Milestone Revenue Recognition Guide (2026) – Method & Tips

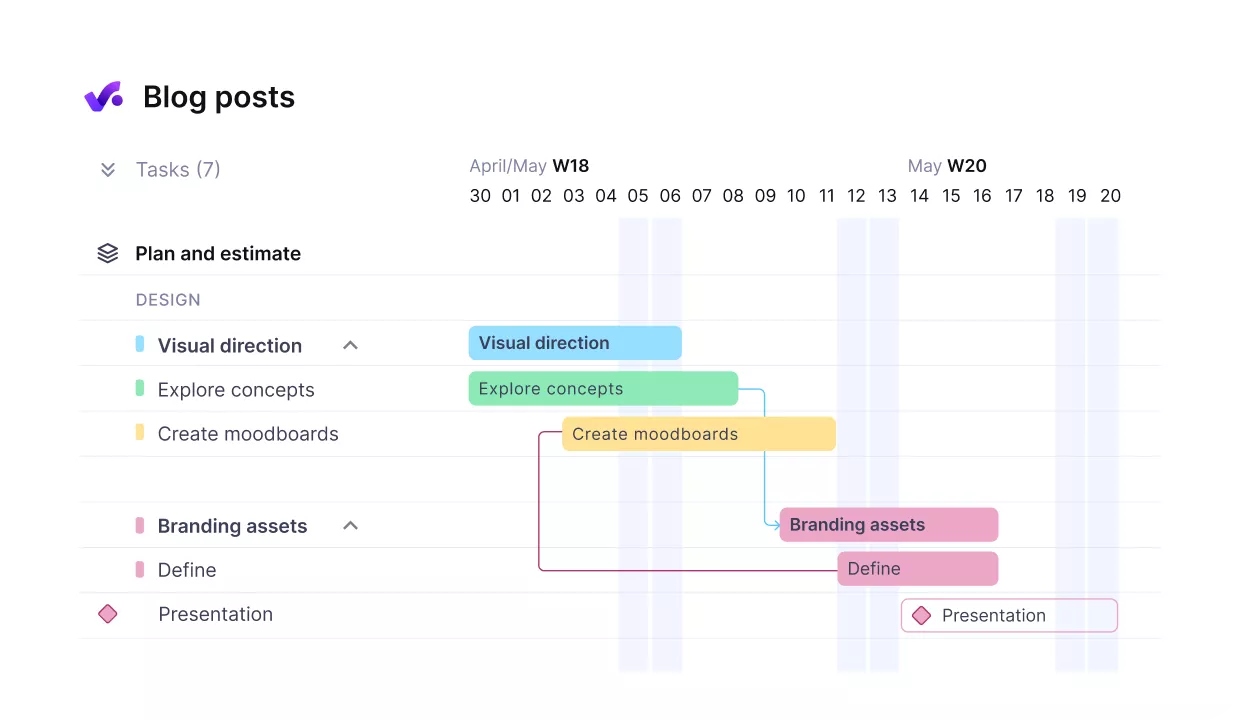

If you manage fixed-fee client projects, you likely break larger work into clear steps or milestones and track progress along the way.

Milestone revenue recognition ensures your revenue aligns with the actual work delivered and approved by your client, following the same milestones.

This guide covers how milestone revenue recognition works, the difference between billing and revenue recognition, best practices for smooth implementation, and how this method compares to other standard approaches.

Key Takeaways

- Tie milestones to clear outcomes: write simple acceptance rules, name the client approver, and agree on what counts as proof that a milestone is complete.

- Automate invoice draft creation: for predictable schedules, set up automations so draft invoices are created on time.

- Connect your PSA software to your accounting system: integrate milestone billing with your accounting software so invoices flow through a single pipeline rather than through manual copy-pasting.

- Match the method to the type of contract work: use the milestone method for projects that progress through clear phases with approvals, and use the percentage completion method for work that delivers value continuously.

What is Milestone Revenue Recognition?

Milestone revenue recognition is a method of tracking revenue in which you record a portion of the project fee each time a defined milestone is completed and approved by the client, rather than only when the entire project is finished.

Revenue recognition here is simply the rule for when you can treat income as earned in your books.

Professional services teams occasionally use the milestone method because it matches how they already plan work in phases and keeps financial reporting closer to reality, since revenue only moves when real progress has been made.

From an accounting perspective, each project milestone is simply a clear promise you made to the client.

USE PRODUCTIVE TO BREAK PROJECTS INTO CLEAR PHASES AND MILESTONES.

Picture a website project split into three contract milestones: discovery and UX, build, and launch, each one being treated as its own performance obligation.

You recognize a chunk of revenue when the discovery phase is completed and approved, another when the build is approved, and the final chunk when the site goes live and the launch milestone is accepted.

How Does Revenue Recognition Work in the Milestone Method?

Revenue recognition works in the milestone method by treating each accepted milestone as the moment you record that part of the project fee as earned revenue, because the related performance obligation has been satisfied.

Accounting principles such as ASC 606 (Accounting Standards Codification) and IFRS 15 (International Financial Reporting Standards) say revenue can be recognised when you have delivered what you promised and the client can genuinely use it.

Behind this method is a standard five-step revenue recognition process that financial management teams use to stay consistent. Let’s look at those steps next.

The 5 Steps of Revenue Recognition

Accountants often use a five-step revenue recognition model from the current accounting standards. Following the version explained in an ACCA article on IFRS 15, the steps are as follows:

1. Identify the contract: This is your signed financial statement of work (SOW) or master services agreement (MSA).

2. Identify separate performance obligations: These are the main milestones in the contract phases.

3. Determine the transaction price: Decide the total amount the client will pay for the promised work.

4. Allocate the transaction price to performance obligations: Split that total across your contract milestones.

5. Recognise revenue when each performance obligation is satisfied: Recognise the portion linked to a phase when the client confirms that the milestone is complete.

With these steps in mind, let’s look at how milestone billing and milestone revenue recognition differ.

Milestone Billing vs Milestone Revenue Recognition

Milestone billing aligns with your project plan and drives cash flow, while recognising revenue follows delivery and client sign-off, so financial reporting reflects what has actually been earned.

To make the difference clear, here is how they compare side by side:

| Dimension | Milestone Billing | Milestone Revenue Recognition |

|---|---|---|

| Purpose | To generate a request for payment from the customer | To determine when revenue is earned and can be recorded |

| Trigger | Planned checkpoint or invoice date | Acceptance of the milestone or clear proof of delivery |

| Timing | Often occurs before or after the value is fully transferred | Must occur only when the value of the completed work is transferred to the customer |

The simple takeaway is that milestone billing is there to manage cash flow and client expectations, while milestone revenue recognition is there to show how much of the fee you have truly earned at each stage of the project.

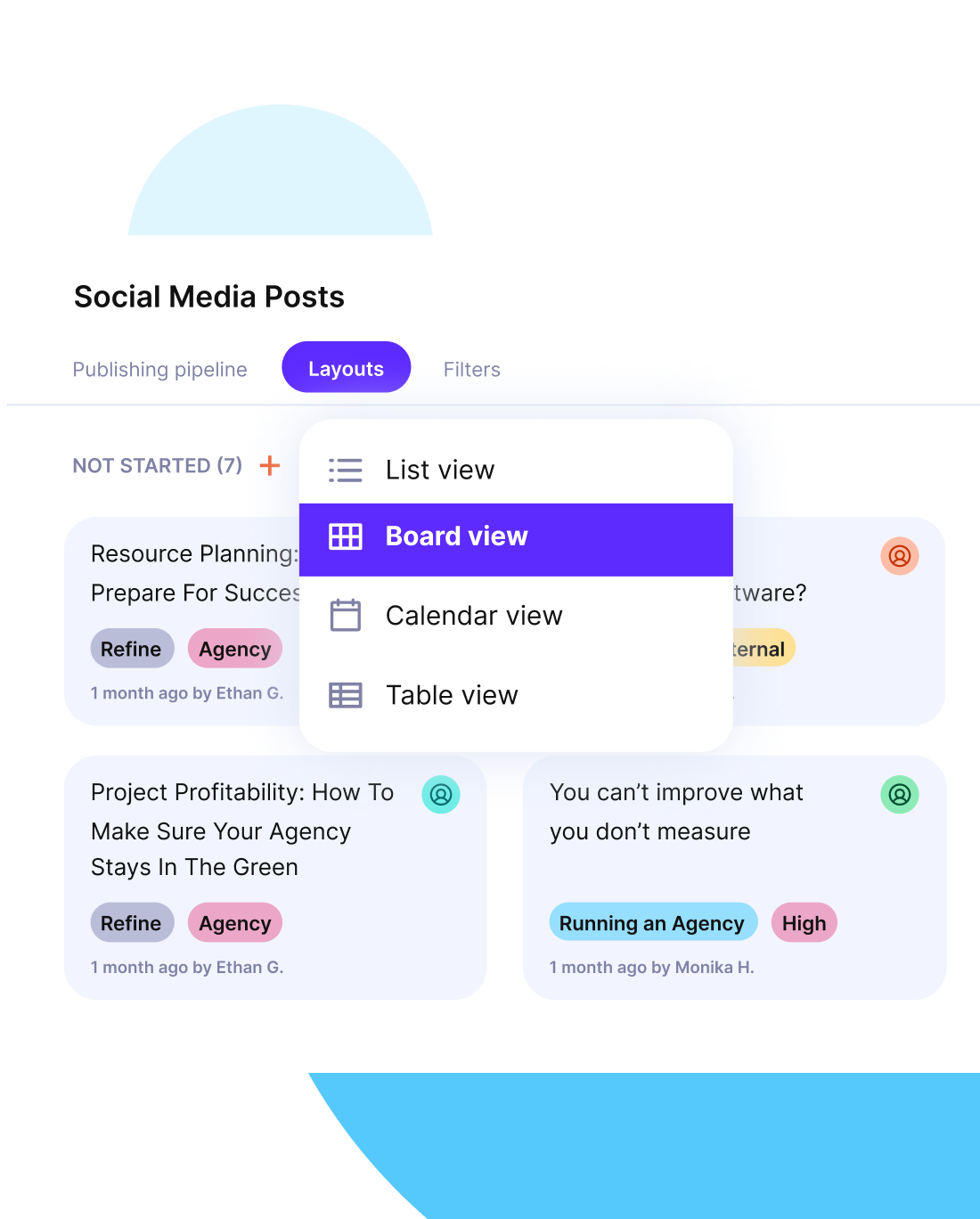

With Productive, you handle the invoicing side by setting up milestone billing: either by scheduling draft invoices against a single budget or by creating one budget per milestone, then raising those invoices in a few clicks when each phase is due.

How and when you recognise revenue still comes from the revenue recognition rules you and your finance team apply in your accounting tools.

Now, when we deliver a project, we just create an invoice in the app, send it, and then close the project. No extra time needed.

What Are the Best Practices for the Milestone Method?

The best practices for the milestone method are to write specific acceptance rules, automate invoice draft creation, and integrate milestone billing with your accounting system.

In the sections below, we will walk through each one in more detail.

Best Practice 1: Write Specific Acceptance Rules

Treat each milestone as a small agreement that includes a detailed description of performance obligations, a named approver on the client side, and a simple form of evidence.

When scope changes, you revisit that list, adjust the project milestones and amounts, and make sure everyone is working from the same updated picture.

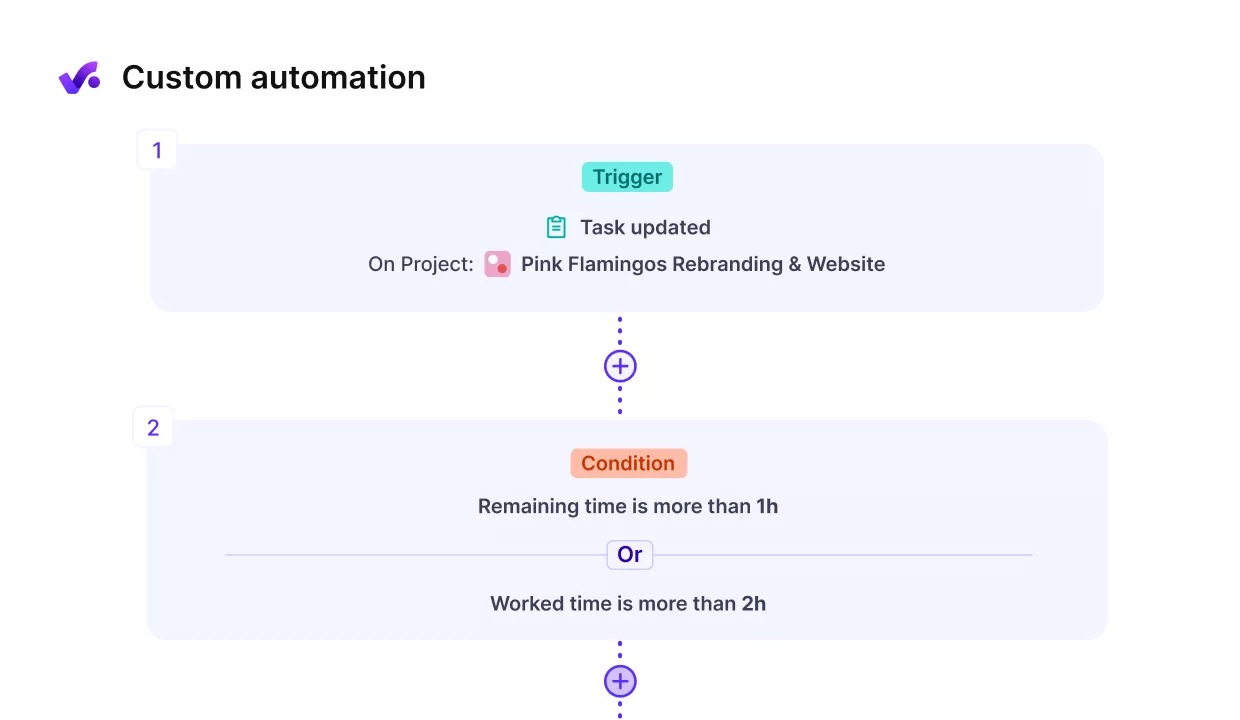

Best Practice 2: Automate Invoice Draft Creation

Repeating consistent invoices usually turns into a lot of manual copy-pasting and date-chasing that a simple rule could handle.

Once you have set up milestone billing in Productive, you can reduce manual invoicing work by automating draft invoice creation.

USE PRODUCTIVE TO CUT MANUAL ADMIN WITH AUTOMATIONS.

Suppose your billing schedule follows a predictable pattern, such as monthly phases or post-delivery billing. In that case, you can use the automation step to generate invoice drafts automatically and notify the account manager or finance owner via Slack for review.

Automate your invoicing in Productive

Best Practice 3: Integrate Milestone Billing With Your Accounting System

Even with clean milestones, things quickly get messy if your project tool and your accounting system live separate lives.

Connecting your PSA to your accounting tool keeps invoiced revenue in a single pipeline rather than in spreadsheets.

Productive integrates with Xero and QuickBooks, so invoices you create from milestone billing can be sent to your accounting system in a few clicks instead of being rebuilt from scratch. Your accounting system then applies your rules for recognising revenue, while Productive stays focused on creating and syncing accurate invoices.

If you want to compare tools for this setup, take a look at our project accounting software list for a deeper dive into popular options.

How Does the Milestone Method Compare to Other Project Management Methods?

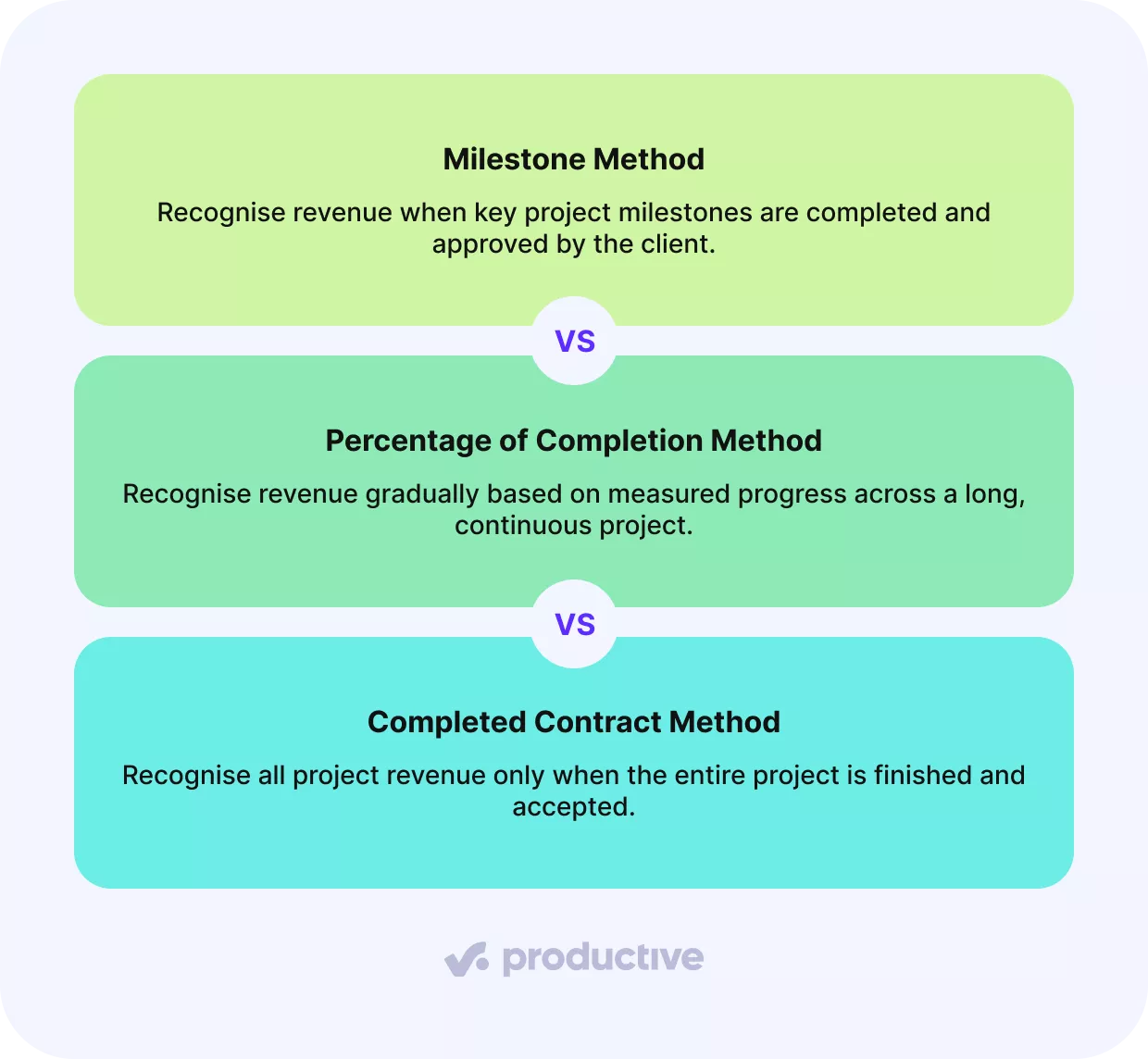

The milestone method differs from other methods because it recognises revenue at specific accepted project milestones. In contrast, other methods either spread revenue over time or wait until the entire project is complete.

To see which type of project it fits, it helps to compare it with two other common revenue recognition standards.

- Percentage of completion method: You recognise revenue gradually as work progresses, often using a percentage of completion measure to decide how much is earned in each period. This suits long-running, continuous projects where value builds steadily, such as large implementation programs or ongoing service contracts.

- Completed contract method: You recognise revenue only when the whole project is finished and delivered. The completed contract method is usually used for short or very uncertain projects where progress is hard to measure.

Suppose your projects already run in clear project phases with formal approvals. In that case, the milestone method often feels like the most natural fit, because it mirrors how your team and clients already think about progress and earned revenue.

Final Thoughts

Milestone revenue recognition is about matching revenue to clear project milestones that you and your client agree on.

In practical terms, it helps to write specific acceptance rules and update them when the scope changes, automate invoice draft creation when the schedule is predictable, and integrate milestone billing with your accounting system so invoicing does not become a separate manual job.

If you want to see how milestone billing, invoice automation, and integrations with accounting systems can work together in your project billing process, book a demo with Productive and see it work with your processes.

FAQ

What Is the Milestone Method of Revenue Recognition?

The milestone method of revenue recognition treats revenue as earned each time a defined project milestone is completed and approved, rather than only at the end of the project.

What Is a Revenue Milestone?

A revenue milestone is a specific checkpoint in a project where you have agreed on what will be delivered, how you will decide it is done, and who will approve it. It usually has clear acceptance criteria, a named client approver, and a defined outcome.

What Are the 4 Criteria for Revenue Recognition?

The four criteria for revenue recognition are:

1. There is persuasive evidence of an arrangement with the customer.

2. Delivery has occurred, or services have been rendered.

3. The seller’s price to the buyer is fixed or determinable.

4. Collectibility is reasonably assured.

Run Milestone Billing Without Juggling Spreadsheets

Use Productive to plan milestone billing, automate invoice drafts, and send them straight to your accounting tools in a few clicks.