Project Expense Tracking – Step-by-Step Guide, Tools & Tips

In project management, seeing where all expenses go is the difference between staying on budget and explaining overruns.

This guide explains what project expense tracking is, shows why it matters, and introduces forecasting and the common roadblocks.

You will also receive a step-by-step guide, best practices, and the tools you should use to manage your project financials.

Key Takeaways

- Make spending visible by category: project expense tracking shows where money goes and, paired with forecasting, keeps budgets on course.

- Forecast early and often: use budget vs actuals and burn rate to see total cost estimates in time to adjust.

- Follow proven practices and avoid common traps: set expense budget limits and alerts, maintain shared definitions with stakeholders, and watch for missing receipts, multi-entity coding, and thin reporting.

- Use the right PSA software: real-time tracking, flexible reporting, forecasting, and accounting integrations keep data trustworthy without extra admin.

What Is Project Expense Tracking?

Project expense tracking is simply keeping a clear record of every project‑related out‑of‑pocket cost and where it belongs. It sits at the heart of project budget management, because it turns everyday spending into clear figures you can use for decisions.

Once expenses are approved, they sit in your expense log as actuals. Actuals are the amounts already spent on the project. They feed budget vs actuals reports, forecasts, and billing.

Budget vs actuals is the comparison between your project budget (the plan) and your actuals (what has happened so far). When that picture is clear, it is easier to explain where the budget went and to agree on next steps.

The next step is to get familiar with the main types of project expenses you will run into in everyday project work.

What Are the Different Types of Project Expenses?

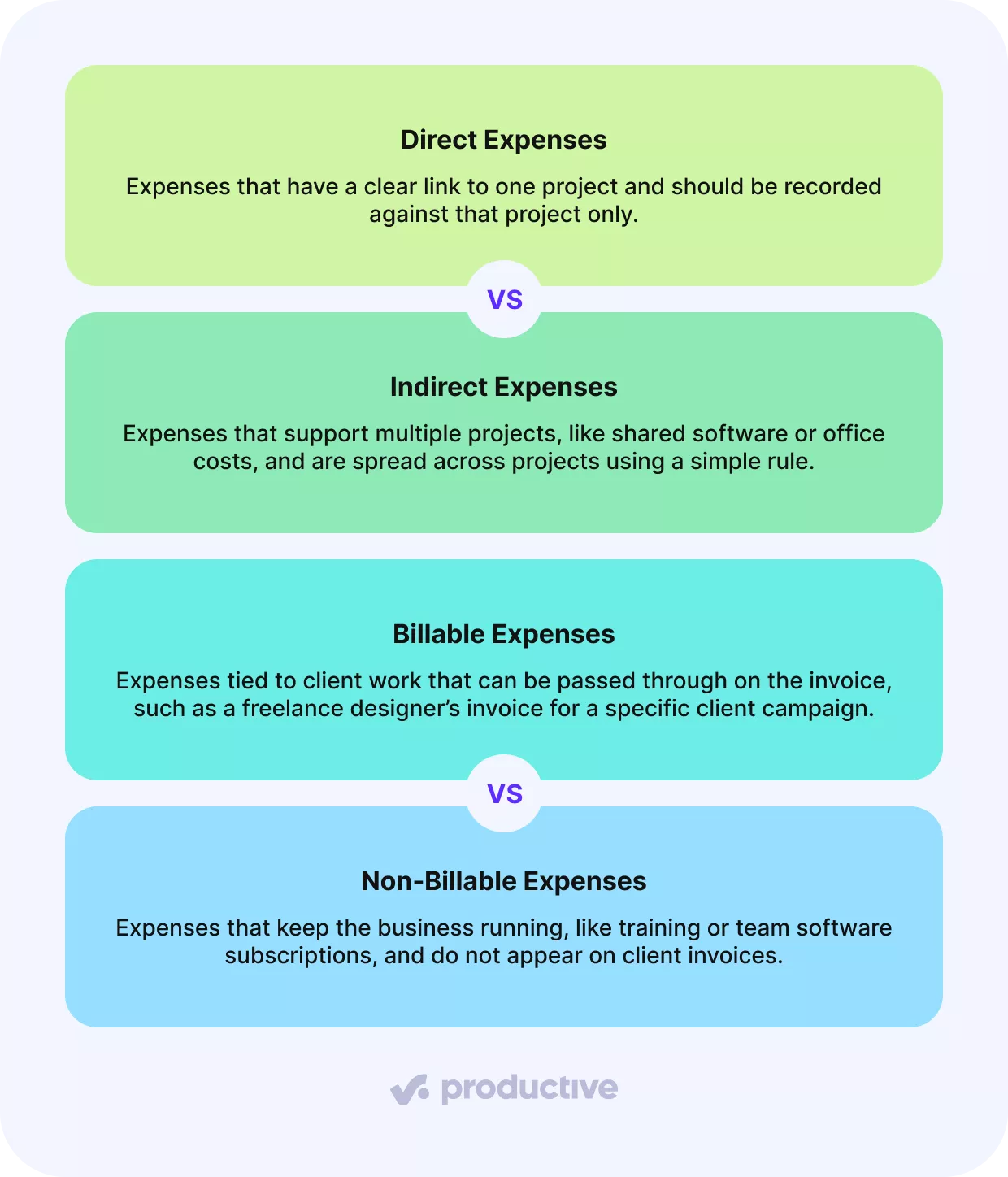

The main types of project expenses are direct, indirect, billable, and non‑billable expenses.

In the next part, each type is unpacked to make clear how they differ in everyday project work.

Direct vs Indirect Expenses

Direct expenses are costs that clearly belong to one project, such as a freelancer’s invoice or stock images bought for a single campaign.

Indirect expenses are shared costs that support multiple projects. Common examples include a team design tool subscription, a shared stock‑asset library, or office internet.

Billable vs Non‑Billable Expenses

Billable expenses are costs that can be charged back to the client as part of a project invoice. They are directly linked to client work and form part of the project’s revenue. A typical example in professional services is a freelance designer’s invoice for a client campaign that is passed through to the client, sometimes with a markup.

Non‑billable expenses are costs the business pays for but cannot charge to any client. They support internal work or operations and do not appear on client invoices. Common examples include training budgets, internal team events, or shared software subscriptions used across multiple clients.

Why Is Expense Tracking Important?

Expense tracking is important because it is the only way to see, in time, whether day to day spending still matches the project budget.

Think about a design agency running a fixed fee website project. The team pays a UX freelancer and buys several software add ons for the client, but these expenses only get logged once the work is nearly finished. For most of the project the budget looks healthy; once everything is finally entered, it becomes obvious that the profit margin is far lower than expected.

In practice, reliable expense tracking:

- Makes spending visible by category and over time.

- Gives early warnings in budget vs actuals, so you can adjust scope, timing, or staffing while there is still room to move.

- Keeps reports consistent across tools, so project leads, finance, and clients talk about the same numbers instead of reconciling different versions.

Now that the benefits are clear, the next piece is expense forecasting: estimating what will be spent and when.

What Is Expense Forecasting?

Expense forecasting is the process of estimating future project spending by looking at what has already been approved and the current pace of spending.

It shows whether a project is likely to finish within the project budget, when larger cash outflows will happen, and how today’s pace changes the final project cost.

Forecasting Basics and Burn Rate

Burn rate is the average amount spent per period, usually per week or month. In forecasting, burn rate indicates how long the remaining budget is likely to last and serves as a simple check on whether the forecast is reasonable.

A simple forecast comes from answering three questions:

- What has been spent already?

- What has already been committed?

- What will it take to finish the remaining work?

When team members want to test different scenarios without rebuilding spreadsheets, Productive’s Scenario Builder lets them model outcomes side by side using current data on the project budget, revenue, costs, and margins.

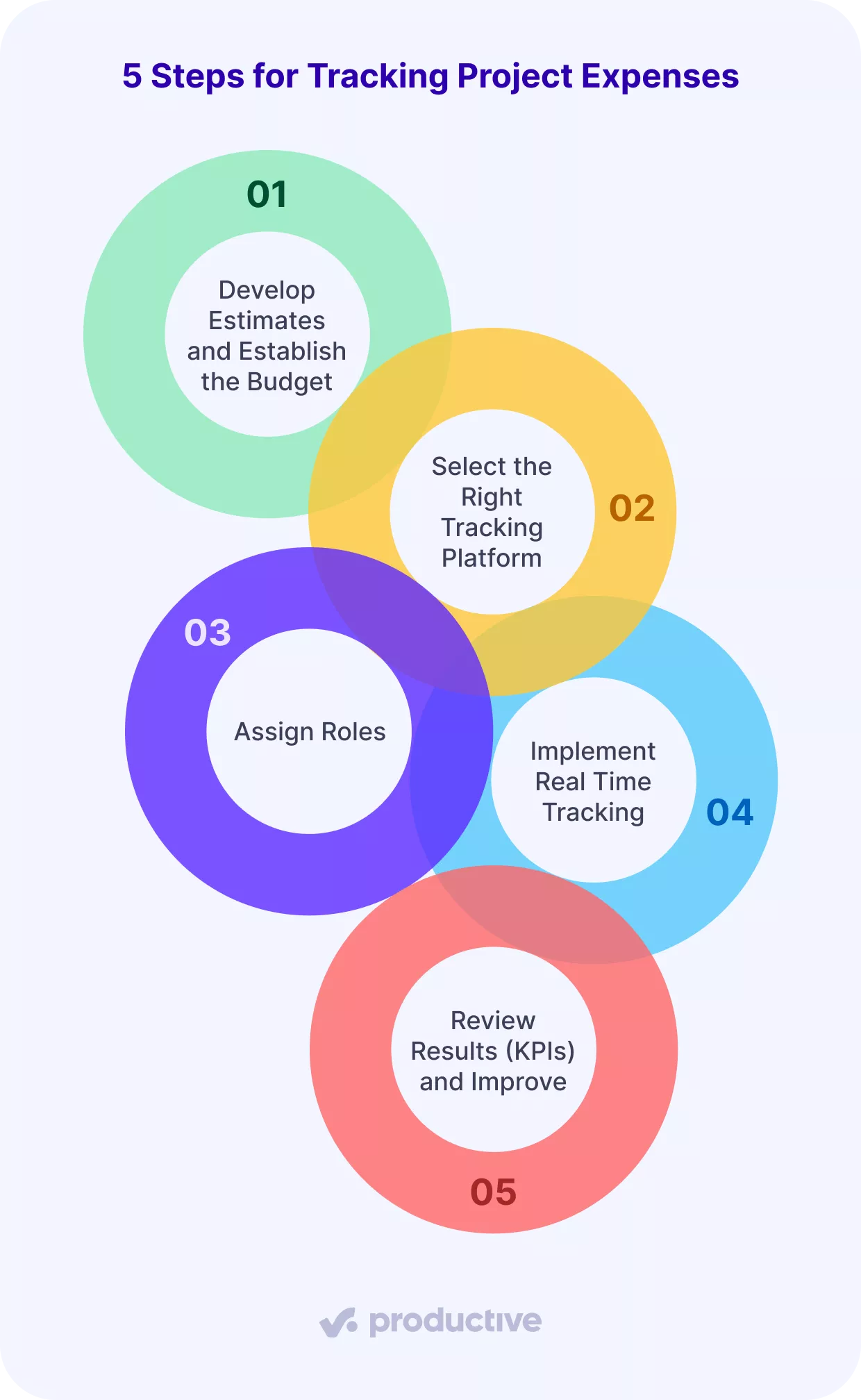

How Do You Track Project Expenses? (+ Step-by-Step Process)

You track project expenses by developing estimates and establishing the budget, selecting a tracking platform, assigning roles, implementing real-time tracking, and reviewing results to improve future projects. The sections that follow walk through each step in more detail.

Step 1: Develop Estimates and Establish the Budget

Start with a basic view of what you expect to spend. Group the plan into a few clear categories such as labor, software and subscriptions, travel, equipment or rentals, and subcontractors.

Why this matters: weak estimating is a common source of budget overruns. In a BCG survey of global C‑suite executives, nearly half said more than 30% of their technology development projects were over budget and late.

Solid estimates and a clear baseline reduce this risk and make gaps easier to spot. Turn those estimates into a budget by category and, if useful, by phase or month.

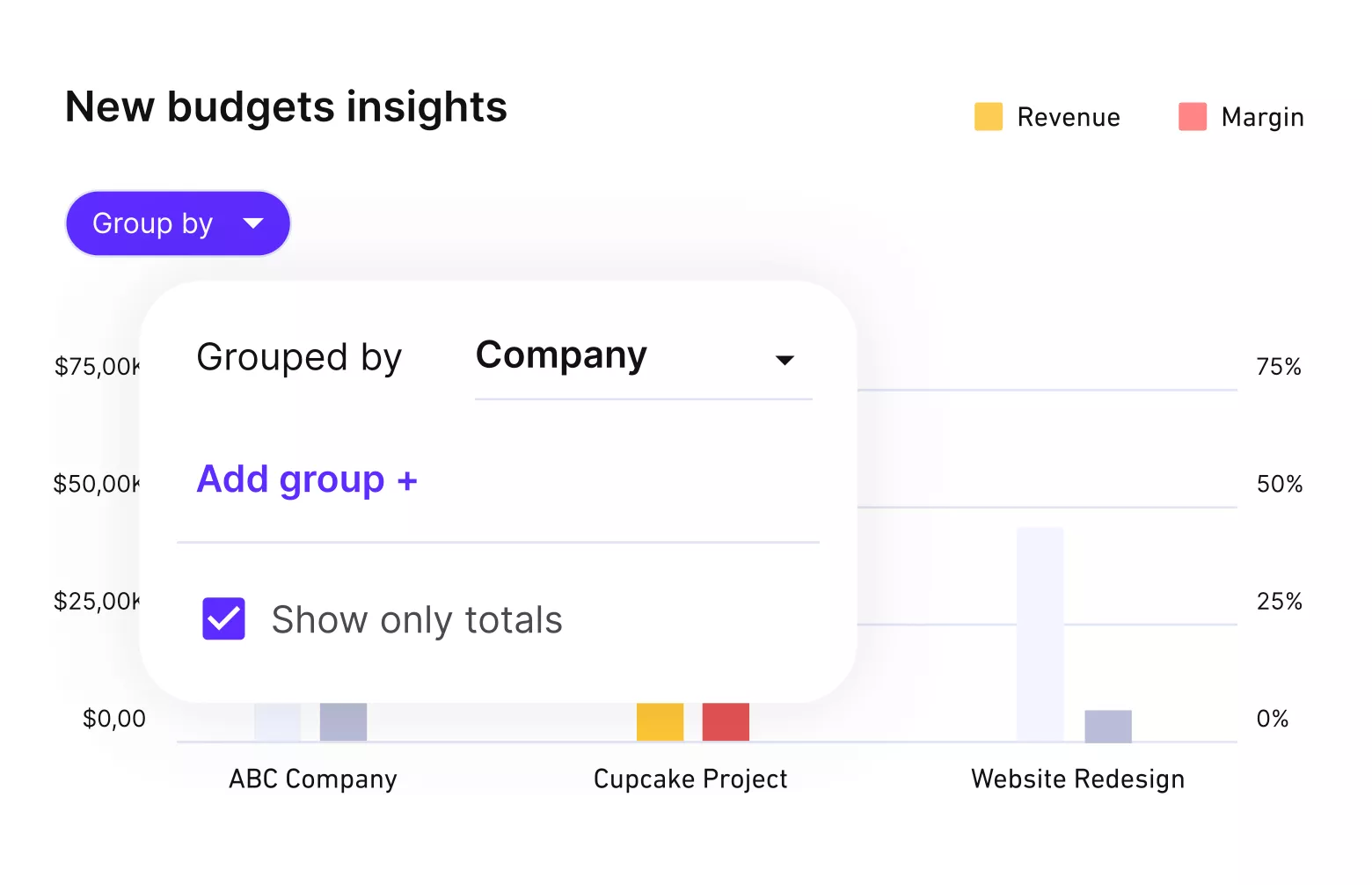

Project management tools like Productive enable expense tracking at the project level, allowing you to set expense budgets, monitor spending against budgeted amounts, and organize expenses using custom categories.

ORGANIZE YOUR BUDGET INSIGHTS BY COMPANY, PROJECT, OR CUSTOM FIELD.

Step 2: Select the Right Tracking Platform

Choose one place where expenses are recorded and where you can see budget vs actuals. The platform should make it easy to categorize items, attach proofs, and connect with accounting.

If purchase orders are used, keep them in the same place so everything related to spending stays together. This article covers tool options in more detail later.

Step 3: Assign Roles

Spell out the core roles so everyone knows their part:

- Team members: record expenses for their project work.

- Approvers (project leads): check that entries are legitimate, coded correctly, and within limits.

- Project manager/budget owner: watches budget vs actuals and highlights trends.

- Finance / AP: reconciles entries, handles taxes, and posts to accounting.

Clear ownership keeps tracking smooth and avoids bottlenecks.

Step 4: Implement Real-Time Tracking

Real‑time tracking matters because if expenses are logged days or weeks later, people forget what they spent, and slight delays pile up at month’s end.

Recording expenses promptly ensures data is fresh, keeps approvals moving, and gives project managers a current view of budget use, which helps with early course corrections rather than end‑of‑month firefighting.

Modern project cost management software like Productive provides real‑time visibility into budget usage, helping managers spot overspending early.

The truth is, we can quickly get a pulse for where we are, at any given time. One way to get a pulse on the business is to get the monthly financials, but for the monthly financials to come in, it takes the accounting department about 15 days after the month ends before we get a picture of how we really did that month. Whereas, with the financial tools that Productive offers, you can check it on a daily basis. We have clear visibility at any given time.

For teams, that level of visibility means they do not have to wait for month end reports to understand how projects are performing day by day.

Manage your expenses in real time with Productive

Step 5: Review Results (KPIs) and Improve

Look at a set of KPIs to understand how the project is progressing:

- Profit margin by client

- Earned value

- Cost performance index (CPI)

- Schedule performance index (SPI)

These signals are the heartbeat of cost tracking and feed project cost reporting and billing. When these KPIs are reviewed regularly, patterns become clearer, and each budgeting cycle becomes easier to improve.

What Are the Best Practices for Project Cost Tracking?

The best practices for tracking project expenses are setting expense budget limits and alerts, maintaining clear and transparent communication, and integrating your expense tracker with accounting systems.

The sections below walk through each of these in more detail.

Set Up Expense Budget Limits and Alerts

Expense budget limits are specific spending limits set by project or by category.

Alerts provide an early heads-up before a limit is crossed, so teams can adjust calmly rather than make last-minute cuts. This is especially helpful for fixed-price work with strict expense caps.

In day-to-day use, this works best when the tracking software supports separate expense budgets, sends approaching limit alerts to the right people, and applies category-level limits so plan and actuals line up.

Maintain Clear and Transparent Communication

Transparent communication means clients and stakeholders see the same picture of spending and progress. When stakeholders share the exact numbers, conversations are shorter and decisions stay grounded.

A straightforward way to strengthen client communication is to use the right project management software, which lets clients view task progress and leave comments on specific deliverables.

Integrate with Accounting Systems

Accounting integrations eliminate double entry, maintain tax and currency consistency, and align project actuals with the general ledger. The result is aligned reports, improved cost tracking across tools, and a faster month-end close with a clean audit trail.

What Are the Common Challenges in Cost Tracking?

Common challenges in tracking project expenses include missing receipt documentation, multi‑entity and intercompany expense tracking, and inadequate expense reporting.

The sections below walk through each challenge in more detail and offer practical recommendations for solving them.

Missing Receipt Documentation

Receipts matter because they prove who was paid, what for, and when. They back up client invoices and keep tax records clean.

A complete receipt shows who, what, when, amount, currency, and tax. Expenses submitted without the correct documentation create problems for client billing, tax compliance, and audit requirements.

Make sure the tools you use support uploading receipts directly to expense entries and provide an audit trail of all expense modifications.

Multi‑Entity and Intercompany Expense Tracking

Organizations with multiple subsidiaries often struggle to maintain a clear picture of shared costs. Expenses have to be split across entities, intercompany charges need to land in the right place, and leadership still expects a single, reliable consolidated view.

The right project management software makes this much easier. Look for tools that:

- Support multi‑company expense tracking

- Handle intercompany billing workflows

- Provide consolidated reporting across subsidiaries

Inadequate Expense Reporting

When reporting is thin, everyone ends up with a different picture of how a project is performing. Clients usually need a clear summary with the key numbers and supporting evidence attached. In contrast, project managers need real‑time views that show trends by category and by phase or month, including billable vs. non‑billable splits.

Utilize software with flexible custom report builders so each stakeholder can get the expense views they need.

In Productive, reports can be tailored in a few clicks using the same up-to-date project financial data, with flexible date ranges for different reporting periods.

We can pull up data really quickly now, tailor it to our needs, and create all kinds of reports in a fraction of the time compared to before.

This means spending less time assembling spreadsheets and more time using insights to steer project management.

CUSTOMIZE YOUR REPORTS WITH PRODUCTIVE TO FIT YOUR ANALYSIS.

What Are the Best Tools for Project Expense Tracking?

The best tools for project expense tracking are all-in-one, budget management, and accounting tools. Together, they help you record expenses, keep budgets and actuals in one place, and pass clean data to finance.

In this section, each group is explained with a simple tool example so you can see where it fits into your own setup.

All-In-One Tools

All-in-one tools bring project management, budgeting, time tracking, and expense tracking into a single system.

A good example is Productive, an all‑in‑one PSA built for services teams. It tackles common issues such as disconnected data, limited visibility into profitability, and inefficient project tracking.

Users get comprehensive budget management, with real-time insight into billable hours and project costs. The integrated platform reduces manual work and spreadsheet use while providing reliable financial reporting to support better decision-making.

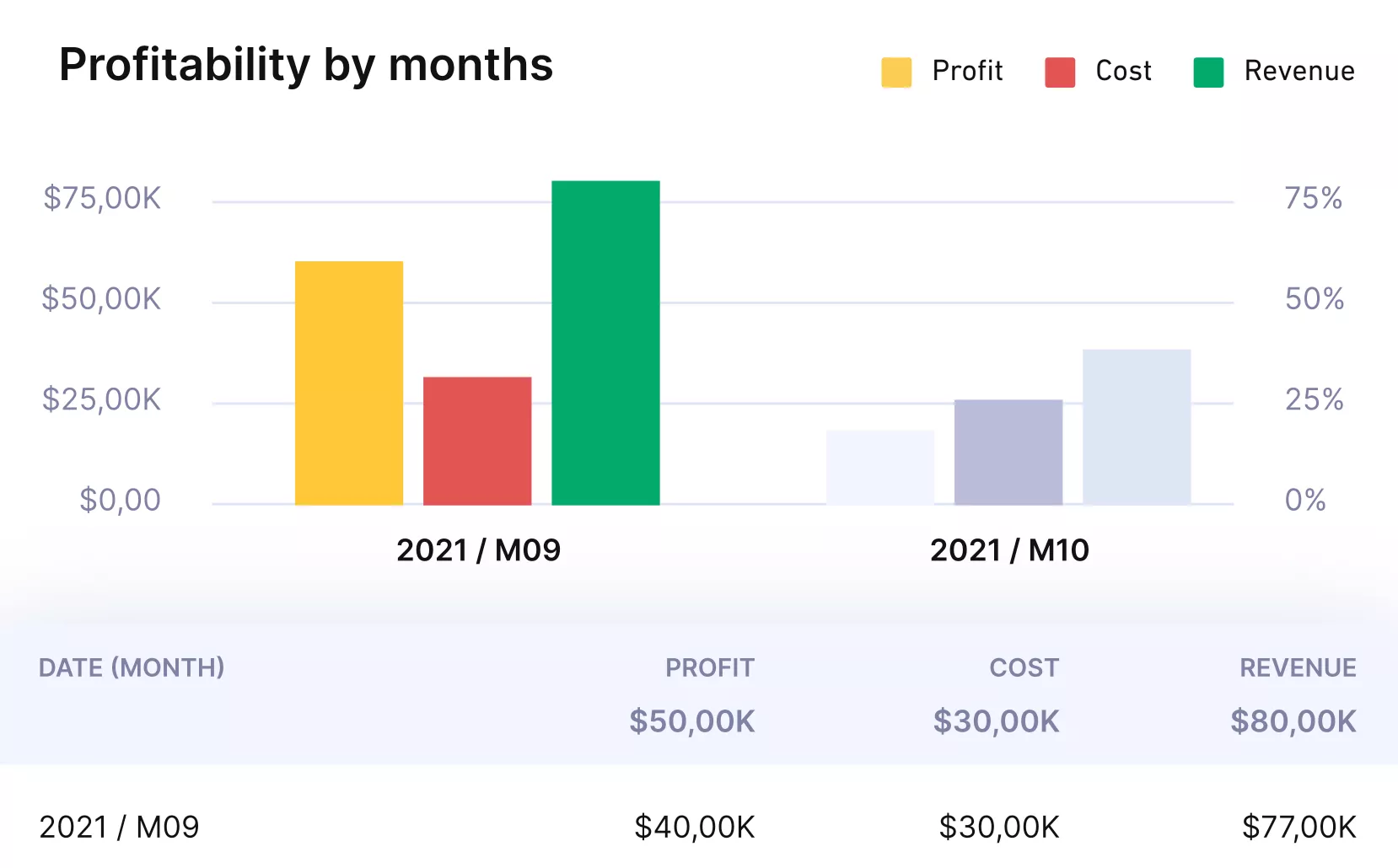

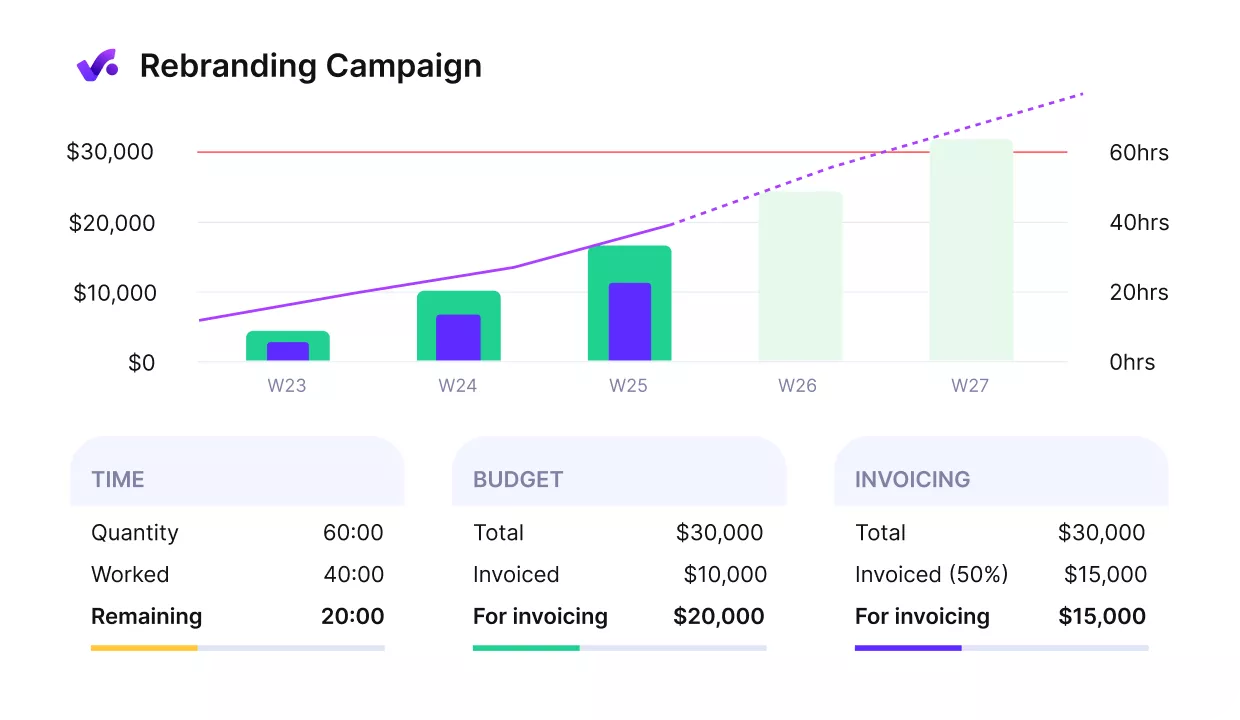

With Productive’s accurate forecasting, teams see future project revenue, budget burn, and profit margin in real time as each project progresses. When resource scheduling or timelines change, financial metrics update instantly, giving clear visibility into project health.

USE PRODUCTIVE’S FORECASTING TO SEE HOW COSTS, TIME, AND REVENUE WILL EVOLVE.

Productive additionally provides:

- Project Management

- Time Tracking

- Resource Planning

- Automations

- Docs

- Sales CRM

Productive is a solid fit for teams that want to bring budgets and workflows into one place. With everything running on a single platform, it is easier to keep a clear, up-to-date picture of projects, resources, and financials.

Budget Management Tools

Budget management tools focus on planning and monitoring spend across projects. They are helpful when teams already have an accounting system in place but need a more flexible way to structure project budgets, timelines, and responsibilities.

Smartsheet is a well-known example in this category. It is a work management platform with straightforward project budget management. Reviewers highlight its user-friendly interface and strong collaboration.

It includes native time tracking, resource planning and team scheduling, expense management through project budget templates, and built-in charts for visualizing results.

Accounting Tools

Accounting tools focus on the general ledger, compliance, and financial statements. They are essential for bank feeds, tax handling, and official reporting, and often provide a basic view of project income and expenses.

QuickBooks is a common choice for smaller businesses that need strong accounting. It streamlines the accounting side of project budgeting with linked bank feeds for automatic transactions, custom invoice creation, and project dashboards that track income and expenses.

Because it runs in the cloud, teams can view real-time financial data from anywhere.

To see a wider comparison and review more available tools, explore our budget management software list.

Tool Feature Checklist

Use this quick checklist when you compare tools

- Real-time tracking

- Custom reports & KPI dashboards

- Accounting system integration

- Multi-entity expense tracking

- Accurate forecasting & scenario planning

Choose a tool that ticks these boxes and fits your workflow, so project cost tracking stays accurate.

Final Thoughts On Tracking Project Expenses

Tracking project expenses matters because it shows where money goes, keeps projects on budget, and gives teams a shared view of what is really happening.

All-in-one tools make this process easier because expenses, budgets, time, and billing are all in one place. You see actuals update as work is delivered, use the same data for forecasts, and set budget alerts before projects drift over agreed limits.

If you want that kind of visibility in one platform, book a demo with Productive.

Get complete control of your expenses in one place

Use Productive to see actuals update in real time, forecast with confidence, keep accounting in sync, and review results with custom reports or prebuilt templates.