Automated Billing: Stop Manual Work From Cutting Your Profit

Automated billing is the upgrade your margins have been waiting for.

So many professional service businesses still struggle with manual invoicing—and it’s quietly draining their profitability. Here’s how switching to automation can help you bill faster, smarter, and with full financial visibility.

A customer recently told us that they spend 4-8 days every month just on manual reconciliation of invoicing processes. More than a quarter of their working time, every month! Imagine the financial value of that time for a senior staff member*.

If you’re running a professional services firm, you know the invoicing struggle is real. Between calculating billable hours, chasing payment schedules, syncing with accounting tools, and trying not to forget that one line item from two months ago, invoicing is not just a burdensome task. It’s a time-eating monster that’s also snacking on your revenue.

In this article, we’ll talk about what manual invoicing is really costing you—and how switching to automated billing can make you faster, more profitable, and a lot less stressed.

*At a rate of $100/hour, it would be up to $6,400 monthly or $76,800 annually, if you’re curious.

“Everything’s Very Manual”: What We Hear From Companies Weekly

If you’ve ever quietly cursed at a spreadsheet or retyped the same invoice data twice, know that you’re not alone. In the age of everything automated and AI-powered efficiency, you wouldn’t believe just how often we hear our customers are struggling with manual billing processes.

Stuck in Spreadsheets

“Everything’s very manual. To be honest, we use spreadsheets and Google Sheets and Excel dots,” Cara from a growing marketing agency told us on a recent call. She’s not alone—we hear variations of this weekly.

Another customer had this story to tell: “Currently tracking hours towards a retainer but creating each invoice manually.” Mark, who runs client services for a digital agency, spends hours each month “looking at hours worked and manually creating invoices.”

Spreadsheets are a trap. What starts as a legit solution for a small team can easily transform into an unwieldy monster as you grow. One customer admitted to using a “complex 16-page Excel spreadsheet” for budgeting and billing, with “high risk of human error in budget management.”

Manual has style. EFFICIENCY, NOT SO MUCH.

No Integration = Double Work

The pain gets worse when systems don’t talk to each other. As one agency owner explained: “Multiple disconnected systems (Monday, Toggle, Xero) that don’t communicate with each other. Manual cross-checking of data across systems is time-consuming and error-prone.”

This fragmentation creates what another customer called “double data entry required”—teams track time in one system, manage projects in another, and create invoices in a third. Each handoff invites errors, delays, and lost revenue.

Manual ≠ Scalable

Perhaps most telling is this quote from Laura, who runs a managed services company: “We want to try to automate as much as we can.” This is a common realization—manual processes that worked for a 5-person team are no longer sustainable at 15, 25, or 50 people.

As one customer put it: “Current systems won’t scale with planned company growth. Need better organization before taking on bigger clients.”

How Professional Services Firms Bill

Before we get into the solutions, it’s important to understand why billing automation for professional services is not always simple. Unlike product companies that use fixed pricing, professional services firms juggle multiple pricing models—sometimes even within the same client relationship.

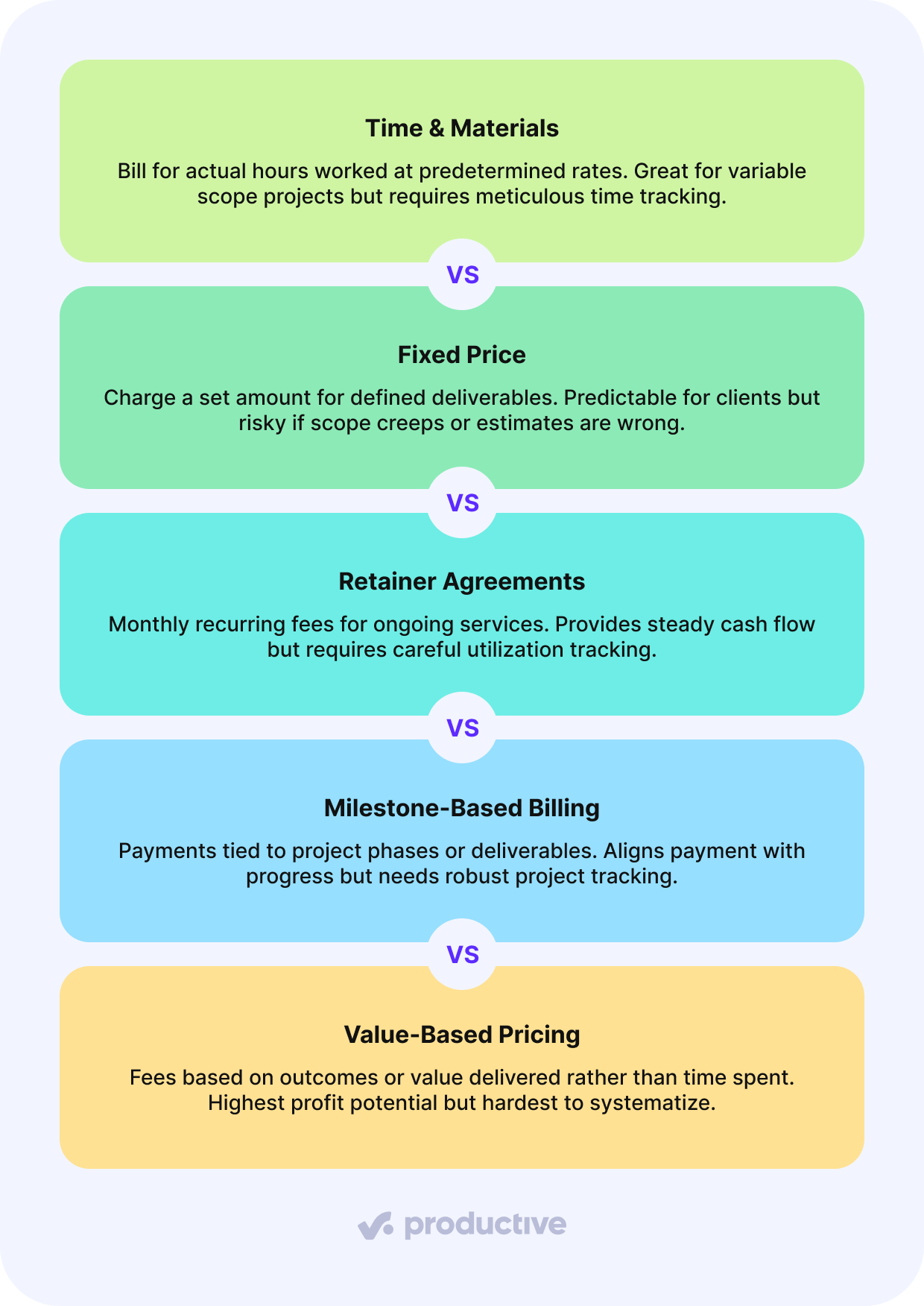

The Five Core Pricing Models in Professional Services

There are multiple ways professional services companies price their work, each affecting their cash flow in a different way. Here’s a quick overview of the models we typically see:

The Hybrid Reality

In practice, the situation becomes more complex. Many companies don’t stick to one model. As one customer explained, they have “a hybrid billing model with retainer fees plus percentage of sales commission, making it difficult to track profitability accurately.”

This flexibility may work for clients, but it’s exactly what makes automated billing so challenging—and why many firms avoid mixing models even when it would serve their clients better.

The 3 Hidden Costs of Manual Billing

Apart from being a strenuous timesink, manual billing is actively eating away at your profitability in at least three ways.

1. Revenue Leakage

Human memory is notoriously unreliable, and manual processes easily translate into missed billables. This happens more than you think:

- Unbilled hours get lost in spreadsheets

- Scope changes never make it to invoices

- Teams forget to submit expenses

- Time entries fall through system gaps

2. Labor Inefficiency

Time spent wrestling with spreadsheets or disparate tools is time not spent serving clients or driving strategy. To make things worse, this work is usually done by your most experienced team members.

3. Poor Financial Visibility

Perhaps the most insidious cost to your cash flow is what you can’t see. Multiple customers told us they’re “relying on ‘gut feel’ rather than data for profitability assessment” because their manual systems can’t provide real-time insights.

When you can’t see your billing cycle clearly, you’re flying blind on some very important business decisions:

- Which clients are actually profitable?

- Are projects on track or bleeding money?

- When should you hire more staff?

- Which services deserve more investment?

From an internal standpoint, Productive has shifted the way we look at things because we’re able to see things very clearly now. This is a person, this is how much that person makes, this is our overhead, this is how much we’re charging our client. The tool gives us full transparency, across the board.

Automated Billing for Professional Services Explained

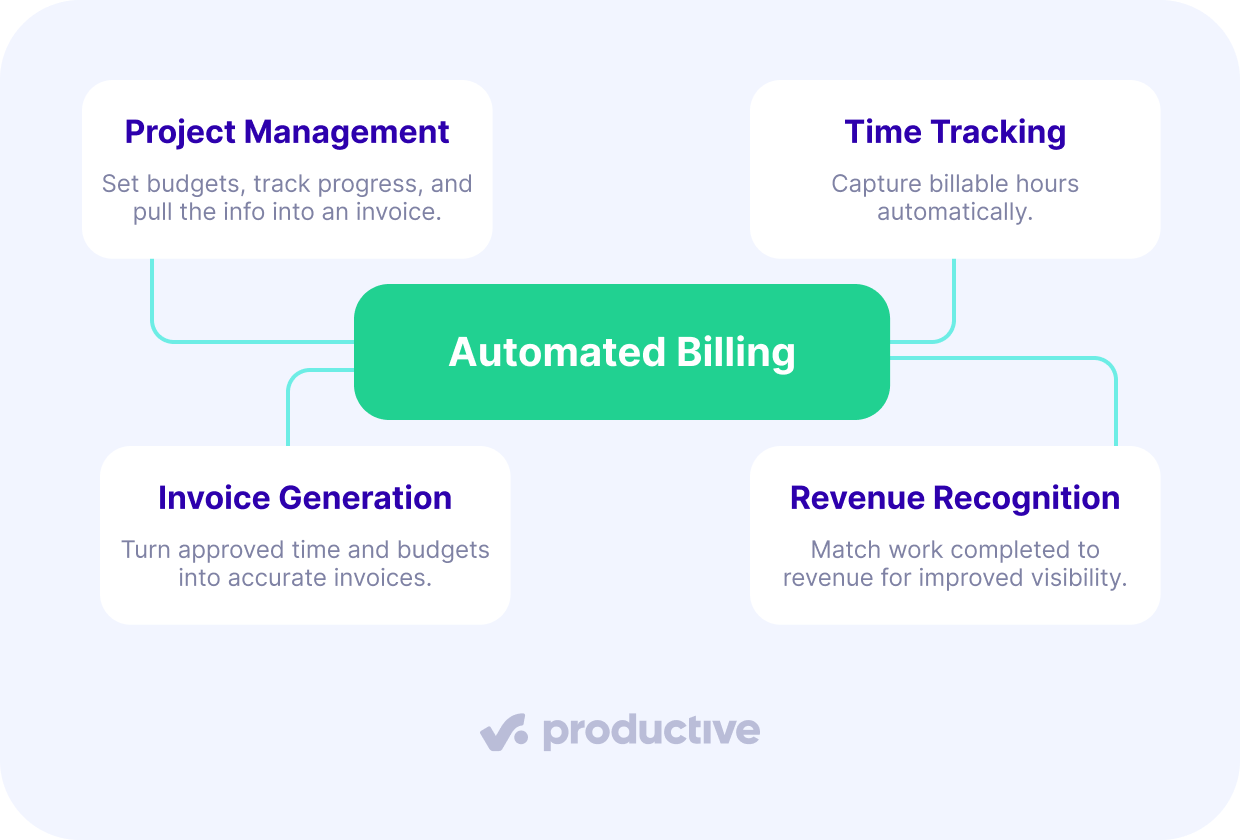

Let’s clarify what we mean by “automated billing” in the professional services context—because it’s not just software that sends invoices.

Automated billing for professional services is an integrated system that connects every step of your revenue cycle:

This connectedness is the most important aspect of billing automation. Yes, you want to get those invoices out faster, but you also want to create a flow from the moment work begins to when it turns into actual revenue. This way, you get visibility across the board and know how individual parts of the process interrelate.

Core Components of Automated Billing

Time tracking utilization: Collects billable time from a project and applies the correct rates based on client agreements.

Rate management: Handles complex rate structures including different rates per person or project, as well as varying work schedules.

Customized invoice generation: Allows you to generate invoices in a few clicks using predefined items—budgets, retainers, or time entries.

Trigger-based automation: Enables rule-based invoicing actions, such as drafting invoices automatically when a project phase is completed or a budget threshold is reached.

Real-time revenue recognition: Tracks work completed versus invoiced, providing accurate financial visibility and automated revenue recognition.

Seamless integration: Connects with your existing systems to eliminate data silos and manual data entry.

What Automated Billing Replaces

For most professional services firms, automated billing replaces a patchwork of:

- Spreadsheets for rate calculations and invoice preparation

- Manual time entry and approval processes

- Separate invoicing software that requires data imports

- Email chains for approval workflows

- Manual revenue recognition calculations

- Disconnected reporting across multiple systems

What Professional Services Firms Get With Automated Billing

Making the switch from manual to an automated billing system may not be as easy as flipping a switch, but has numerous advantages in the long run.

Scalability

You can probably handle a certain number of invoices manually, but what happens when your team, your projects and your client list grow? Manual is fine for a couple of invoices a month, but scalability is hard to achieve without automated processes.

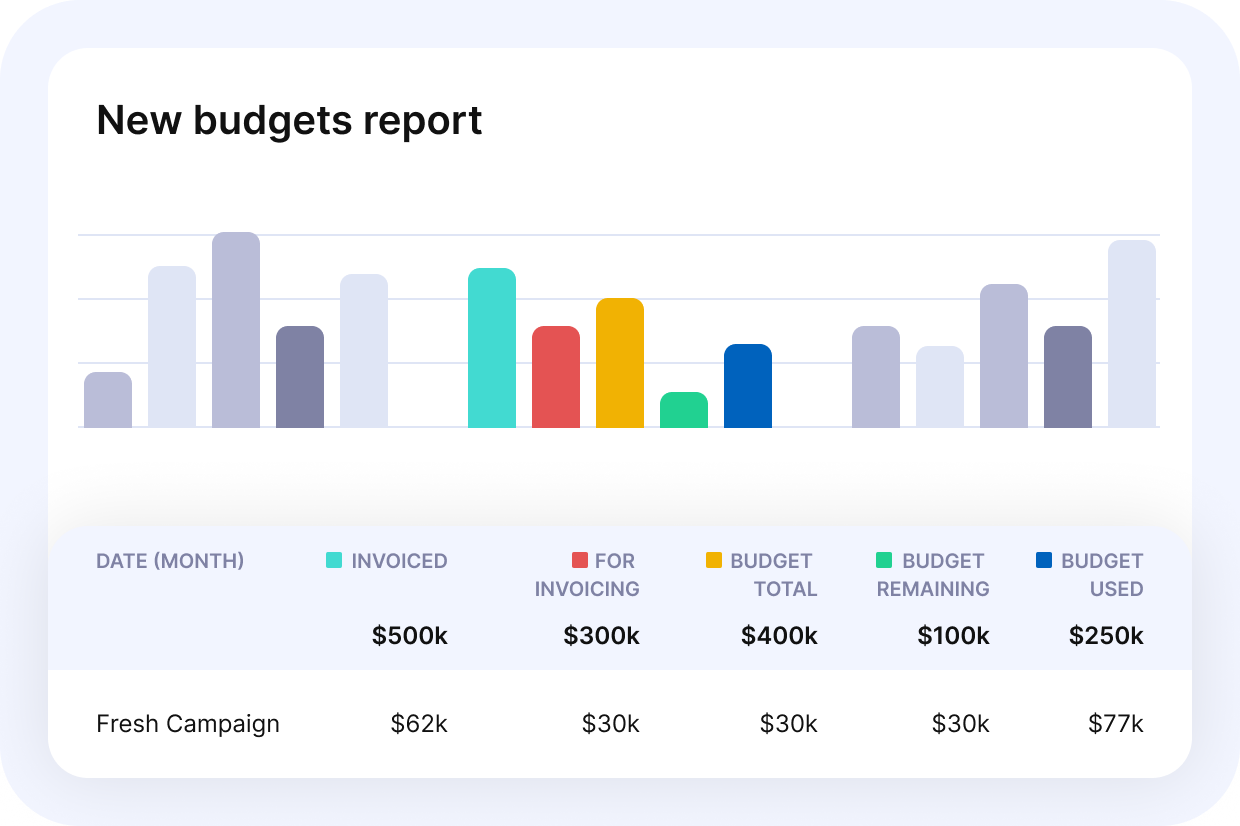

Profit Visibility

With real-time billing data, you know what’s been earned, what’s still in the pipeline, and how your actuals compare to your forecast.

Team Happiness

Unless you have staff members who find administrative busywork truly fulfilling, your team will be happier when they have more time to utilize their skills on interesting projects. It’s a bonus for customer experience as well—clients are also happier when they get clear, timely, and consistent invoices.

Faster Client Payments

Automation tightens your billing cycle and gets invoices out faster, so the money comes in faster, too.

Streamlined Payment Processes

Automated billing software helps you manage the entire payment process, from sending invoices to tracking payment collection and sending reminders. That means fewer delays, less chasing, and a better experience for everyone.

Billing Automation Blueprint: What Good Looks Like

So what does an effective automated billing system actually look like for professional services? Here’s what this setup can look like in practice:

- A unified system: Time tracking, project budgets, and invoicing all live in one place. No exports, no manual data entry, no double-checking across systems.

- Simple invoice generation: Invoices pull directly from tracked time, budgets, and planned work.

- Flexible billing models: Fixed fee, T&M, retainers, split billing, multi-currency, multi-subsidiaries—a smart invoice generation system supports all of them.

- Revenue recognition: Track earned vs. scheduled revenue in real time

- Dashboards & reporting: Real-time visibility into billables, margins, and cash flow

- Accounting integration: Syncs with commonly used tools like QuickBooks, Xero, Exact, and more

How to Choose the Right Automated Billing Tool Without Getting Burned

When setting up your automated billing system, of course you want a tool that adapts to your workflows, not forces you to change how you work. The best tools out there are flexible and customizable, so you can adapt them to your needs.

Here’s how to approach the selection process and avoid expensive mistakes:

Set the Requirements for Your Automated Billing System

Before looking at any tools, look at your own needs:

- Which billing models do you use?

- How many clients and projects do you manage?

- What accounting system must it integrate with?

- Who needs access and what permissions do they need?

Prioritize Multi-Purpose Platforms

Go for a platform that connects all your business processes rather than a collection of point solutions. The fewer tools you use, the better your visibility and accuracy.

Test With Real Data

Demos are fine, but it’s even better to test your automated billing system with actual projects, rates, and invoicing scenarios. See how the tool will hold with real-world data.

Balance Automation with Manual Generation

With so many custom billing options out there, fully automated invoicing may not work for everyone. Choose software that allows you to automate whatever you can, and still leaves you space to pick and choose what you want to invoice.

Plan for Growth

Choose automated billing software that can handle 2x or 3x your current volume without breaking.

Evaluate Total Cost of Ownership

Consider not just subscription fees, but:

- Implementation and setup time

- Training requirements

- Integration costs

- Ongoing maintenance needs

Want a shortcut to the top options? Here’s our take on the 11 Best Time Billing Software Tools (Paid and Free) for 2025. Spoiler alert: we like the first one.

How Productive Helps You Stop the Profit Bleed

Unified Time Tracking & Billing

Track time and generate invoices in one platform, supporting different professional services billing models.

Flexible Rate Management

Different rates per person, project, or task. Handle retainers, fixed-price, T&M, and hybrid models by customizing your setup.

Simplified Invoice Generation—with Automation

Generate invoices in just a few clicks. Set up automations to create invoice drafts based on budget status changes or recurring schedules.

Want to see how it works? Explore Productive’s billing features.

Real-Time Profitability

See project profit margins in real time, not weeks after projects complete.

Revenue Recognition

Accurately recognize revenue based on work completed, eliminating manual reconciliation.

Seamless Integrations

Connect with QuickBooks, Xero, and other accounting software to smoothen your financial workflows.

Implement an Automated Billing System and Stop Losing Money

With the complexity of the pricing and business models used in professional services, fully automated billing system may seem difficult to implement. However, there is a better and smarter way to invoice—one that doesn’t involve your senior staff members wasting 4-8 days of their precious time juggling multiple tools and inserting everything manually.

It’s time to show those spreadsheets and calendar reminders the way out and put an automated billing system in place. If you need any support in that area, see how Productive can help you invoice faster, more accurately, and more competitively.

Take the Busywork Out of Getting Paid

Switch from multiple tools and spreadsheets to a single platform for invoicing, cash flow management, and project profitability.