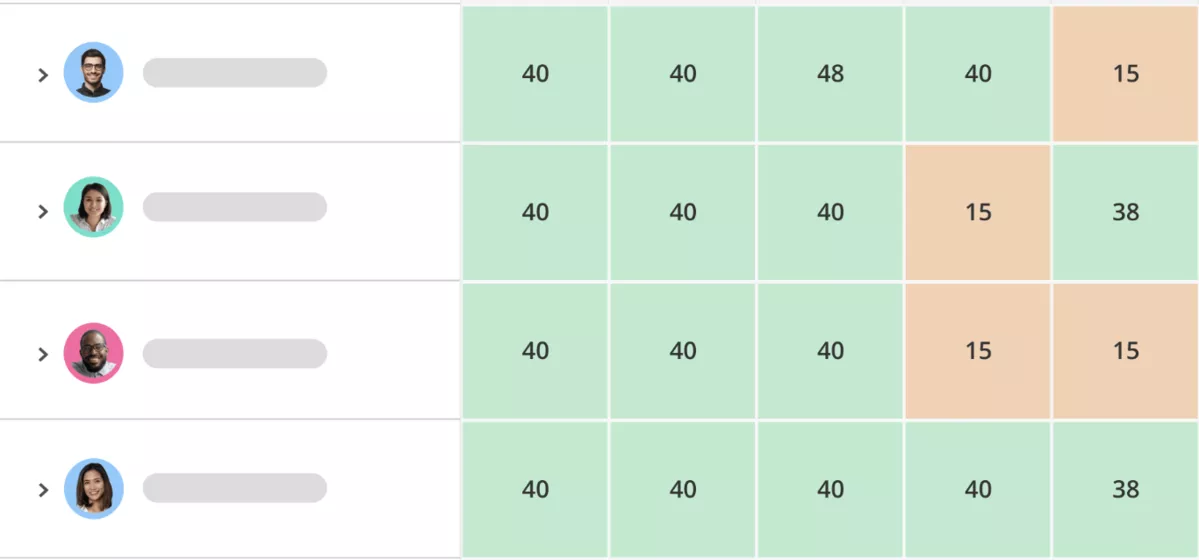

Plan capacity with time off and utilization in view

Productive’s Resource Planning feature lets managers create comprehensive resource plans while taking into account the full picture of team availability and capacity.

See who is available, who is booked, and where capacity is tight.

With time entries and integrated leave management in the same place, managers can spot over or under utilization and rebalance work.

Schedule changes update forecasts right away, so revenue and margin projections stay current.

Use reports with real-time budget updates

Another one of Productive’s features that supports the budgeting process is Reporting.

Productive can become the single source of truth for all your business operations.

All your activities on the platform power up real-time reports, such as budgets and profitability per client, invoicing amounts and status, forecasted profitability and revenue, overall project progress, and much more.

Productive includes over 50 professional services report templates that can be customized with business specific information, and added to custom dashboards.

These reports can also be sent automatically (at specific intervals) to Slack or email addresses to effortlessly keep clients and teams in the loop.

GET A HIGH-LEVEL OVERVIEW OF YOUR PROJECT AND EMPLOYEE Workloads.

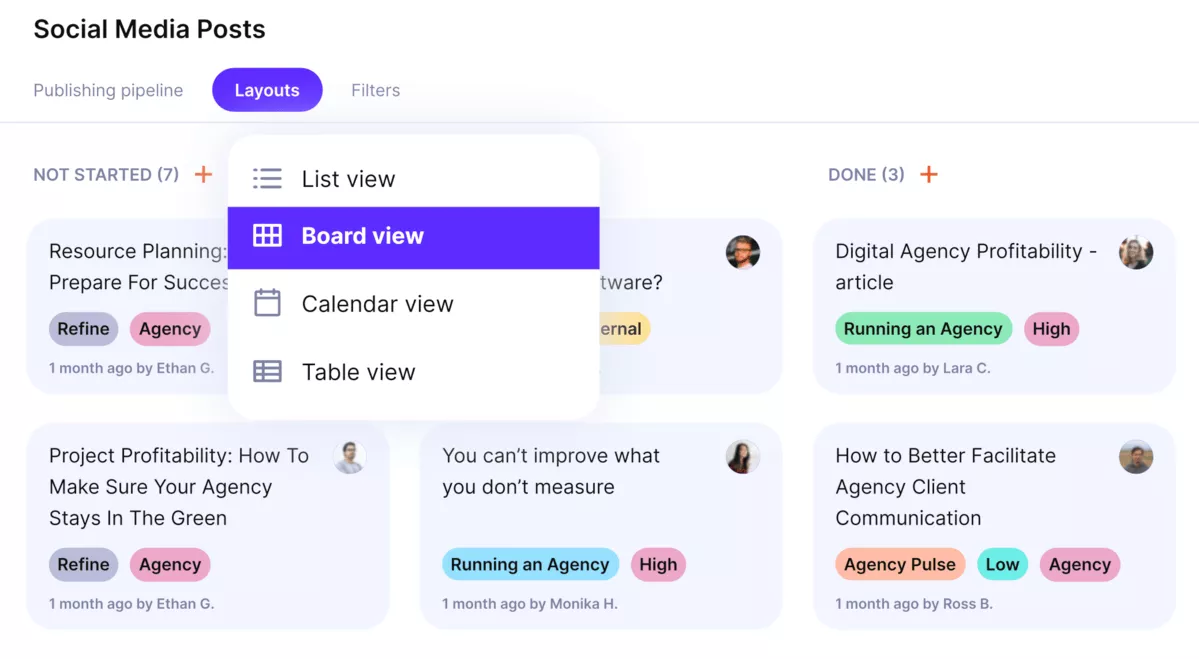

Manage Projects and Time Where your Budgets Live

Productive’s Project Management helps you manage tasks and time in the same place as your budgets.

Create a collaborative workspace to track tasks, dependencies, and progress.

Manage projects and financial models with Productive.

Switch views as needed: Kanban, Gantt, Workload, and more.

With built-in time tracking, teammates can run a timer, duplicate previous entries, or enter time retroactively.

Accurate time powers budget and resource planning by tracking costs per service, plus billable and non-billable hours for utilization.

Additional features include: Sales, Docs, mobile and desktop app

Some of Productive’s additional features include:

- CRM to track data on potential customers, customize sales funnel stages, and forecast finance metrics such as sales revenue

- Docs for easier team collaboration and project information management

- Client Portal for working together with clients and sharing finance data with user permissions

- Mobile and Desktop app

Connect accounting, HR, and collaboration tools

Productive offers seamless integrations with HR, accounting, and collaboration tools.

Integrations include Slack, Google Calendar, and Outlook for scheduling and updates; Xero and QuickBooks for accounting and invoicing; BambooHR, Breathe, Humaans.io for HRM; Memtime for time tracking; and more.

Pricing

- Plans start with the Essential plan at $10 per user per month, which includes essential features such as budgeting, project & task management, docs, time tracking, expense management, reporting, and time off management.

- The Professional plan includes custom fields, recurring budgets, advanced reports, billable time approvals, and much more for $25 per user per month.

- The Ultimate plan has everything that the Essential plan and Professional plan offer, along with the HubSpot integration, advanced forecasting, advanced custom fields, overhead calculations, and more. Book a demo or reach out to our team for the monthly price per user.

Try out Productive with a 14-day free trial today.

Manage Budgets and Finances With Productive

Get more control over your finance data and key business resources with an all-in-one professional services management platform.

2. Workday – Budgeting Tool for Businesses of All Sizes

Workday is a cloud-based accounting software that offers strategic planning and money management support to a wide range of industries, from healthcare, consumer, professional and business services, to technology and media.

Workday provides a suite of solutions with Workday Adaptive Planning, Workday Financial Management, Workday HCM, and more.

Key Features:

- Control cash flow with automated bank account management

- Continuous payroll processing for a global workforce

- Real-time and ad hoc financial performance reports

- Interactive data visualizations with tailored reports and dashboards

SOURCE: WORKDAY

Workday Verdict:

As Workday doesn’t offer transparent pricing on its website, this means that engagement with the vendor is necessary prior to getting all essential information. Additionally, the choice between multiple modules can complicate your decision-making.

When it comes to customer reviews, Workday Adaptive Planning is the best-rated out of Workday’s offerings, with a 4.3 score on G2 and a 4.5 score on Capterra.

Overall, Workday is a good choice for businesses that are able to invest some time and money into making the best decision. For a simpler process, you might want to consider an all-in-one ERP for service providers instead.

3. Sage Intacct – Complex Financial Planning Tool

Sage Intacct is a cloud accounting and financial management solution from the leading provider of ERP solutions, Sage Group. Sage Intacct supports a wide range of industries and businesses of all sizes with their financial processes and accounting tasks.

Key Features:

- Automated bill entry and payment processing

- Predictive insights with customizable dashboards

- Streamlined communications with Sage Intacct Collaborate

- Integrations with accounting and productivity tools

Source: SAGE INTACCT

Sage Intacct Verdict:

The most frequently underlined downside of Sage Intacct is the complexity: users report that it takes some time getting used to the platform, and even more time to master it.

Others have noted that the pricing makes the tool geared more towards larger companies. For businesses on a limited budget or dynamic schedule, considering a streamlined, comprehensive solution that combines project management with finances might be a good idea.

We also covered Sage Intacct in our list of the top BigTime alternatives.

4. Xero – Good Accounting Solution for Medium to Small-Sized Businesses

Xero is a budgeting tool tailored to small businesses. As for the pros of Xero, reviewers on Capterra describe the budgeting software as “very intuitive” and “easy to use”, and praise it for improving their efficiency and financial analysis capabilities.

Key Features:

- Schedule payments and access your bills

- Track expenses with real-time reporting

- Stay on top of business with automatic bank feeds

- Monitor project finances and customize invoices

source: XERO

Xero Verdict:

As for the cons, some users note that the reports could be more detailed and that they are somewhat restrictive when it comes to pulling the information you need.

Overall, Xero is a fine specialized solution to consider for cash management if you’re running a small business, especially as an integration to a more comprehensive agency management tool with robust budgeting and financial planning features.

What Xero doesn’t have is an integration of project management and advanced budgeting features. For this, you’ll want an all-in-one time and billing software solution.

5. QuickBooks – Fine Business Tool for Smaller Companies

QuickBooks is an online small business budgeting and accounting software solution.

Reviewers on G2 state that QuickBooks Online is “easy to learn” and requires no previous accounting experience, with other users underlining that it helps them keep track of their financial performance in one place.

Key Features:

- Save time and reduce errors with bank feeds

- Create custom reports that align with your branding

- Track project details on smart dashboards

- Simplified labor costs with a dedicated rate calculator

source: QUICKBOOKS

Quickbooks Verdict:

Although QuickBooks Online has plenty of good reviews praising its simplicity and user-friendly interface, there’s a notable amount of negative reviews that mostly comment on issues with customer support.

Even some positive or neutral reviews comment that it takes some time for requests or problems to be resolved.

Overall, like Xero, QuickBooks Online can complement your more robust project management tools with its accounting capabilities. Keep in mind that time tracking is a separate feature available in QuickBooks Time.

Check out some alternatives, such as our list of the top strategic workforce planning software or Time Doctor competitors.

6. Planful – Good FP&A Platform for Rolling Budgets and Scenario Modeling

Planful is corporate financial planning software for FP&A and finance teams that need rolling budgets and fast what-if modeling. It centralizes plans, forecasts, and reporting to shorten cycles and react to change.

Key Features:

- Driver-based planning and rolling forecasts

- Scenario modeling and variance analysis

- Consolidated reporting and workflows

source: planful

Planful Verdict:

As stated by users on G2; Planful is a solid pick for teams moving off large spreadsheet workbooks who want faster consolidation and cloud access, with reporting that’s easy to work with.

Expect some unintuitive workflows and extra steps to sync changes across modules, and support responses can take time.

7. Mosaic – Collaborative FP&A with Headcount and Expense Planning

Mosaic is business budget management software that connects ERP, CRM, and HRIS so department owners can plan headcount and expenses while finance keeps control. Real-time dashboards and what-ifs help finance teams align plans to runway and board metrics.

Key Features:

- Headcount and expense planning

- Real-time dashboards and metrics

- Quick integrations with common finance stacks

source: mosaic

Mosaic Verdict:

Users on G2 state that Mosaic is easy to get around with clear visuals and helpful notifications, and it works across web and mobile.

It’s useful for pulling projects into one place and improving visibility, though reviews note clumsy sync, occasional slow loading, and limits when trying to see all notes on one screen.

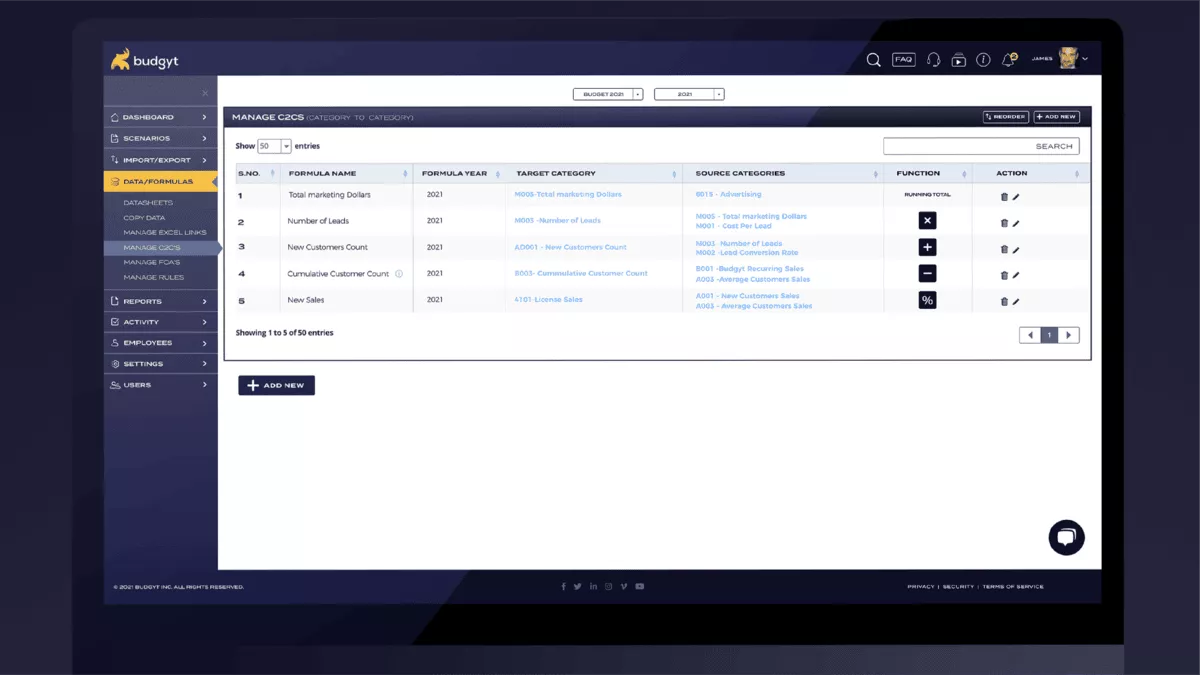

8. Budgyt – Simple Multi-Department Budgeting with Unlimited Users

Budgyt is a mid to small business budgeting software designed to replace large spreadsheets with controlled multi-department input. It supports rolling forecasts, granular variance checks, and simple approvals at a price point that suits nonprofits and smaller finance teams.

Key Features:

- Multi-department budgets and templates

- Variance reviews and notes

- Approvals and user permissions

source: budgyt

Budgyt Verdict:

According to Capterra reviews Budgyt has a good value for smaller teams that need multi-department budgeting with lots of users at a low cost.

Reviewers like the ease of building budgets and access control, but call out lighter reporting and some friction with QuickBooks imports or API stability.

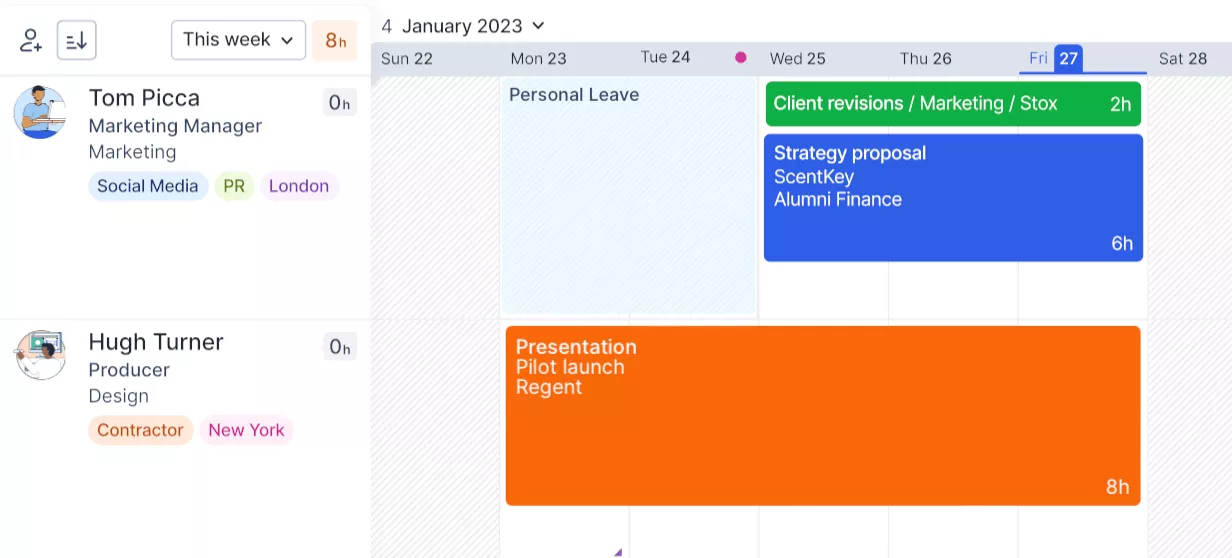

9. Float – Cash Flow Forecasting that Syncs with Xero and QuickBooks

Float is business budget tracking software focused on cash flow. It syncs with Xero and QuickBooks to build daily, weekly, or monthly forecasts and lets you test scenarios for upcoming spend or revenue changes.

Key Features:

- Direct sync with Xero and QuickBooks

- Cash flow scenarios and what-ifs

- Approvals and user permissions

source: float

Float Verdict:

According to G2 reviews, Float is helpful for capacity planning and visibility into upcoming work, with simple forecasting that supports weekly team reviews.

Reviewers like easy reallocations, calendar sync, and color-coded work types, but note slow performance at times, time-consuming setup for recurring tasks, and that deeper project management is outside Float.

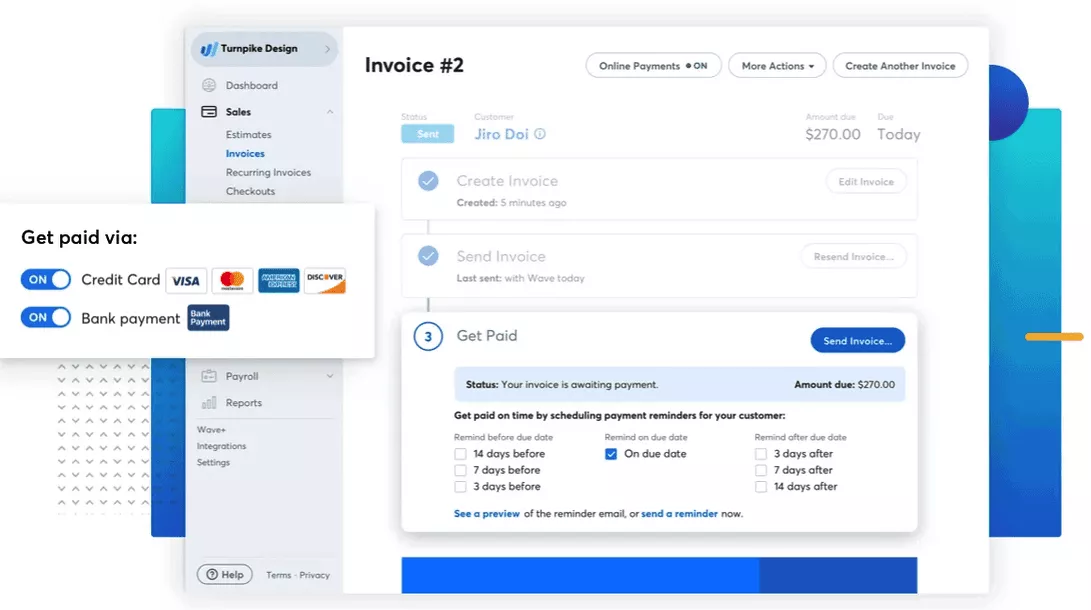

10. Wave – Free Accounting for Small Finance Teams with Optional Add-ons

Wave is free accounting for small businesses that need invoicing, expense tracking, and core reports with minimal setup. Teams can start on the Starter plan and add payments or Pro features as they grow.

Key Features:

- Invoicing, payments, and expenses

- Basic reporting and bank connections

- Optional paid payroll

source: wave

Wave Verdict:

A useful free starter for solo or very small businesses that need basic invoicing and bookkeeping, with handy receipt uploads and manual bank statement import. Capterra reviews point to clunky navigation, bank connections that don’t always work, and some features moving behind paid tiers over time.

Who Are Business Budgeting Tools For?

Business budgeting tools are for the company’s financial department, including the accounting team and CFO, but they’re also useful for business analysts, project managers, and heads of various departments.

The best business budgeting tool provides comprehensive support for all levels of agency project management. Ideally, it should have an intuitive interface so that it can be understood by non-finance professional, but also robust enough to cover all business accounting needs.

Why Are Budgeting Tools Important?

Budgeting tools are important because they reduce mistakes, speed up updates, and give you a reliable picture of money in and out.

Google sheets are powerful, but they’re easy to break. Common slip-ups include typos, broken links, hidden rows, copy-paste errors, and omissions that are hard to spot. One wrong cell can send a forecast off course.

You don’t need to drop Excel (or Google Sheets). Keep it for ad hoc analysis, and use a budgeting tool as the system of record. When actuals, budgets, and forecasts live in one place, your numbers stay consistent.

Change is constant. Projects shift, scope evolves, and new costs appear. Updating that in a sheet is slow and error-prone. Budgeting tools apply the change everywhere, and refresh reports right away.

How Financial Tools Impact Business Growth?

- Lowers risk of manual errors

- Better visibility with KPI dashboards that processes complex data in real time

- Data collection that connects plans, actuals, and forecasts in one place

- Supports forecasting with scenario analysis when projects or assumptions change

- Improves accountability with shared dashboards and an audit trail

What Are the Main Types of Budget Management Software?

The main types of of budget management software are on-premise and cloud-based. Since they’re both very different, below we’ll expand with more decision making context.

Type 1: On-premise software

Lives on your own servers. You control infrastructure and data residency, which can help with strict compliance. Trade-offs are higher upfront costs, longer setup, and less flexible upgrades.

Best fit if you have strict regulatory requirements, tight data residency rules, or legacy systems that your own IT team needs to maintain closely.

Type 2: Cloud-based budgeting software

Hosted by the vendor and accessed online with secure logins. You get faster implementation, automatic updates, and flexible pricing. The trade-off is relying on a third party for uptime and security, so vendor due diligence matters.

Best fit for distributed finance teams that want quick rollout, frequent improvements, and easy integrations with other cloud tools.

You can also group tools by capability:

- Basic: time and billable hours tracking, simple invoicing, light reporting.

- Advanced: expense tracking, sales forecasting and cash flow projections, revenue management, scenario modeling, Multi P&L budgeting, and richer financial dashboards and report generation.

Find out more in our review of the best time billing software.

What Are the Key Features of Top Budget Management Software?

The key features of the best budget management software are budget planning with continuous reforecasting, forecasting for revenue and margin, real-time collaboration and transparency, flexibility for finance and delivery teams, and integrations with your core systems.

Together, these help you plan, check progress, and adjust work with confidence.

Feature 1: Budget planning with continuous reforecasting

Budgets move when scope shifts or rates change, so the budget management software should move with them. The right budget planning software lets you set fixed, time and materials, or retainer budgets, then reforecast from actuals as time and expenses land.

You see plan vs actual in the same view, update the remaining budget, and adjust hiring plans or phases before overrun turns into write-offs.

Feature 2: Forecasting for revenue and margin

Forecasts should answer “what happens if we change the plan” with numbers. Strong budget forecasting software projects revenue, cost, margin, and burn from the current schedule and pipeline, then lets you try scenarios like shifting dates, swapping roles, or adjusting rates.

You immediately see the effect on utilization, invoice timing, and gross margin so you can choose the least risky path.

Feature 3: Real-time collaboration and transparency

When budget management software updates budgets, time, expenses, and invoices in one place, everyone works from the same version of the truth. Audit trails show who changed what and when, and stakeholders can self-serve current figures without waiting on a manual rollup.

The result is faster approvals and fewer corrections later.

Feature 4: Flexibility for finance and delivery teams

Finance needs drill-downs. Project leads need a clear runway. Top budgeting tools support dashboard and reporting capabilities with department, project, and client views, multi-entity structures, and role-based access.

Finance can manage recognition rules and accounts, while PMs track remaining budget, burn rate, and next steps without digging.

Feature 5: Integrations with your core systems

Data should flow, not be copied. Look for budgeting software for business that connects to accounting, HR, calendar, and collaboration tools so actuals, rates, and staffing stay in sync.

That shortens close, keeps forecasts current, and gives leadership a single picture instead of stitched reports.

What Are the Benefits of Implementing Budget Management Software?

The core benefits of budget management software are higher accuracy, faster decisions, clearer collaboration, time savings through automation, and better forecasting.

In short, implementing the right end-to-end project management software with financial reporting and forecasting tools can:

- Improved accuracy and fewer errors: Replacing manual accounting in scattered spreadsheets with budget management software cuts copy-paste mistakes and version drift. Actuals, budgets, and forecasts live in one place, so plan vs actuals reconcile faster and month-end close is cleaner.

- Enhanced decision-making with real-time data: With budget planning software, project leads and finance see current burn, remaining budget, and margin in the same view. That makes mid-project decisions concrete: shift dates, adjust scope, or rebalance staffing and immediately see the financial impact.

- Better collaboration and transparency: When budget management tools update time, expenses, and invoices in real time, everyone works from the same numbers. Stakeholders can self-serve dashboards and audit trails explain changes, which speeds approvals and reduces rework.

- Time saved through automation: Budgeting software for business handles routine steps like pulling uninvoiced time, applying tax rates, or scheduling reports. Finance spends less time on manual rollups and more time on analysis that protects margin.

- Future-ready planning with forecasting: Built-in budget forecasting software projects revenue, costs, and margin from your current schedule and pipeline. You can test simple scenarios and choose the plan that keeps utilization healthy and cash flow predictable.

Real examples speak real volumes. As Born Social’s Head of Operations, Kate Higham stated:

If I had to describe the one thing that Productive does for us it’s decision-making. Not just in my role, but across our finance and operations team. We are in and out of the platform on a daily basis, using the data and the reporting to help us make key commercial decisions about how we’re running the business, running our accounts, how we’re hiring and managing resources. It really is the tool for helping us make decisions.

Learn how Productive helps businesses make informed decisions backed up by real-time data.

Final thoughts on Choosing the Right Business Budgeting Tool?

Here’s the point. The best choice is the tool that keeps budgets, actuals, and forecasts in one place and ties them to the work your team actually does.

If your budget management lives across spreadsheets and point tools, you will spend more time reconciling numbers than improving margin.

All-in-One Approach to Budgeting & Planning Software

For most agencies, an all-in-one approach is the smart investment. You get budget planning, resource planning, time and expenses, invoicing, and reporting working from the same data. That means cleaner month-end close, faster reforecasting, and fewer surprises on profit.

Productive is built for that use case. It is a budgeting tools that connects project budgets with schedules, rates, time, expenses, invoicing, and real-time reporting. And yes, there’s also a mobile app.

You can model fixed fee, time and materials, and retainers, see plan vs actual in one view, and forecast revenue and margin from your schedule.

If you want to see how this looks with your clients and projects, book a demo with Productive.

Connect With Agency Peers

Access agency-related Slack channels, exchange business insights, and join in on members-only live sessions.