7 KPIs To Keep Your Agency Profitable

Want to know how to use your data to your own benefit? First things first: you need to decide which agency KPIs you should track.

Because, you know it: each part of your agency’s workflow needs attention.

What’s more, each type of agency business (whether you run an advertising, PR or creative agency) will have its own specific KPIs they will keep an eye on.

For instance, if you focus on profit too often, you can lose sight of other areas where you should be improving your agency’s performance—like bringing in new business for an extended period of time.

Keep reading to unfold the top seven KPIs we suggest you watch to keep agencies profitable, as well as the most popular key performance indicators that different marketing agencies will watch depending on the services they offer.

How To Define KPIs for Agencies

Agency key performance indicators or KPIs are metrics used to measure the success of your agency business, campaigns and strategies. They can indicate how well your marketing efforts are performing or how much you spend for a typical customer acquisition cost.

You can’t track every agency KPI that exists, primarily because no two agencies are the same. In other words, there’s no complete list that every agency should track. What you will track as an agency will depend on the industries you serve, the size and type of agency you are, and the goals your agency has.

Also, depending on the type of services you offer your clients, you’ll also follow a number of different KPIs to ensure the success of your campaigns.

So, before we dive into the top 7 KPIs to keep your agency profitable, let’s make a distinction between the different key metrics that different types of agencies monitor, depending on their services.

KPIs That Marketing Agencies Generally Follow

Marketing agencies generally pitch for, launch and monitor the success of one marketing campaign or multiple campaigns and marketing goals for clients via different marketing channels.

They generally track the following KPIs according to their services:

- Website traffic

- Brand awareness

- Social media engagement

To watch these KPIs, they’ll use a mix of tools, such as social media insights, Google Analytics and specialized media monitoring tools.

Support Your Agency’s Financial Success

Get invaluable insights and forecast key agency metrics with all-in-one agency management software.

Advertising Agency KPIs

Besides monitoring KPIs typical to marketing agencies, advertising agencies will also follow KPIs that will measure their advertising content and marketing efforts for clients.

Advertising Agency KPI Examples

- Impressions i.e. the number of times their ads have been shown to the target audience

- Click-through rates (CTR)

- Cost per click (CPC)

- Conversion rates

- Return on advertising spend (ROAS)

To monitor these metrics, advertising agencies will use a mix of platforms such as social media, Google Analytics, and specialized media monitoring tools.

PR and Media Marketing Agency KPIs

PR and media marketing agencies are different from marketing agencies because of the types of services they offer. Besides monitoring some KPIs that marketing agencies watch, PR agencies typically follow KPIs that will measure their PR efforts or content published for clients over a certain time period, such as:

- Media impressions

- Share of voice

- Message resonance with target audience

- Reputation score

To monitor these metrics, PR agencies will use tools such as social media insights, Google Analytics, plus specialized PR and media monitoring tools.

Social Media Marketing Agency KPIs

Marketing agencies that focus on providing social media services will also follow certain specific KPIs that measure the efforts of their social media campaigns:

- Engagement rates

- Follower growth rates

- Brand sentiment

- Influencer engagement

The Most Important Digital Marketing KPIs

Some of the most important KPIs that digital marketing agencies watch to make sure their campaigns are running smoothly over a certain time period are:

- Conversion rates

- Traffic sources

- Click-through rates (CTR)

- Engagement rates

- Customer lifetime value (CLV)

Creative Agency KPIs

Creative agencies will follow most of the same KPIs as digital marketing agencies, however creative agencies tend to be slightly more focused on how a their content has resonated with their target audience. This is why creative agency KPIs will include:

- Campaign reach

- Engagement rates

- Brand recognition

Now, let’s move on to the 7 KPIs to keep your agency profitable.

Top 7 Business KPIs to Keep Your Agency Profitable

Your profitability KPIs can be grouped into three main categories: sales and acquisition agency KPIs, retention KPIs and agency profitability KPIs.

First, consider answering these three questions when choosing which KPI to monitor to keep your agency profitable:

1. What are your business goals?

What’s important to your agency? The right KPIs will help you measure what matters to your business. You may have goals specific to your employees, your marketing activities or services. Are you aware of your marketing budget and what it will take to bring in sales qualified leads? One of the main goals of any business is continually securing new business, so your customer acquisition cost is always a good metric to follow.

2. What stage is your business in?

Maybe your agency doesn’t want to grow in number of employees. Maybe you’re a new company and your main goal is to focus on retaining talent that will help you steadily grow in the coming years. Businesses that are in different stages will want to focus on different KPIs, so try to answer which KPIs are most relevant to the stage that your business is in.

3. What’s going to be your mix of lagging and leading KPIs?

The ideal mix of marketing agency metrics to monitor for your agency will be a combination of both lagging and leading KPIs. Leading KPIs are forward-looking, e.g. client satisfaction. If your clients are happy with your services, that can be a leading indicator that new business from them will keep coming.An example of a lagging indicator is profit. Monitoring your profitability will show you how well you have been financially performing, but profitability won’t reveal how well your business will be doing in the future.After you’ve answered those questions, it’s time to look at the top seven KPIs that are most often monitored by agencies. We’ve divided them into three big categories:

Now let’s dive in.

KPI #1: Number of Pre-qualified Leads and Lead Time

If you have a sales funnel that you use to bring in new leads and convert them into clients that will bring in more revenue, that’s great. But how do you measure your total number of pre-qualified leads and lead times?

Let’s take a look at an example. Let’s say you’re looking at the month of March. How many new qualified leads landed in your sales funnel in March? Why not expand further and look at the total number of leads in the entire first quarter of the year? Now you’ve got an idea of what your business growth could look like next quarter.

Your agency’s lead times can range from a couple of days to several months. When you’re looking at your pre-qualified leads, you’ll want to understand the lead times of new client work. Your lead time per client will depend on the complexity of a campaign or project. It’s important for marketing agencies to manage lead times effectively to ensure timely delivery and optimal results for their clients.

KPI #2: Sent Proposals

Even though you shouldn’t jump to send a proposal to every lead you get, you should aim to get your total number of qualified leads to the proposal stage as quickly as you can. A typical challenge that many agencies face is when proposals sit in their funnel for over a month—sometimes even 90 days—without closing.

Maybe you have a large number of leads coming in but they’re not making it through your pipeline. Why? Either your sales team is sitting on them too long or there aren’t enough qualified leads.

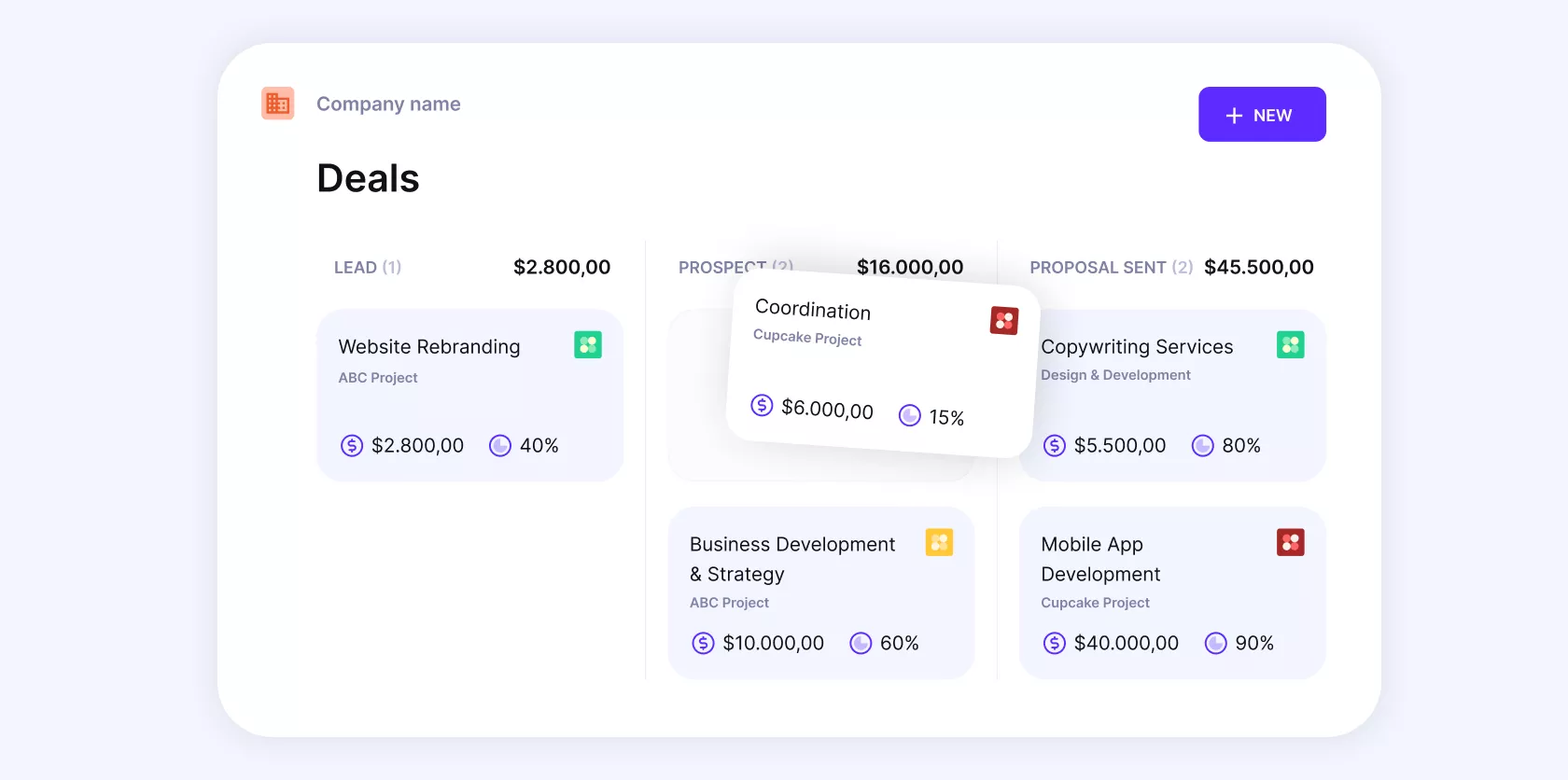

KPI #3: Value of Your Sales Funnel

Similar to your number of qualified leads and proposals sent, the value of your sales funnel will help you predict your revenue in the coming months. But it doesn’t matter how valuable your funnel is if you’re not closing deals. That’s where close rates are important.

What is your sales process like? Can your team identify sales qualified leads that are coming in? Do you have a way to forecast recurring revenue and make sure you’ll make revenue targets? Ideally, you’ll want to have both a high close rate and a high value of your sales funnel. But of the two, having a higher close rate is more important.

Example 1: Imagine your funnel contains 20 deals that total $100,000 each. The value of your sales funnel is $2,000,000, and your close rate is 40%. According to that information, you can forecast that your agency will close $400K within the next month or two.

Example 2: Now imagine that you have a sales funnel that totals at smaller value, like $1,000,000. You might have less deals at a smaller price in your pipeline, but with a higher close rate, you can actually end up closing the same amount of revenue (and similarly, the same margins) with less effort.

Having an end-to-end agency management tool will help you visualize your sales funnel and make more informed decisions. Make sure that your sales team judges well: which leads are more and less worthy of your time? Are there business relationships you can work on to secure new projects?

Make sure that your sales team judges well: which leads are more and less worthy of your time?

Now, with Productive, we’re able to now see out into the future—far more than we were ever able to see before.

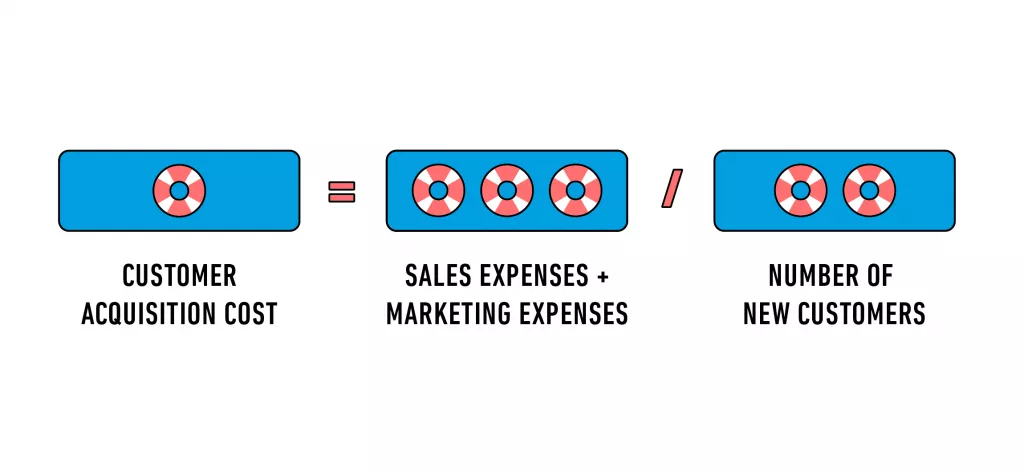

KPI #4: Client Acquisition Cost

Your client acquisition cost or CAC is a key metric to keep track of how well your sales process is performing. If your agency is young, you may not be worrying about it as much, but as your company grows, this expense will be more and more critical for you to watch. Your CAC will answer the question: how much do you have to spend to get a new client? What is the average cost of acquiring a customer? How much do quality leads really cost your agency? What’s your yearly marketing spend? Do you know your average customer conversion rate? To calculate your CAC, you will need to add up all your marketing and sales expenses and divide that sum by the number of new clients that came in during a given time period.

Example: Let’s say you spent $10,000 on sales and marketing throughout the last quarter and you got 20 new clients. That means that your client acquisition cost is $500 per client.

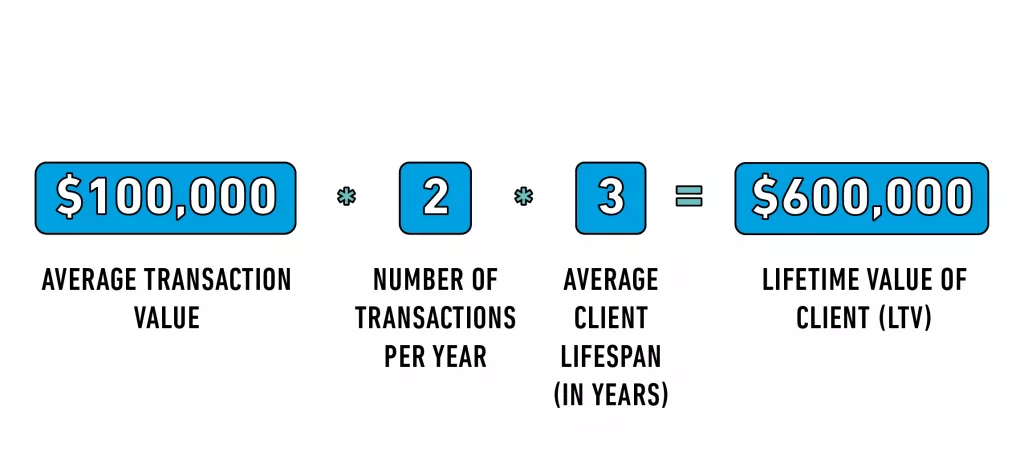

5. Lifetime Value of Clients

Now let’s have a look at your number one retention KPI: lifetime value of clients (LTV). The reason why you’ll want to track your client or customer lifetime value is that it will help you decide how much you can spend on acquiring new clients. If you know that your average client spends $1,000 per month with you, you need to make sure that your expenses (sales and marketing costs) to acquire the same customer are below $1,000.

That said, LTV isn’t the easiest KPI out there to track. Understanding your customer retention rate, customer churn rate and similar metrics will take time and resources. Some agencies will have a harder time figuring it out, but the more retainer work you have, the easier it is to measure. With time, this metric will influence how much you’re going to be able to spend on marketing strategies managed by your marketing teams, as well as how much time you’ll invest in customer success to manage your average churn rate.

To calculate your LTV per client, multiply your average transaction value and your average number of transactions per year with your average client lifespan.

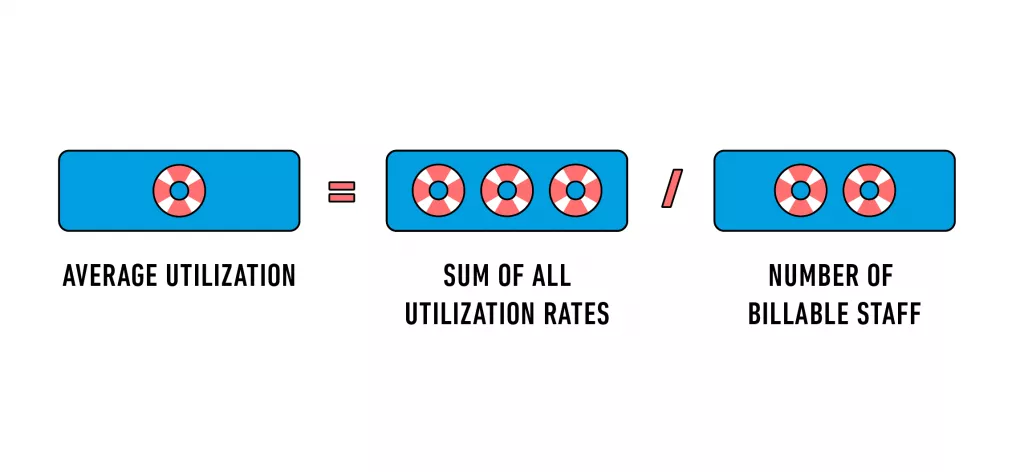

KPI #6: Agency Utilization Rates

As an agency or service provider, you always want to know the bottom line: are your employees working effectively? That’s what your utilization rates tell you.

Your agency utilization rate is a percentage that indicates the amount of hours or time that a teammate is spending on billable work.

Your agency’s average utilization rate is calculated as the sum of all your employee’s utilization rates divided by your number of billable staff.

Getting high-level insight into your utilization in Productive is just as easy as going into the tool to check out your team’s schedule. Assuming that everybody is regularly tracking their time, all you need to check your teammates’ utilization rates is to go into your utilization insights

We’ve always known, on a monthly basis, how we’re doing as a company. But knowing on a per project level, in real time—we never really had that visibility. You guys do a good job of providing that. If you look at it on a yearly basis, it does give us the ability to look, per client and per project, where we really stand.

KPI #7: Agency Profit Margins

To track your agency’s profitability there’s a lot of things to take into account such as: marketing spend, customer acquisitions cost, marketing performance, billable hours, labor costs.

At the end of each month, quarter or year, one of your main questions is: as an agency, are you profitable?

To get high-level insight into profit margins and calculate your agency’s profitability in Productive, first, you need:

- Hours tracked by all your employees (top management included)

- Employee salaries

- Overhead costs

- Project estimations

Once you’ve got your expenses and budgets in Productive and time tracking going, you can analyze profitability without ever having to enter a spreadsheet again. To get your ready-made profitability reports, just go into the reports library and choose how you want to view profitability, e.g. Profitability by month.

See? That was easy.

Learn more about how to increase your agency profit margins.

Now, we can see a lot of that information built right into the UI of Productive. We’ve entered in all our cost and overhead information, so we look forward to seeing the numbers for each of our employees.

Bonus: Agency Gross Income

Agency gross income is all the income you’ve billed to clients without the cost of external services or goods you (still) have to pay for. In other words, your AGI is calculated by subtracting your expenses related to clients from your gross billings.In a marketing agency, an example of external expenses related to clients will be buying media space or renting out equipment for a project that you’ll invoice to your clients with a markup.

Another typical client-related expense would be when you hire contractors to join you in a project.When you charge your clients for extra freelancers you hired to get a job done quicker, the total revenue you get from the client clearly isn’t all your own. In an agency, it’s important to be able to forecast how much your contractors are costing you because depending on the nature of the work, certain things are better delivered in-house. Being able to visualize different scenarios will help you increase your profitability in the long run.

Track the Top Agency KPIs That Will Keep Your Business Profitable

There’s no doubt you need to keep track of the agency KPIs that will keep your business afloat. But, remember: profit margins aren’t the only indicator to watch to keep your agency profitable.

With an end-to-end agency management tool, you can keep track of all your KPIs, streamline your agency’s processes and make data-driven decisions. Schedule a demo call with our Sales team to learn how Productive can shape your agency’s future.

Support Your Agency’s Financial Success

Get invaluable insights and forecast key agency metrics with all-in-one agency management software.