AGENCY GUIDE

The 2024 Report on Agency Valuations

1. Introduction

What’s your agency really worth?

Let’s face it—it’s a question on every agency owner’s mind. Even if you don’t plan on selling your business, understanding the factors that drive its value can help you make smarter decisions. In today’s fast-moving agency world, this insight matters more than ever, whether you’re looking to sell, scale, grow, or simply stay competitive.

Over the past year, M&A activity has picked up—and with it, more agency owners are taking a closer look at their financials, operations, and market position. In 2024, 783 agencies completed our Agency Valuation survey, which gave us insight into how agencies are performing across key metrics, including revenue, profit, growth, client mix, and leadership.

This report breaks down the biggest trends we saw in 2024 and provides a detailed analysis of valuable statistics that will boost your understanding of current agency valuation trends.

2. The Agency M&A Landscape in 2024

In 2024, agencies operated in a rapidly changing environment shaped by new technologies, shifting client needs, and economic uncertainty. Demand for services such as digital marketing, software development, and creative work remained strong, but the pressure to stay competitive was higher than ever.

Competition grew tougher, budgets were tighter, and clients expected more strategic value. These changes had a clear impact on M&A activity. Buyers looked for agencies with recurring revenue, efficient operations, and a strong tech foundation.

Those that adapted to these new expectations became top targets on the market, achieving higher multiples and stronger deal interest.

2.1 Agency Size & Type

Size may not be the first thing that comes to mind when considering agency valuations. Still, it often directly correlates with EBITDA, making it an important factor for your agency’s value.

Larger agencies typically have higher revenue, stronger profitability, and more established processes, making them more attractive to buyers and investors.

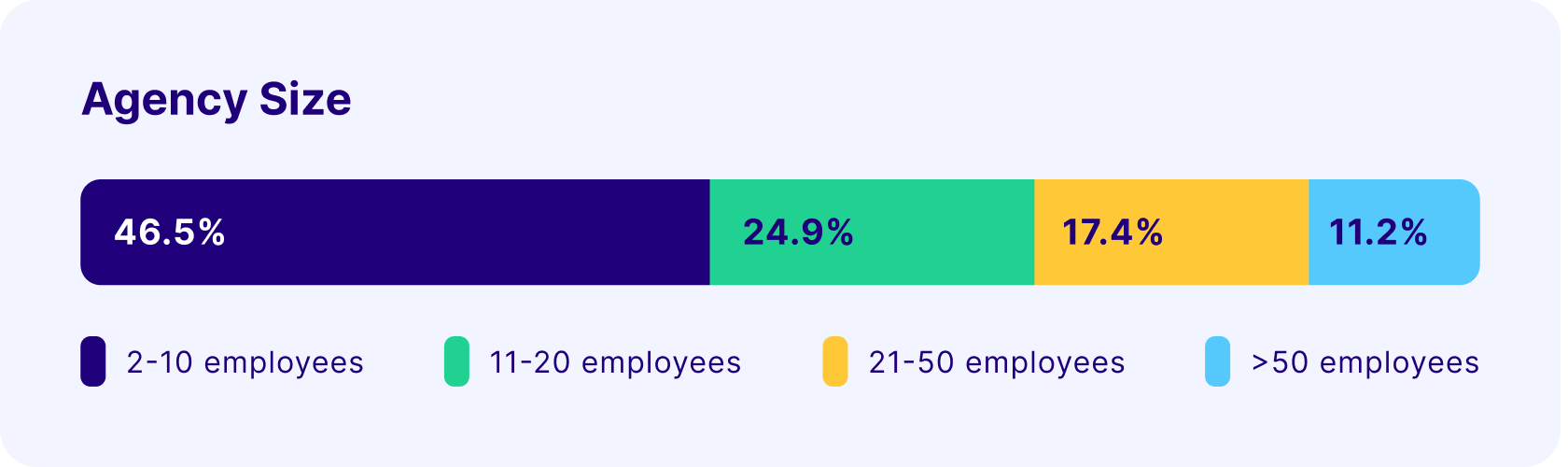

When looking at the agencies that took part in the survey, we divided them into four categories: from 2-10 employees, 11-20, 21-50, and those over 50 FTEs.

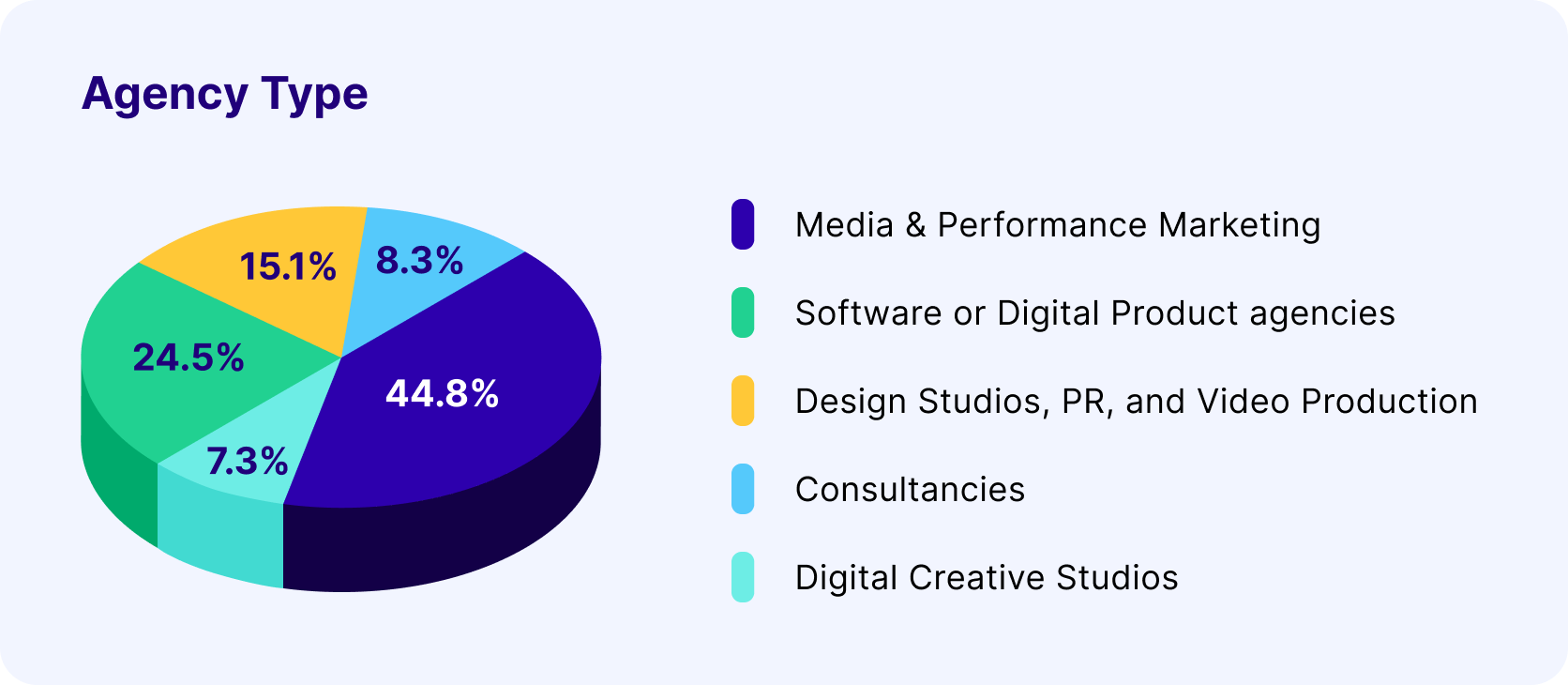

Here’s how they break down by type of agency:

With the global digital ad market projected to reach $1 trillion USD by 2027 (Goldman Sachs, 2024 M&A Outlook), agencies specializing in digital marketing are positioned for increased investor interest.

According to Kelly Molson, an agency advisor with over 20 years of agency management experience, finding your agency’s niche can also be a good strategy for differentiating in saturated markets.

Niching down can increase agency valuations by boosting profitability, improving client retention, and creating a more precise market position. A well-defined niche makes your agency stand out in the market, which can drive demand and justify a higher valuation.

2.2 Revenue & Profitability

Revenue plays a significant role in determining how agencies are valued—it serves as the starting point for understanding a business’s financial health and growth potential.

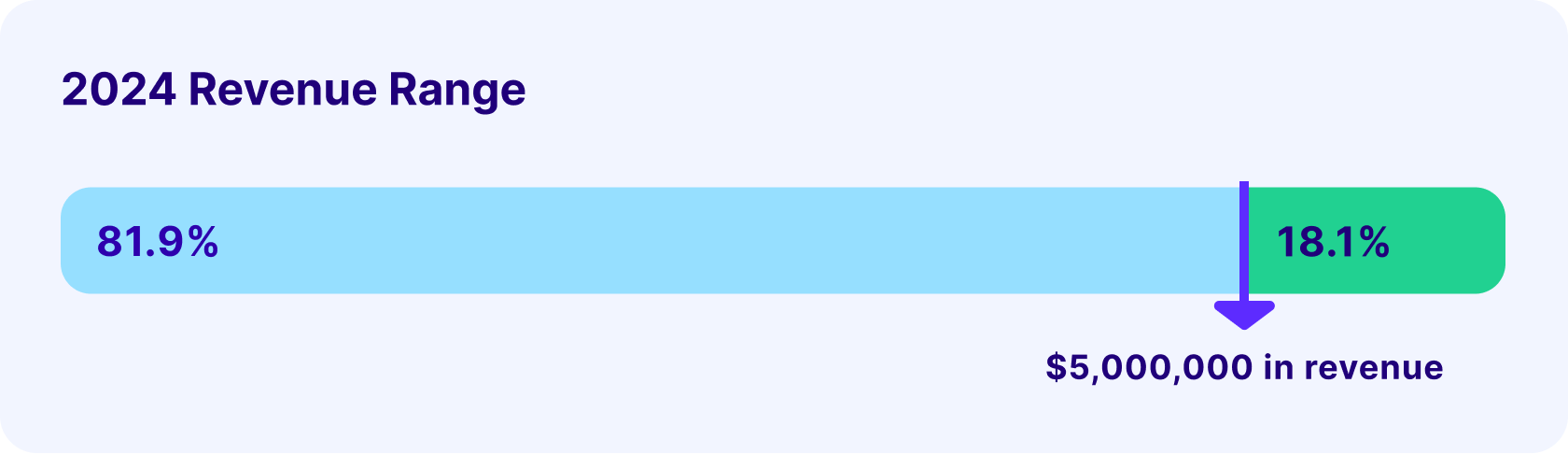

Respondents were divided into two categories: those with revenue below $5 million USD and those with revenue above $5 million USD.

However, revenue alone isn’t enough—what really matters is how efficiently an agency turns that revenue into profit. That’s where EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) comes in. It gives a clearer picture of how much profit the agency makes from its core operations, without one-off expenses or financial structures getting in the way.

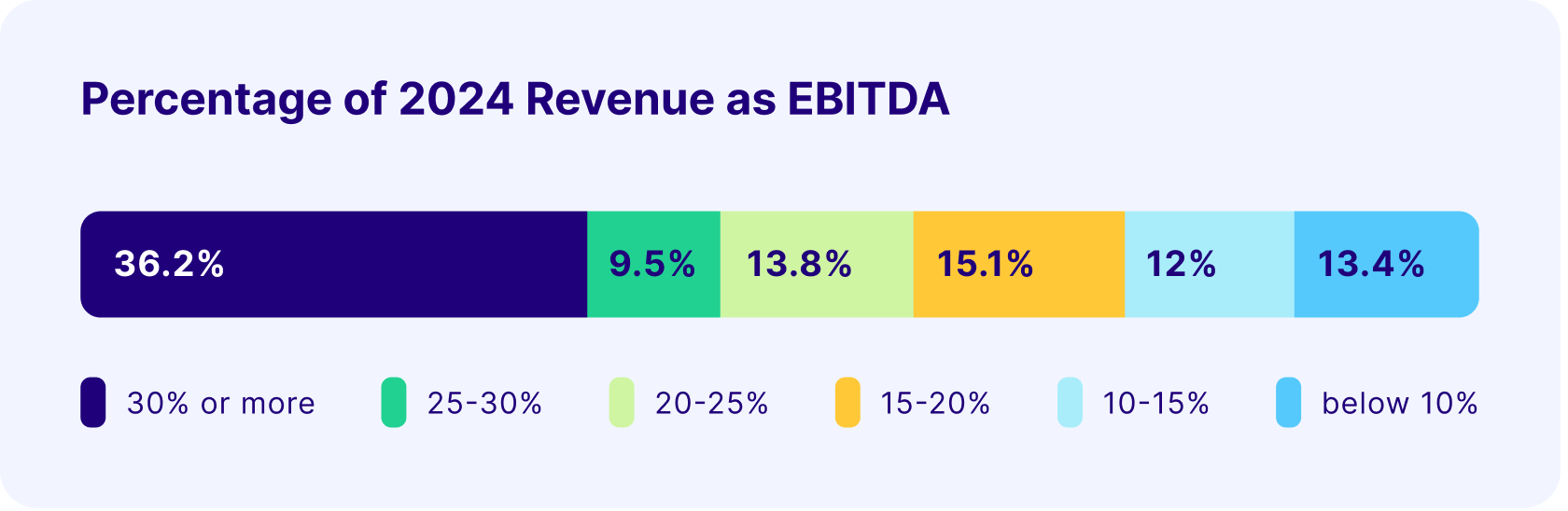

Regardless of their size, many agencies operate with healthy profit margins:

Revenue and EBITDA determine the multiplier used to value your agency. The more your agency earns, the higher your multiplier will be.

2.3 Growth & Risk Factors

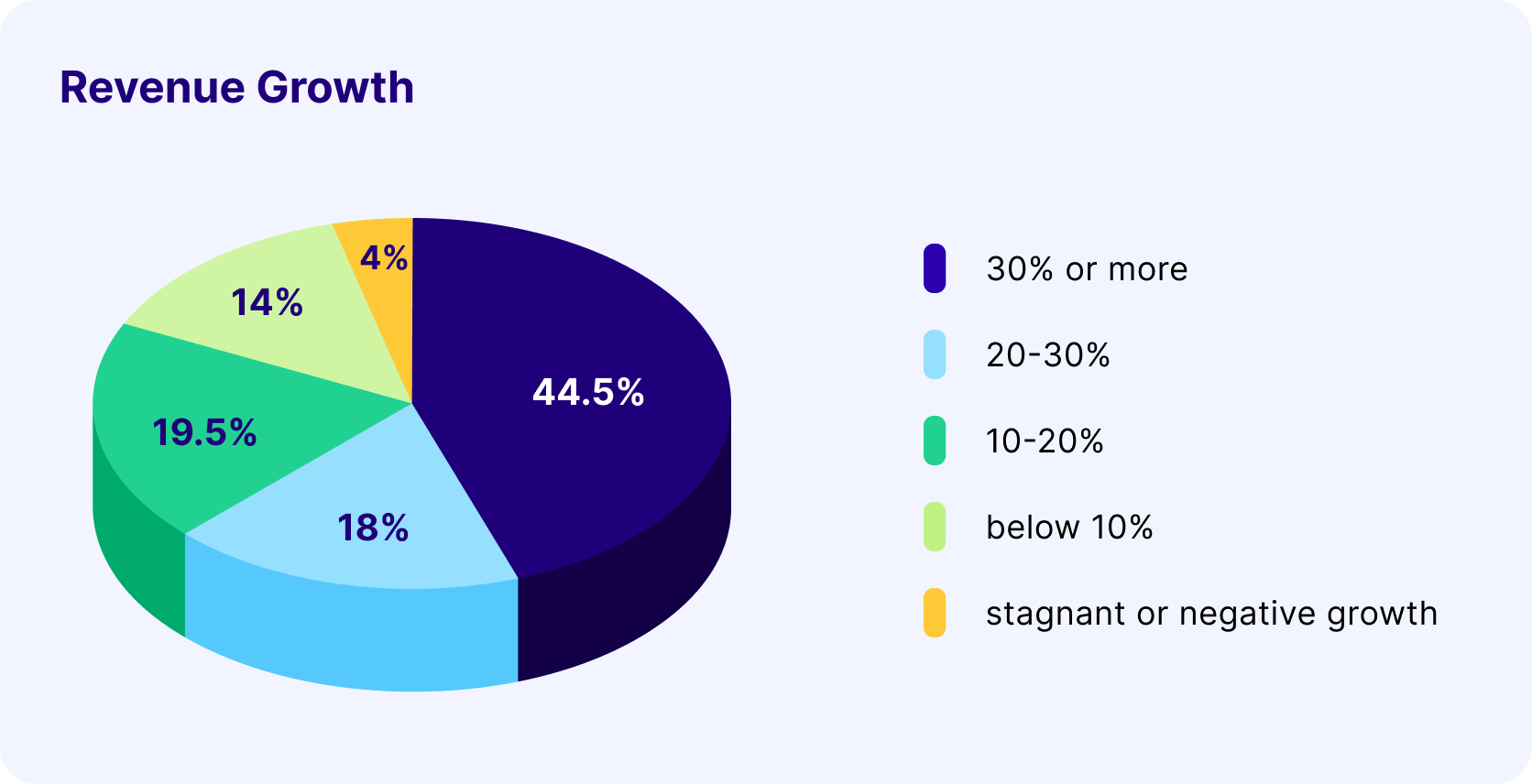

As mentioned earlier, revenue growth is another important factor in valuations. A growing agency is more likely to attract new clients, expand service offerings, and improve profitability, making it a more valuable investment.

Steady revenue growth also directly impacts EBITDA and valuation multiples. If an agency’s revenue increases while maintaining or improving profit margins, its EBITDA will rise, leading to a higher valuation.

Here’s how the respondents performed in terms of revenue growth:

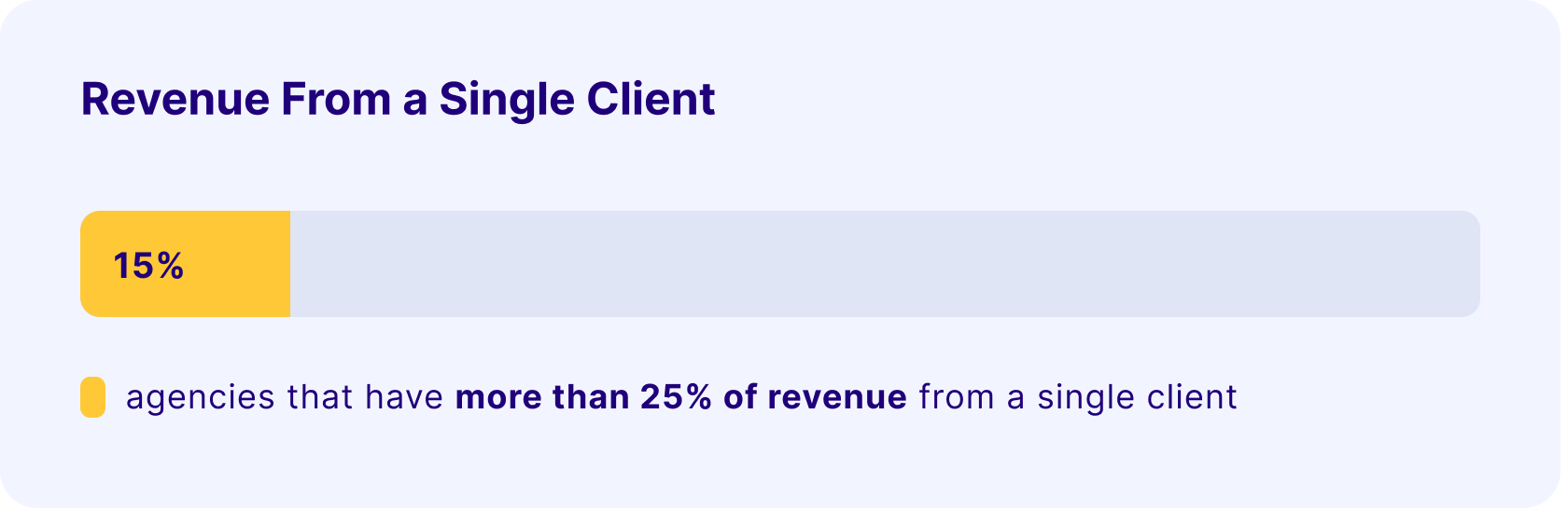

Another thing you should keep an eye out for is your agency’s client concentration. Simply put, the more clients you have, the less revenue you risk losing when a client walks out. Generally, client concentration below 25% is considered good.

Around 15% of agencies reported that they derive over 25% of their revenue from a single client, a significant drop from 2023, when 26% had over 25% of their revenue from a single client. It’s clear from this that agencies still need to work on diversifying their client portfolios to ensure financial robustness and higher valuations.

3. What Makes Agencies Attractive for M&A?

3.1 Recurring Revenue & Stability

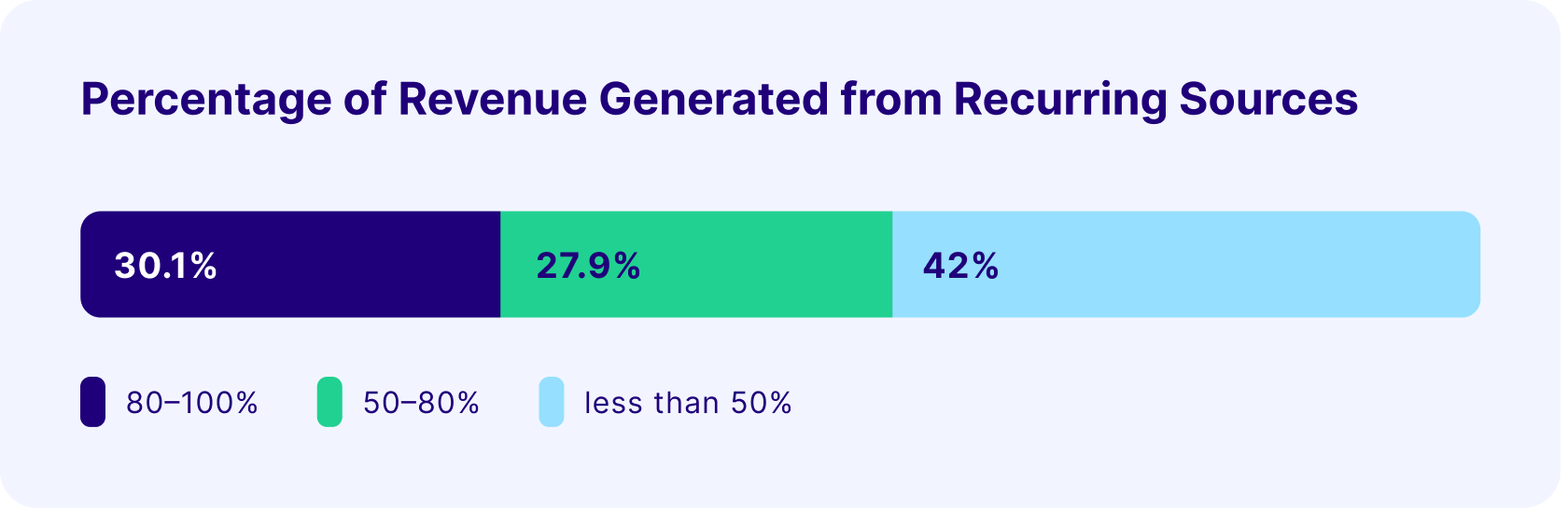

Recurring revenue plays a central role in driving agency valuations. It brings predictability, cushions against short-term market shifts, and signals long-term financial health. For buyers and investors, that kind of stability is gold.

Nearly 60% of agencies reported that over half of their annual revenue is recurring.

Higher recurring revenue doesn’t just ease cash flow—it boosts valuations.

3.2 Business Development & Management Maturity

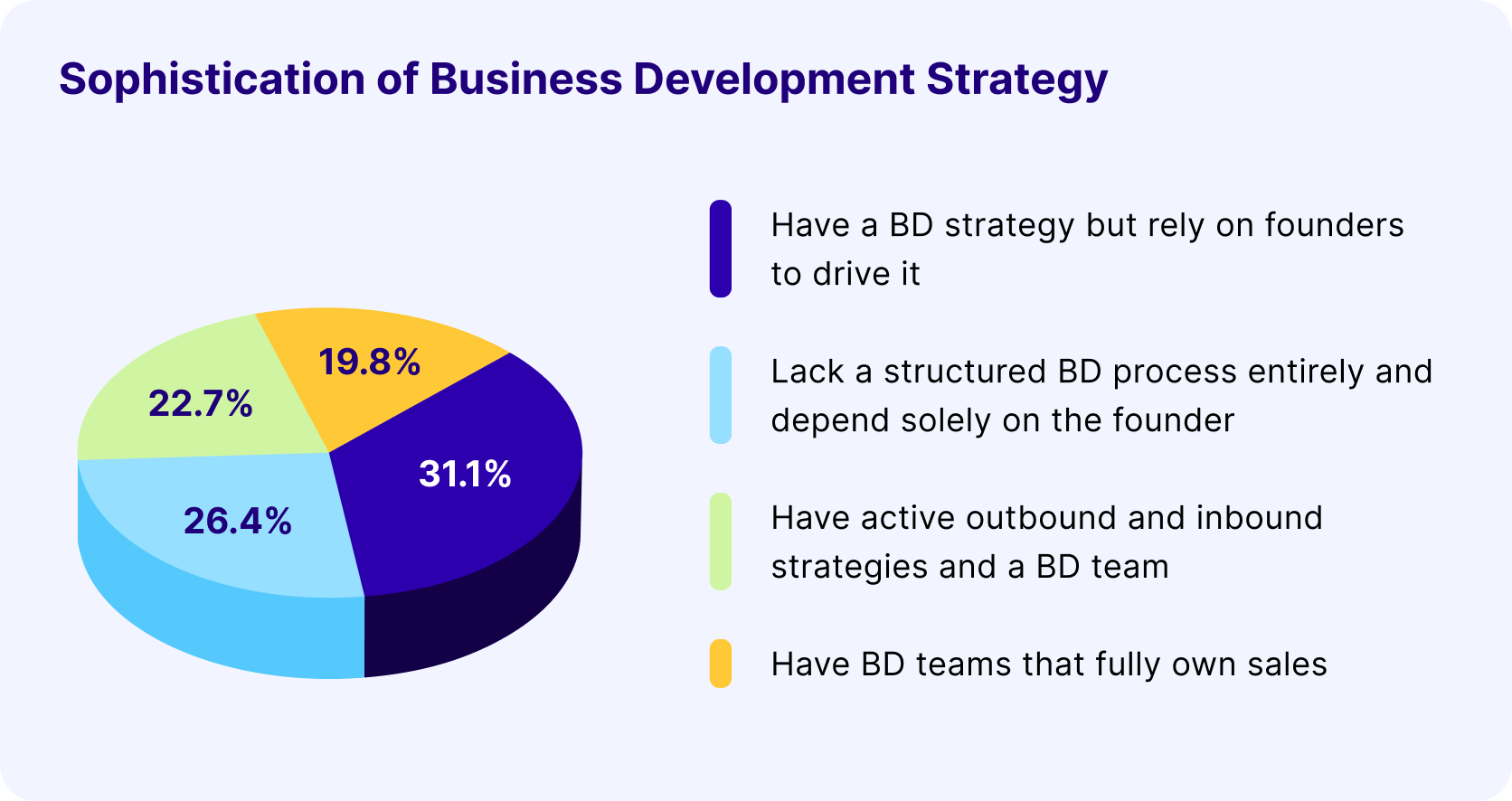

Buyers and investors don’t just look at what an agency has done. They also look at what it can do next. A strong business development (BD) strategy signals growth potential beyond current client relationships. Whether it’s outbound sales, inbound marketing, partnerships, or referrals, having a repeatable process for generating new business reduces risk.

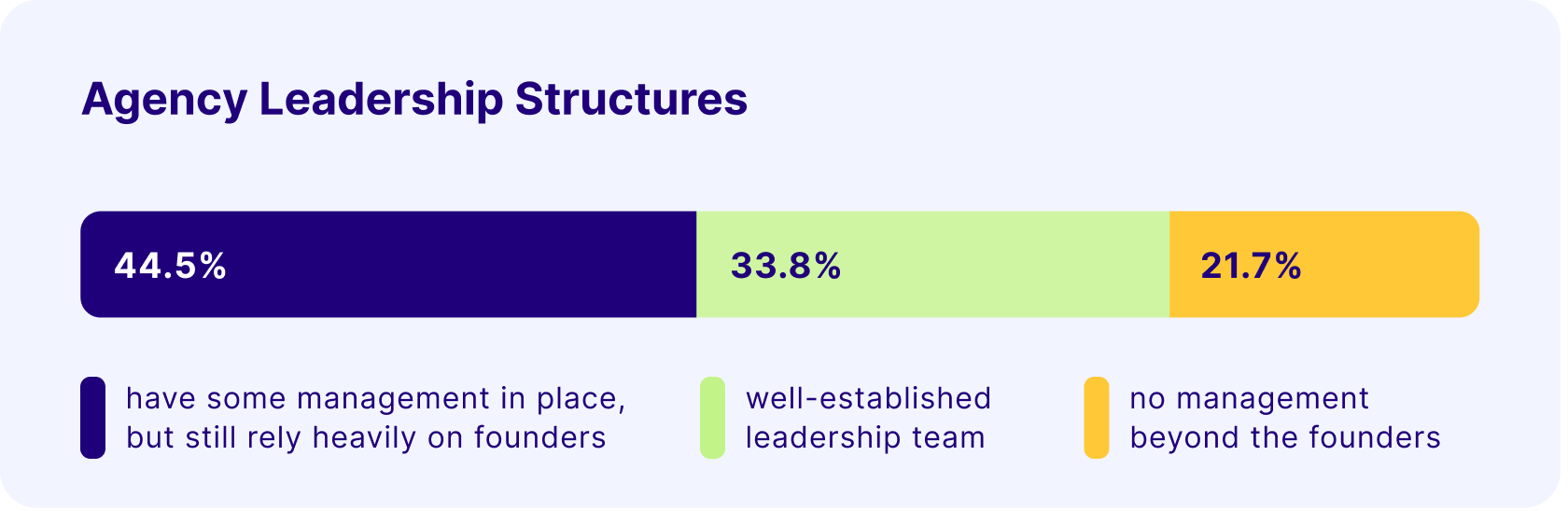

However, many agencies are still heavily founder-dependent:

Buyers prefer agencies where growth isn’t tied to one person. Founder dependence presents a risk: if the founder leaves, clients and team members might follow. Agencies that run smoothly without day-to-day founder involvement are more likely to command higher valuations.

That same thinking applies to the management structure. A mature leadership team shows that an agency can operate, grow, and retain clients independently.

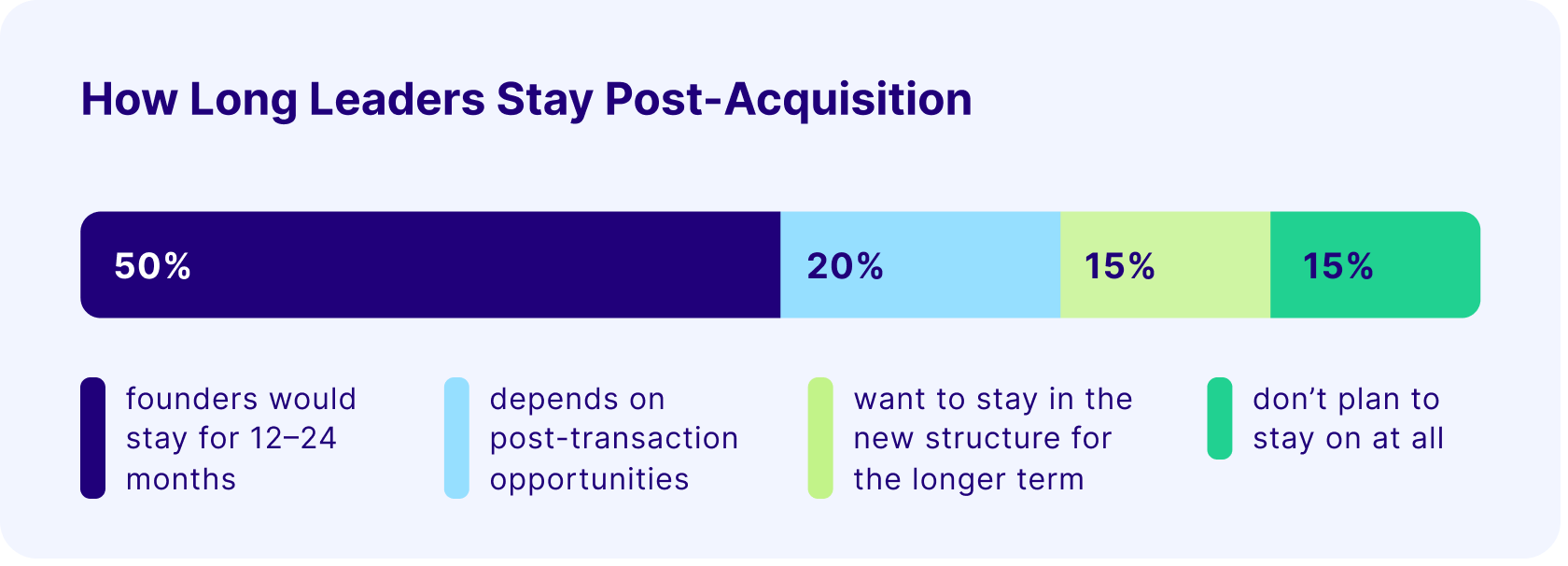

Another important factor is how long founders or leaders intend to stay in the company after the acquisition. That continuity matters for client retention, employee stability, and overall integration.

When asked about transition plans, most owners said they would stay for at least 12 months.

Earn-outs and retention incentives are common in M&A deals to mitigate risk. Not only do they encourage key people to stick around, but they also help ensure the agency remains stable through the transition.

3.3. Reputation and Brand Image

An agency’s brand and reputation are among its most valuable—but often overlooked—assets. They shape clients’ perceptions of the agency, influence buying decisions, and impact long-term business sustainability.

A strong reputation builds trust. It keeps existing clients coming back and brings in new ones through referrals and inbound interest.

Because reputation is difficult to measure, we asked agencies to estimate how well-known they think their brands are.

A recognizable brand isn’t just a marketing asset—it’s a multiplier for valuation. Investors don’t want to fix brands post-acquisition; they’d rather buy one that’s already working.

3.4 Technology & Operational Efficiency

How agencies run their day-to-day operations says a lot about how well they’re set up for long-term success.

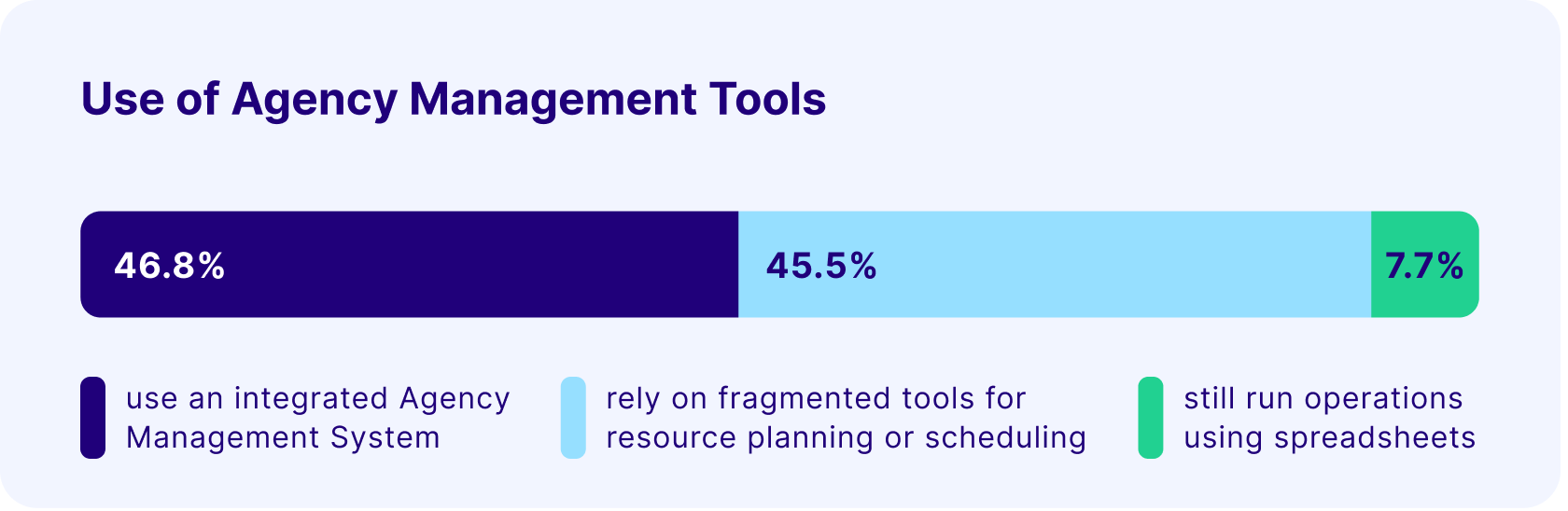

Utilizing an agency management tool helps streamline processes, enhance financial visibility, and support business growth. For buyers and investors, it shows the agency is organized, data-driven, and easier to integrate post-acquisition.

Still, not everyone is on the same page when it comes to tooling.

Having all your project, budgeting, and resourcing data in one place means you can track performance clearly, whether revenue per project, utilization rates, or overall profitability.

It also means the business isn’t relying on one or two key people to hold it all together. And when you’re thinking about selling or getting acquired, that kind of operational maturity goes a long way.

4. Top Performing Agencies: Key Takeaways

Learning from mistakes is a crucial part of any development, be it personal or professional. While analyzing the gathered data, we identified common mistakes that agencies often make. But don’t worry, we also have some recommendations for fixing them.

5. Conclusion

In 2024, agency valuations were shaped by a simple truth: the more stable and mature your business is, the more valuable it becomes.

While demand for digital services stayed strong, that alone wasn’t enough. The agencies that stood out combined profitability with steady growth, diverse client bases, and clear business development strategies.

Our data show a consistent pattern: agencies with high recurring revenue, strong leadership beyond the founder, and streamlined operations tend to command higher valuations. On the other hand, heavy founder reliance, client concentration, and a lack of structure around growth are still holding many agencies back.

The playbook for agency owners looking to boost the value of their business is clear: reduce founder dependency, invest in a capable leadership team, and focus on building predictable, profitable revenue. These foundations will drive stronger valuations and set the stage for long-term success.

Achieve Your Agency’s

True Potential

Switch from multiple tools and spreadsheets to one scalable agency management system.